You are visiting United States

If this is incorrect,

01-Apr-2025

Low P/E doesn’t equal high potential. At Comgest, it’s long-term earnings visibility and quality growth — not bargain valuations — that drive our conviction and portfolio construction.

We all love a bargain, but is cheaper really better? It’s tempting to think that a company trading at 12x price-to-earnings (P/E) is more attractive than one at 25x. However, that assumption can be misleading.

Is a company trading at 12x P/E really more attractive than one at 25x?

At Comgest, prospective clients sometimes view our equity portfolios as expensive, given they trade at a significant P/E premium to the market. But over nearly four decades, it’s been earnings growth – not low valuations – that has powered our long-term performance.

Before we even consider valuation, we focus on the visibility and earnings dynamics of a company. Valuation matters, of course, but it’s not the primary driver of our investment decisions or portfolio construction.

Relying too heavily on low P/E ratios can lead investors into a dangerous “value trap”, i.e., taking a P/E ratio at face value and making it an important factor in stock selection and portfolio construction. This is particularly risky when evaluating quality growth companies.

Over-reliance on low P/E ratios can lead investors into a dangerous “value trap”, which is particularly risky when evaluating quality growth companies.

Why? The “E” in the P/E ratio can be fraught with uncertainty. Over the past few years, we’ve seen persistent downward revisions in consensus earnings forecasts.

Secondly, the P/E ratio is short-sighted, typically capturing just an estimate of the next 12 months earnings per share (EPS), while a company’s value is a discounted cash flow of future earnings streams that go well beyond the next 12 months.

Although the popular P/E ratio is easy to understand and use, it is also built on assumptions, including that 100% of a company’s earnings are paid out. Hence, it is only a fair yardstick for zero growth companies.

That is the opposite of what we do at Comgest. We look at companies such as EssilorLuxottica or Microsoft, which have delivered an annual earnings growth of over 10% over several years. This makes a one-year forward P/E meaningless as an isolated tool for portfolio construction.

A lower P/E may reflect higher risk or weaker growth prospects.

Of course, we don’t ignore valuation altogether — we monitor it and adjust position sizing accordingly. But we don't jump into low P/E stocks just because they appear on a screen. A lower P/E may reflect higher risk or weaker growth prospects. In contrast, we have conviction in the visibility and durability of growth in names like EssilorLuxottica or Microsoft.

Even discounted cash flow (DCF) models — often viewed as more sophisticated — come with limitations. No one can predict a company’s earnings or free cash flow five years from now with certainty. Discount rate assumptions are equally critical.

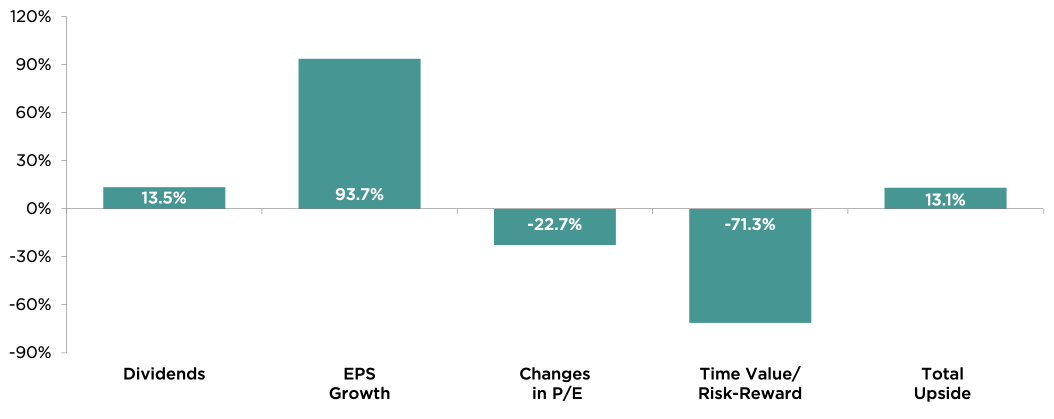

Take, for example, a high-visibility growth company in our portfolio. As per figure 1, at our fair value estimate, 71% of its value is “stored” in the time value of money over five years. This translates into an annual appreciation potential of 11% — a reasonable compensation, in our view, for holding a high-visibility growth company even if the DCF suggests fair value has already been reached.

At Comgest, we apply a conservative average discount rate of 11% for our European large-cap portfolio and 10% for our Global large-cap portfolio, despite a beta below 1 and observing substantially lower long-term interest rates across markets. That reflects our caution — and ensures the time value of money is a meaningful part of our valuation process.

Source: Comgest. This example is for illustrative purposes only and not a recommendation to buy/ sell any security. Valuation components and stock data are hypothetical or based on publicly available information and may not reflect current market conditions.

This is not a rejection of P/E ratios or valuation models — far from it. As outlined in my Comgest white paper, “The Fair Value Folly”,1our point is simply that valuation should not be the focal point of stock picking or portfolio construction in a growth strategy.

We focus on the visibility and durability of future earnings growth, qualities closely tied to fundamentals such as pricing power, innovation, recurring revenues, management strength, and capital efficiency.

As quality growth investors, we give our companies time to crystallise the value embedded in their long-term growth trajectories. Our focus is on the visibility and durability of future earnings growth — qualities closely tied to fundamentals such as pricing power, innovation, recurring revenues, management strength, and capital efficiency.

We maintain a highly selective approach, investing in a limited pool of companies we've followed and analysed — often for years or decades — to build conviction and monitor growth. Few companies meet our criteria, and that's exactly the point.

At Comgest, we're not at risk of falling into the “value trap”. Our European and Global large-cap portfolios trade at a premium to the US market2— and we’re proud of that. Why? Because our quality growth companies have paid it back with regular and multi-year double-digit earnings.

That growth — not valuation — has been the primary driver of our performance. It’s why we continue to focus on the visibility and durability of superior earnings growth, rather than trying to outsmart the market on valuation alone.

For a deeper dive into this topic, please read Franz’s full white paper, The Fair Value Folly available in the “Our Thinking/White paper” section of your local Comgest website.

1 To read this paper, please see the “Our Thinking” section on your local Comgest website.↩︎

2 Source: Comgest/Factset.↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. S&P Dow Jones Indices LLC (“SPDJI”). S&P is a registered trademark of S&P Global (“S&P”); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest’s fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).