You are visiting United States

If this is incorrect,

10-Jan-2025

Around the world, people are living longer. The World Health Organization (WHO) estimates that 1 in 6 people will be aged 60 years or older by 2030. As societies age, the demand for healthcare services is likely to grow. That’s why we view medical devices, pharmaceutical products and healthcare technology as promising long-term investment opportunities.

Global life expectancies have improved significantly in recent years. Better access to health care, education and food, as well as declining child and maternal mortality rates, have increased lifespans around the world. Between 2000 and 2019, the WHO reported that global life expectancy had increased by more than six years – from 66.8 to 73.1. 1With people living extended lives, the prevalence of chronic conditions and diseases associated with older age, such as hearing loss, dementia and diabetes, are likely to rise in the coming years. 2Technological advancements and scientific progress have improved patient outcomes by enabling better diagnosis, prevention and treatment.

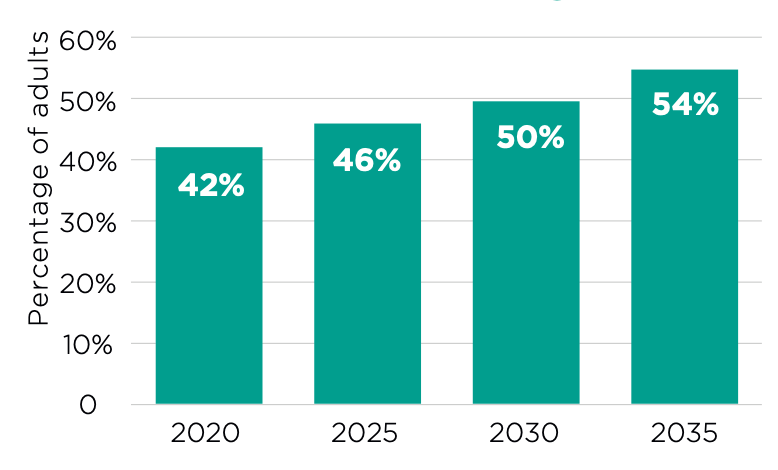

Source: Statista, 2024.

Although longevity is improving, another global health challenge is surfacing. Obesity rates around the world have been escalating. Long considered to be a problem faced by high-income economies, about 70% of the world’s obese people live in low- and middle-income countries as of 2020. 3Processed foods, reduced exercise and rising incomes, for instance, have led to higher consumption rates of unhealthy foods. 4The American Medical Association estimates that there are around 200 obesity-related diseases, including diabetes and high blood pressure. 5By 2035, more than half of the world’s population is expected to be affected by excessive weight levels. 6

Longer lives and growing obesity rates are driving up health costs worldwide. In the United States, health care spending grew by 4.1% in 2022 to $4.5 trillion, or $13,493 per person. 7Health care spending currently amounts to 17.3% of the country’s GDP – three times more than the 5% GDP budgeted in 1960. 8The picture is similar in other countries, too. In 2022, member countries of the Organisation for Economic Co-operation and Development (OECD) spent on average 9.2% of their GDP on healthcare, up from the 2013-2019 average of 8.8%. 9

From an investor’s perspective, the healthcare sector has long defied economic cycles because its products are considered as a vital necessity for people everywhere. In our view, ageing populations and rising obesity levels are likely to serve as long-term growth drivers for research and development (R&D) and innovation. Rising costs for healthcare systems will also likely encourage the creation of more efficient products and services. 10Given the essential nature of healthcare products and services, we believe it’s unlikely that macroeconomic developments (such as interest rates, wars, pandemics) could steer these long-term growth drivers off their current course.

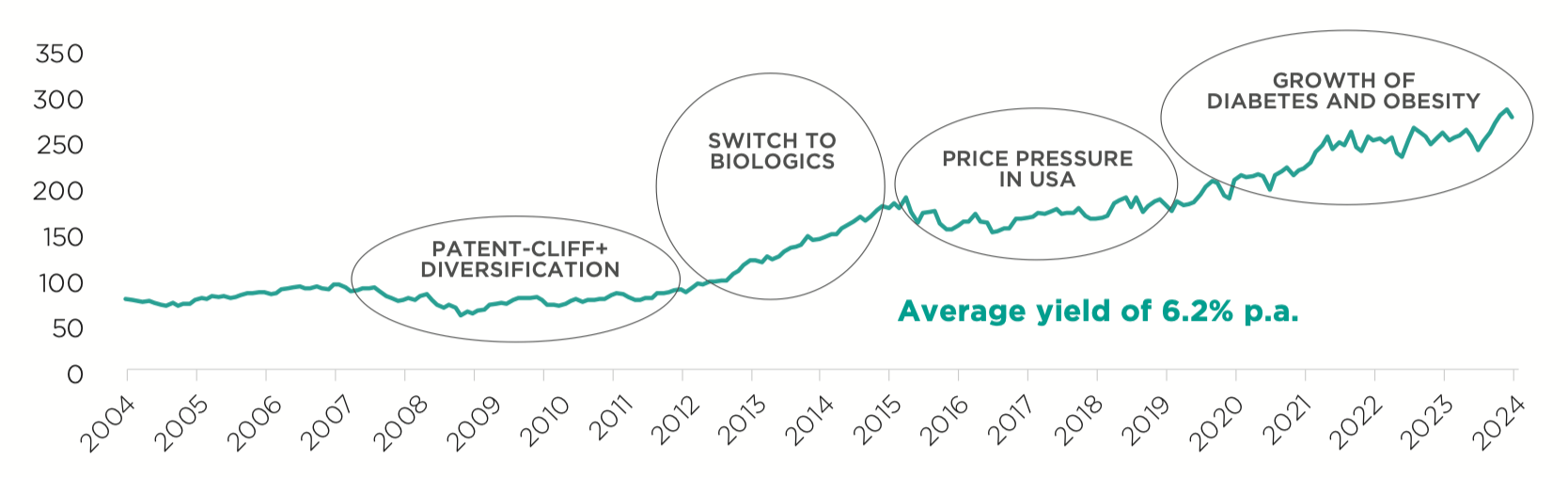

Past performance is not indicative of future returns. Source: Comgest / Factset. Performance expressed in EUR; as at 30-Apr-2024.

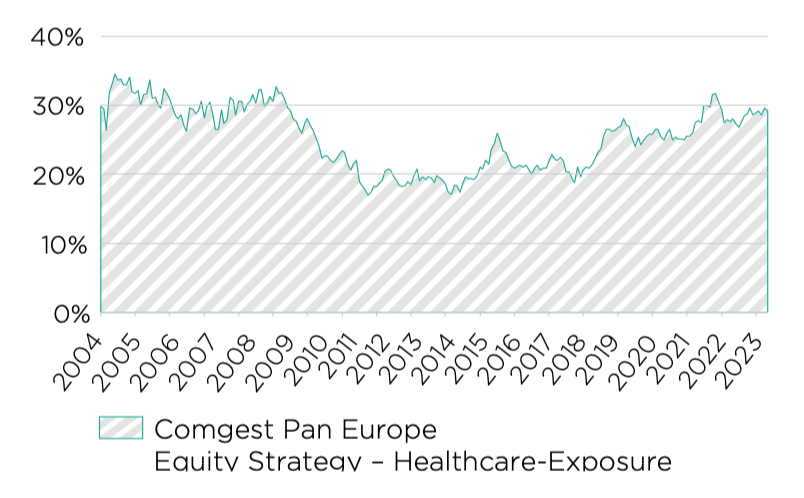

The healthcare sector is vast and varied, encompassing everything from hearing aids to weight loss drugs and care facilities to ultrasound machines. Based on our experience, Comgest’s investment approach enables us to scan this universe of opportunities and uncover what we consider quality growth companies with durable competitive advantages. Our Comgest Pan Europe Equity Strategy has consisted of around 20%–35% healthcare companies over the past two decades (as shown in figure 3).

Source: Comgest / Factset, 30-Apr-2024.

At Comgest, we are not thematic or sector investors. When you visit our website, you will not find an “anti-obesity fund” as part of our portfolio of products, nor will you see sector-specific job titles, like “Portfolio Manager – Healthcare”. That’s because we are generalist stock-pickers that look for company-specific drivers of growth and enduring competitive advantages – regardless of sector. In our view, this “generalist” approach ensures that our investment opportunities are diversified and that we are not blinded by one growth trend or sector at the cost of another.

Our investment approach places an emphasis on quality – not on predicting clinical trial results. In the healthcare sector, we are wary of business models that promise the next miracle drug. Pharmaceutical drug pipeline forecasts are difficult and news is quickly reflected in share prices. This makes investing in pharmaceutical manufacturers, the largest part of the healthcare sector, highly complex. In recent years, pharmaceutical companies have faced several market phases of underperformance, with an annual average return of around 6% over the past two decades. 11

We are aware of the fundamental challenges facing pharmaceutical companies, from price regulations to the capital-intensive nature of research and development (R&D). The timeline for developing a new drug can take years, sometimes even decades.

Pharmaceutical products undergo various preclinical and clinical test phases over several years. Of the countless products in an R&D pipeline, only a select few eventually receive authorisation for market use . Sometimes patents expire or price controls are put into place by government policymakers, as has been the case in the European Union 12and, more recently, the United States. 13Investors are highly reactive to R&D developments as successes and failures are also quickly reflected in a company’s share price.

Based on our experience, R&D spending is an essential competitive advantage for a healthcare company’s long-term success, but it’s not the only one. We seek pharmaceutical companies with deep competitive moats, built on innovation and culture, to drive sustainable growth.

As bottom-up stock pickers, we believe that companies with these distinctive strengths – regardless of their sector – have the potential to achieve continuous growth over time. Rather than getting bogged down in predicting pharmaceutical trials, we stick to our time-tested investment approach of identifying high-quality companies.

Consider Danish pharmaceutical company Novo Nordisk. Since its founding over 100 years ago, the company has maintained a razoredge focus on combatting diabetes. We believe that Novo Nordisk’s specialisation in just a few product areas, including diabetes and haemophilia, has enabled it to increase production efficiency, realise R&D returns and strengthen its marketing strategies. The company’s R&D spending has made it difficult for competitors to gain a foothold in the diabetes market. 14In 2023, research and development costs represented 14% of net sales – compared to 13.6% in 2022 and 12.6% in 2021. 15The company’s accelerating R&D spending will likely further strengthen its already wide competitive moat in the coming years.

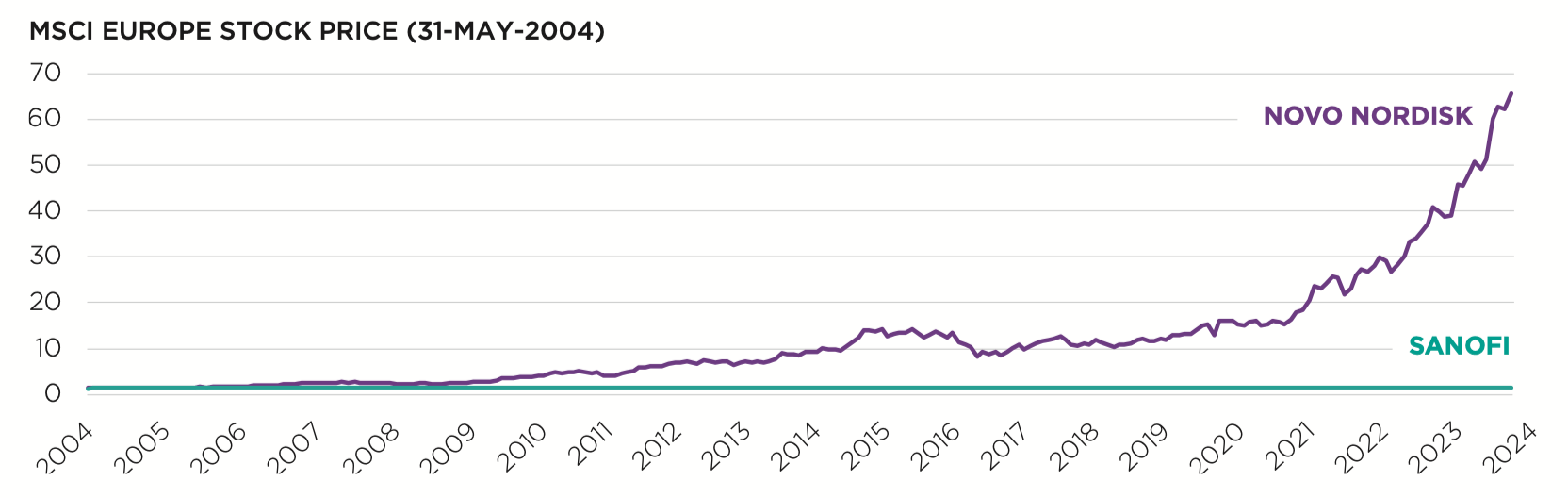

R&D spending has been a crucial part of Novo Nordisk’s growth story. In the past decade, the company overtook French rival Sanofi to become the leader in the diabetes treatment market by introducing a new treatment known as glucagon-like peptide-1 (GLP-1). As a result, Novo Nordisk’s share price has increased 70-fold over the past two decades, while Sanofi’s has largely stagnated (see figure 4).

Past performance does not predict future returns. The securities discussed above are provided for information only, are subject to change and are not a recommendation to buy or sell the securities. The securities referenced herein may not be held at the time you receive this publication and are subject to change without notice. Source: Comgest / FactSet financial data and analytics, 24-May-2024

Novo Nordisk’s initial investment in GLP-1 paid off in more ways than one: it has also proven to be an effective anti-obesity drug. 16When GLP-1 was first introduced, investors and the scientific community were unaware of its effectiveness in countering obesity. Now marketed under the name Wegovy, the drug is a leader in the growing obesity market alongside Eli Lilly’s Zepbound. 17In our view, companies that share Novo Nordisk’s fundamentals – namely a strong reinvestment rate, healthy balance sheet, longevity and visible track record of growth – are better positioned to innovate and deliver long-term returns.

By operating independently of a benchmark, we believe that Comgest is well placed to invest in areas of the healthcare sector beyond pharmaceuticals. For example, our Pan Europe portfolio includes biopharmaceutical manufacturing suppliers, such as Sartorius Stedim, a German laboratory equipment supplier and Icon, an Irish healthcare company. These companies supply equipment and render services required for biopharmaceutical R&D and production, including microbial tests and technology solutions.

Our Pan Europe portfolio also features medical device retailers, such as the Italian hearing aid company Amplifon and the Swiss dental implant manufacturer Straumann Group. These companies are likely to benefit from the growth trends linked to an ageing population, as people will likely need hearing and dental solutions as they age. In our view, longer lifespans will create more demand for health care products and services as people seek to maintain health and vitality throughout their lives.

All of these businesses possess significant competitive advantages and prioritise end-user markets. From diabetes to myopia and dentures to gastrointestinal issues, Comgest invests in a wide variety of healthcare companies that target specific markets with bespoke and diversified growth models. By sticking to our quality growth approach, we can diversify our research and investments across various medical sectors, thereby minimising R&D pipeline risks associated with large pharmaceutical manufacturers that dominate the sector.

At Comgest, we are less concerned with sectors or themes when it comes to investing. For nearly 40 years, we have concentrated on quality growth stock picking. We are firmly convinced that active investors can identify attractively valued healthcare companies by focusing on company fundamentals and durable competitive advantages. Our Comgest Pan Europe Equity strategy benefits from long-term growth drivers such as an ageing population and the rising demand for weight loss solutions.

By applying our bottom-up, quality growth investment approach, we aim to identify healthcare businesses that can weather policy shifts and macroeconomic disruptions, while delivering consistent, long-term returns that compound to benefit our clients.

1 Source: WHO https://www.who.int/data/gho/data/themes/mortality-and-global-health-estimates/ghe-life-expectancy-and-healthy-life-expectancy↩︎

2 Source: WHO https://www.who.int/news-room/fact-sheets/detail/ageing-and-health↩︎

3 Source: World Bank Group - https://www.worldbank.org/en/news/press-release/2020/02/05/obesity-related-diseases-among-top-three-killers-in-most-countries-world-bank-says↩︎

4 International Fund for Agricultural Development. “Addressing Overweight and Obesity in LMICs in Rural Development and Food Systems: A Country Mapping.” International Fund for Agricultural Development, June 2023. ↩︎

5 “Obesity.” American Medical Association. Accessed 28-Nov-2024. ↩︎

6 World Obesity Federation. “ Economic Impact of Overweight and Obesity to Surpass $4 Trillion by 2035.” World Obesity Federation, 2-Mar-2023. ↩︎

7 Source: National Health Expenditure Accounts (NHEA), 2024 ↩︎

8 Source: Organisation for Economic Co-operation and Development, 2024 ↩︎9 OECD. “ Health at a Glance 2023.” OECD iLibrary, 7-Nov-2023. ↩︎

10 World Economic Forum. “How Digital Healthcare Tools Cut Costs and Boost Outcomes.” World Economic Forum, 4-Jan-2024. ↩︎

11 Source: MSCI World Pharmaceuticals Biotechnology & Life Sciences Index, as of 30-Apr-2024 ↩︎

12 Council of Europe. “ Council Directive 89/105/EEC of 21 December 1988 relating to the transparency of measures regulating the prices of medicinal products for human use and their inclusion in the scope of national health insurance systems.” Council of Europe, 21-Dec-1998. ↩︎

13 The White House. “ Fact Sheet: Biden-Harris Administration Announces New, Lower Prices for First Ten Drugs Selected for Medicare Price Negotiation to Lower Costs for Millions of Americans.” The White House, 15-Aug-2024. ↩︎

14 Johnston, Ian. “Novo Nordisk Chief Seeks More Deals to Cement Weight-Loss Lead amid 'Hype'.” Financial Times, 8-Mar-2024. ↩︎

15 Source: Novo Nordisk Annual Report 2023↩︎

16 Johnston, Ian. “ Novo Nordisk Readies Trial Results for Next-Generation Weight-Loss Drug.” Financial Times, 17-Nov-2024. ↩︎

17 Nelson, Eshe, and Charlotte De La Fuente. “ It Introduced Ozempic to the World. Now It Must Remake Itself.” The New York Times, 20-Apr-2024. ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

The representative accounts discussed are managed in accordance with their relevant Composite since the Composite’s inception. The representative accounts are open-ended investment vehicles with the longest track record within their respective Composite. The performance results discussed reflect the performance achieved by the representative accounts. Accordingly, the performance results may be similar to the respective composite results, but the figures are not identical and are not being presented as such. The results are not indicative of the future performance of the representative account or other accounts and/or products described herein. Account performance will vary based upon the inception date of the account, restrictions on the account, and other factors, and may not equal the performance of the representative accounts presented herein.

Comgest claims compliance with the Global Investment Performance Standards (GIPS ®). To receive GIPS-compliant performance information for the firm’s strategies and products please contact info@comgest.com. GIPS ® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).