You are visiting United States

If this is incorrect,

24-Jan-2025

In 2024, several companies in our Comgest Pan Europe Equity portfolio 1faced headwinds in the form of weak consumer spending in China. Despite this, growth drivers, such as diabetes and obesity, digitalisation, artificial intelligence and data centre construction provided tailwinds for stocks in our Pan Europe Equity strategy. By focusing on resilient performance in the face of macroeconomic uncertainties, our portfolio aims to harness the rising tides from underlying growth trends.

In his 1977 annual letter to Berkshire Hathaway shareholders, Warren Buffett wrote, “ One of the lessons your management has learned – and, unfortunately, sometimes re-learned – is the importance of being in businesses where tailwinds prevail rather than headwinds.” 2

At Comgest, we focus on building portfolios of quality growth companies with lasting competitive advantages driven by structural tailwinds, such as digitalisation, increased healthcare spending and decarbonisation. We then look for idiosyncratic growth drivers, like innovation. In our view, these companies tend to be well-equipped to withstand macroeconomic headwinds and generate above-average growth rates over the long term.

Our Comgest Pan Europe Equity strategy seeks companies with exceptional longevity, visible growth, robust free cash flow, capital allocation skills, barriers to entry, strong corporate cultures and ESG credentials. We believe that our focus on company fundamentals enables us to cut through the short-term market noise and concentrate on what matters for successful compounding: long-term earnings growth.

Over the past two decades, several companies in our Comgest Pan Europe Equity strategy have leveraged tailwinds from China. The country’s ascension to the World Trade Organization in 2001 opened a new era of global trade that coincided with a rising number of middle-class consumers. As of 2024, China boasts the world's largest middle class with more than 500 million people. 3This shift from an inward-looking agrarian economy to the world’s second largest economy over three decades has created a bourgeoning middle class with growing disposable income, driving export demand for a wide variety of European goods and services, including consumer brands and healthcare products. 4Many of the companies that form our Comgest Pan Europe Equity portfolio have benefitted from the consumption habits of China’s growing middle class.

However, in recent years, China’s growing property crisis, local government debt, unemployment and the government’s “common prosperity” policy 5have dampened consumer demand for these goods and services. 6China has shifted from a tailwind to a headwind for several of the investee companies in our Comgest Pan Europe Equity portfolio, whose businesses are exposed to various aspects of the Chinese economy. Slowing sales in China and slowing economic growth have affected European companies, like French beauty company L'Oréal, which reported a slowdown to 3.4% organic sales growth in the third quarter of 2024 due to “low consumer confidence” in China and lower pricing contributions— a common theme experienced by consumer companies faced with the recent period high inflation. 7

Source: Comgest/Factset as of 14-Jan-2025. *The data shown is based on available figures (EUR) are actual results of the representative account of the Pan-Europe Large Cap Equities Composite, managed in accordance with the Composite since the Composite’s inception.

Please refer to the important information section for more details on the representative account, its selection methodology and where to receive the GIPS compliant presentation of the composite. The results are not indicative of the future performance of the representative account or other accounts. Please refer to the important information section for more details on the representative account, its selection methodology and where to receive the GIPS compliant presentation of the composite.

In late September 2024, Beijing announced stimulus measures aimed at reviving investor and consumer confidence. It’s too early to predict what type of ramifications this announcement will have on Chinese consumer confidence moving forward. Our investment approach is rooted in bottom-up stock picking and does not rely upon macroeconomic policy announcements. By ensuring a high degree of geographic diversification within our portfolio, we aim to mitigate the macroeconomic risks associated with any region.

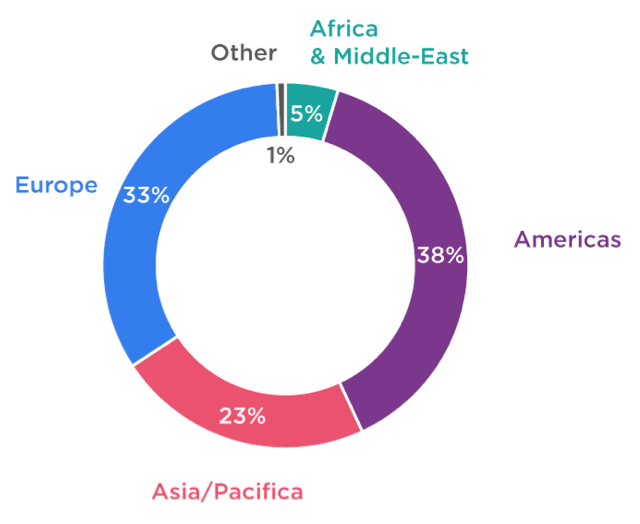

With lower consumer demand from China, our portfolio uses growth from other regional and global tailwinds, including digitalisation, healthcare and information services. In terms of revenue exposure, China represents 7.33% of the activities in our portfolio, compared to 38% for the Americas and 34% for Europe (as shown in figure 1). Based on our experience, building our portfolio with diverse growth drivers and endmarkets is critical for the resilience we seek when short-term demand swings occur.

Despite the headwinds from China, our Comgest Pan Europe Equity portfolio has leveraged other key global growth drivers, including digitalisation. The surge in artificial intelligence is fuelling a growing demand for data. 8Not just any data— quality data. There is already evidence to suggest that incomplete datasets can lead directly to costly AI hallucinations and inaccuracies. 9We believe that the possession of reliable, evidenced-based data will become even more essential as AI applications become more widely available.

In our view, Dutch publisher Wolters Kluwer is well positioned to benefit from this data-driven tailwind. The company’s vast library of digital content has been validated for decades by professionals working across various sectors, including healthcare, financial services, accounting and law. As an early adopter of digital publishing, Wolters Kluwer has leveraged data and its relationship with customers to curate tailored software, known as “Expert Solutions,” which is specifically designed for the needs of accountants, doctors and lawyers to speed up and improve their decision-making processes. 10

From our perspective, Wolters Kluwer can further refine its Expert Solutions and software products by leveraging AI and its unique repository of propriety data in the years to come. In 2023, the company recorded 8% year-over-year organic growth for its Expert Solutions products and 15% growth in cloud software. 11We believe that the company’s long-standing relationship with customers and rich data library are formidable barriers for AI start-up challengers and new market entrants.

Healthcare has been another global tailwind for our portfolio. With over 500 million people around the world estimated to have diabetes and nearly one in eight dealing with obesity 13, we believe that Danish pharmaceutical giant Novo Nordisk will have a central role to play in expanding access to critical treatments to patients. The company’s glucagon-like peptide-1 (GLP-1) based treatments have been proven to boost insulin and stop glucose from entering the bloodstream and reducing appetite. Drawing on a century of expertise in insulin production, we believe that Novo Nordisk’s innovative culture and commitment to research and development (R&D) have positioned it to effectively address global health challenges and generate strong sustainable revenue growth over the long run.

The rapid growth of AI, expanding global populations and the increasing number of communities connected to the internet is significantly driving up global energy demand. As more and more countries and companies adopt net-zero emission plans, we recognise that the energy transition and decarbonisation will require intermediate steps in the near- and long-term future.

Source: Comgest / Factset. The security discussed above is provided for information only, is subject to change and is not a recommendation to buy or sell the security.

In our view, Air Liquide, the French industrial gas company, possesses the several characteristics that align with our quality growth investment approach. We believe that the company has established high barriers for new market entrants through strong pricing power and a resilient business model.

Hydrogen distribution is an intricate and highly specialised process. Since its inception in 1902, Air Liquide has a presence in over 70 countries around the world. 14Over decades, the company has developed industry-leading expertise and built an extensive infrastructure network dedicated to hydrogen production, positioning it well to benefit from rising hydrogen demand. We believe that Air Liquide, which supplies gases to a wide range of sectors—from manufacturing to hospitals— benefits from several long-term tailwinds, including electrification, decarbonisation and advancements in healthcare.

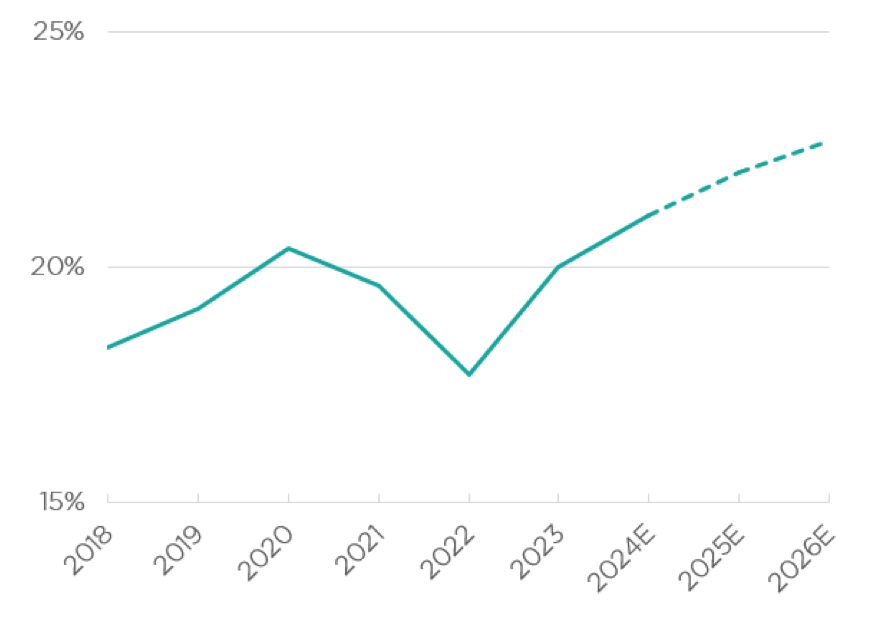

Under a new management team that arrived two years ago, Air Liquide launched a strategic plan aimed at decentralising its operational structure, fostering a new culture around performance and shoring up its balance sheet. 15As a result, the company has increased its adjusted earnings before interest and taxes (EBIT) margin from 18% to 20% higher in 2024 (as shown in figure 2).

As quality growth investors, we prioritise a company’s fundamentals rather than relying on allocations tied to benchmarks, sectors or geographies when it comes to building our portfolios. Our investment style emphasises bottom-up research to assess a company’s quality and potential for double-digit earnings growth. Despite facing headwinds from China, our Comgest Europe Equities strategy has adjusted its sails to capitalise on global tailwinds in digitalisation, healthcare, and the energy transition. The portfolio holdings’ strong exposure to the North American growth markets compensates for weakness on other continents. We believe diverse secular growth drivers results in resilient growth in all market conditions, which can be seen by the high risk-adjusted return that our strategy has delivered over the past decades.

Our investment teams seek to identify the underlying secular trends and resulting tailwinds that will shape industries for decades to come. While we may encounter headwinds, like declining consumer confidence in China and Europe, we believe that our fundamental research equips us with the tools to recognise long-term growth drivers that will shape the global economy and ultimately lift growth for our portfolio of quality growth companies.

Our Comgest Europe Equities strategy capitalises on various long-term structural trends shaping the global landscape, including digitalisation, healthcare and decarbonisation. By focusing on a bottom-up, stock picking approach, we can identify companies with competitive advantages, resilient business models and strong earnings potential.

With nearly four decades of experience in Europe, we remain confident that our quality-focused growth investment approach is key to delivering sustainable, long-term returns for our clients.

1 Pan Europe Growth strategy is the representative account of the Pan - Europe Large Cap Equities composite managed in accordance with the Composite since the Composite’s inception. Please refer to the important information section for more details on the representative account, its selection methodology and where to receive the GIPS compliant presentation of the composite. ↩︎

2 Buffett, Warren. “ Chairman’s Letter - 1977.” Berkshire Hathaway, 14-Mar-1977. ↩︎

3 Zuo, Mandy. “ China’s Middle-Income Population Passes 500 Million Mark: State-Run Newspaper.” South China Morning Post, 3-Mar-2024↩︎

4 Hale, Thomas, Madeleine Speed, Daniel Thomas, Edward White, Claire Jones, and Patricia Nilsson. “ Multinationals Sound Alarm over Weak Demand in China.” Financial Times, 11-Aug-2024. ↩︎

5 Sun, Xin. “ Decoding China’s ‘Common Prosperity’ Drive.” LSE Ideas, April 2022. ↩︎

6 Fray, Keith, Edward White, Cheng Leng, and Joe Leahy. “ Why Xi Jinping Changed His Mind on China’s Fiscal Stimulus.” Financial Times, 22-Oct-2024. ↩︎

7 “ Solid +6% Growth despite Turbulences.” L’Oréal, 22-Oct-2024. ↩︎

8 Hu, Krystal, and Anna Tong. “ OpenAI and others seek new path to smarter AI as current methods hitlimitations.” Reuters, 12-Nov-2024. ↩︎

9 Redman, Thomas C. “ Ensure High-Quality Data Powers Your AI.” Harvard Business Review, 12-Aug-2024. ↩︎

10 “ Wolters Kluwer’s Expert Solutions Combine Expertise with Advanced Technology.” Wolters Kluwer. Accessed 13-Nov-2024. ↩︎

11 Source: Wolters Kluwer Annual Report 2023↩︎

12 Source: “ Diabetes Data Portal.” International Diabetes Federation. Accessed 13-Nov-2024. ↩︎

13 “ One in Eight People Are Now Living with Obesity.” World Health Organization. Accessed 13-Nov-2024. ↩︎

14 https://www.airliquide.com/group/worldwide-presence↩︎

15 “ Air Liquide presents ADVANCE: its new strategic plan for 2025 combining financial and extra-financial performance.” Air Liquide, 22-Mar-2022. ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).