You are visiting United States

If this is incorrect,

19-Sep-2024

The African savanna with its sprawling grasslands, trees and wildlife is home to the largest living land animal – the African bush elephant. These colossal giants measure up to four metres and can weigh as much as 6,300 kg. Their sheer size provides protection against predators and enables them to dominate their surrounding environment.

Europe’s largest companies – the “elephants” – are driving performance of the MSCI Europe index.

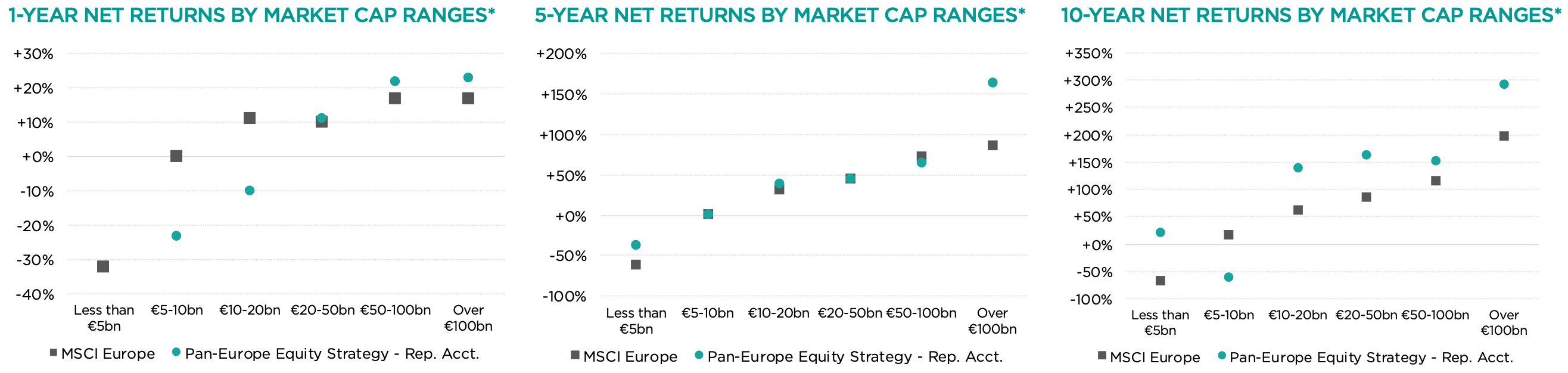

Across the European business landscape, there’s a similar dynamic at play. The “elephants" – the continent’s largest companies – hold sway over the corporate ecosystem. Over the past years, Europe’s largest-listed companies have recorded an outsized contribution to the performance of the MSCI Europe index (the “index”). Companies with market capitalisations exceeding €100bn account for nearly 20% of MSCI Europe’s returns. 1Despite strong headwinds – inflation, Russia’s invasion of Ukraine and slow economic growth – many of these corporate giants have stood firm. Performance for Comgest’s Pan Europe Equity Strategy (our “portfolio”) has also largely been concentrated in mega-capitalisation (“mega-cap”) companies. 2As illustrated in figure 1, companies with market capitalisations exceeding €100bn have generated a 28% return in the past 12 months (vs. 19% for the index) and nearly 178% over the past five years (vs. 88% for the index).

Past performance does not predict future returns. Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 31-Mar-2024 expressed in EUR. Past performance does not predict future returns. *The performance results shown are actual results of the representative account of the Pan Europe Large Cap Equities Composite, managed in accordance with the Composite since inception of the Composite. The results are not indicative of the future performance of the representative account or other accounts. Please refer to the important information section for more details on the representative account, its selection methodology and where to receive the GIPS compliant presentation of the composite. Comgest runs a buy-and-hold contribution system which performs holdings-based analysis using the beginning of period weights of securities and their returns to calculate contributions. Returns are therefore not derived from the actual portfolio return and may not reconcile with the calculation of performance which is based on the net asset value (NAV). Total Return is calculated taking into account a stock’s entry or exit date over the period, if relevant. Average weight is calculated over the entire period and not only in accordance with a stock’s presence in the portfolio. *The market capitalisation ranges are based on the market capitalisation at the end of the period under analysis which is 31-Mar-2024.

The historic success of these companies is not solely due to their size. Within the mega-cap category, many companies have reached “ex-growth”, the point when a mature company’s growth has slowed or stopped altogether. At Comgest, we seek mega-caps that have achieved remarkable success through a blend of widening moats over time due to innovation, brand recognition and formidable balance sheets. We seek quality companies – regardless of size – with exceptional longevity, visible growth, robust free cash flow, formidable barriers to entry and a strong corporate culture. Our investment team constantly researches what separates these businesses from the rest of the herd.

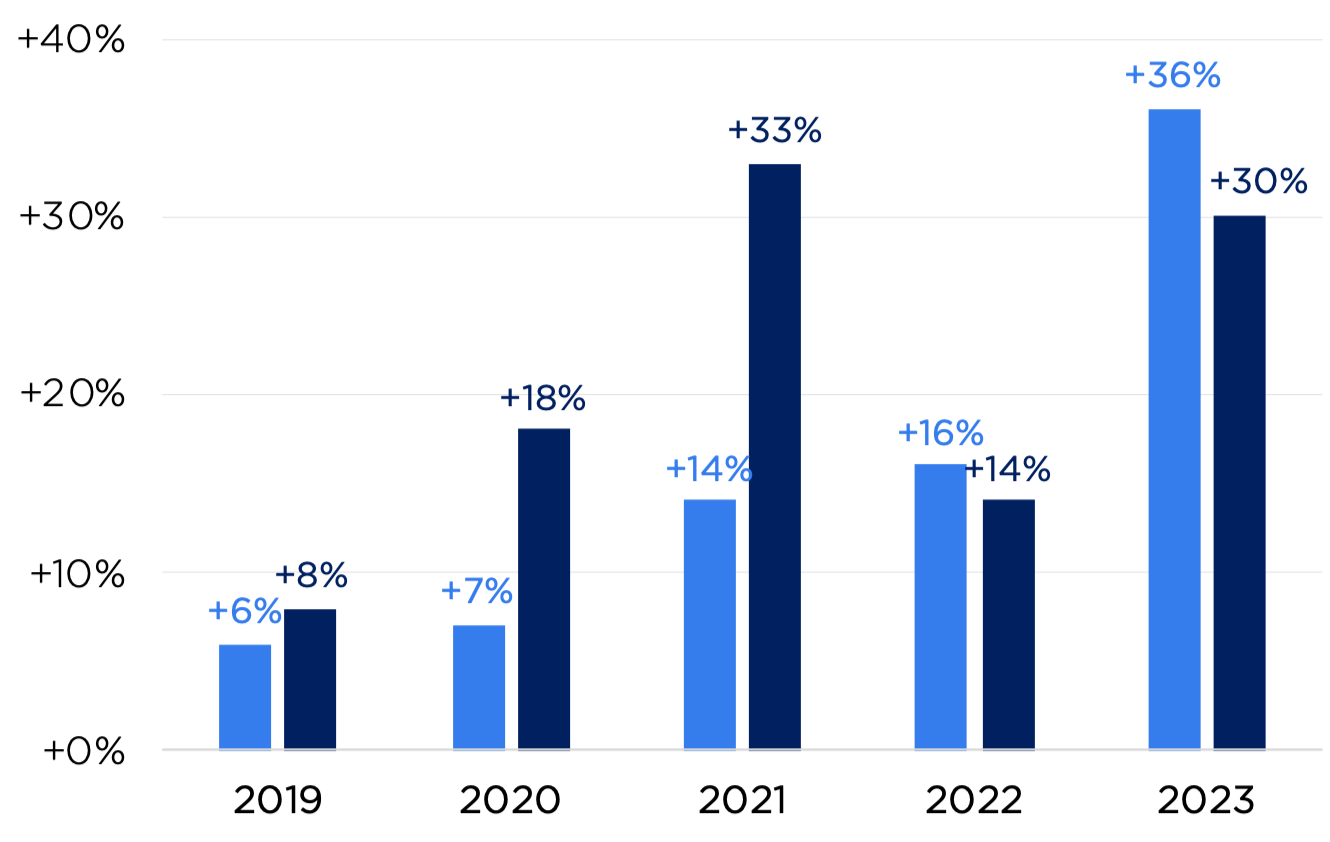

Among the elephants trampling through the golden grasses of this corporate savanna are Danish pharmaceutical giant Novo Nordisk and Dutch semiconductor supplier ASML. These companies, which are the top contributors to the Comgest Pan Europe Equity Strategy, have experienced tremendous revenue growth over the past five years. As figure 2 demonstrates, Novo Nordisk, a leader in diabetes and obesity treatments, grew its revenue by 36% last year. Meanwhile, ASML, a key producer of lithography machines, increased its revenue by 30% over the same period. Just as elephants grow long tusks to defend against predators, we believe companies such as Novo Nordisk and ASML use their competitive advantages to construct high barriers that hinder new entrants from encroaching on their market share.

Source: Comgest/Factset/Company websites as of 31-Mar-2024. The securities discussed above are provided for information only, are subject to change and are not a recommendation to buy or sell the securities.

For Novo Nordisk, the company’s market lead is due to its best-in-class glucagon-like peptide-1 (GLP-1), which serves as the “tusks” that aim to keep them ahead of competitors in the diabetes and obesity treatment segment. 3Similarly, ASML is the only company in the world that possesses the technology and machinery to create the indentations required for the world’s most sophisticated semiconductor chips. 4Without ASML’s lithography machines, leading manufacturers such as TSMC, Samsung and Intel would be unable to produce their cutting-edge chips. Recent advancements in artificial intelligence, the race to keep up with Moore’s Law and the unfortunate rise in people with diabetes and obesity have created a favourable environment for ASML and Novo Nordisk to forge expanded growth trajectories. Given these companies’ competitive edge, we believe that it will be challenging for new entrants to capture greater market share and seize the leads of ASML and Novo Nordisk.

While elephants are known for their long trunks, their huge footprints actually create vital watering holes that nurture tiny aquatic creatures and sustain the surrounding ecosystem. Similarly, when European megacaps move, there is a ripple effect around them. About ten years ago, Novo Nordisk, leveraging its century-long expertise in diabetes treatment, started marketing GLP-1, a hormone that boosts insulin and stops glucose from entering the bloodstream.

Source: Comgest/Factset/Company websites as of 31-Mar-2024. The securities discussed above are provided for information only, are subject to change and are not a recommendation to buy or sell the securities.

This helped establish Novo Nordisk as a leader in the diabetes treatment market, followed swiftly by US pharmaceutical company Eli Lilly.

After conducting further research and development (R&D) on GLP-1, researchers at Novo Nordisk concluded that GLP-1 can also reduce appetite. These findings led to the development of GLP-1 weight-loss drugs, including Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound.

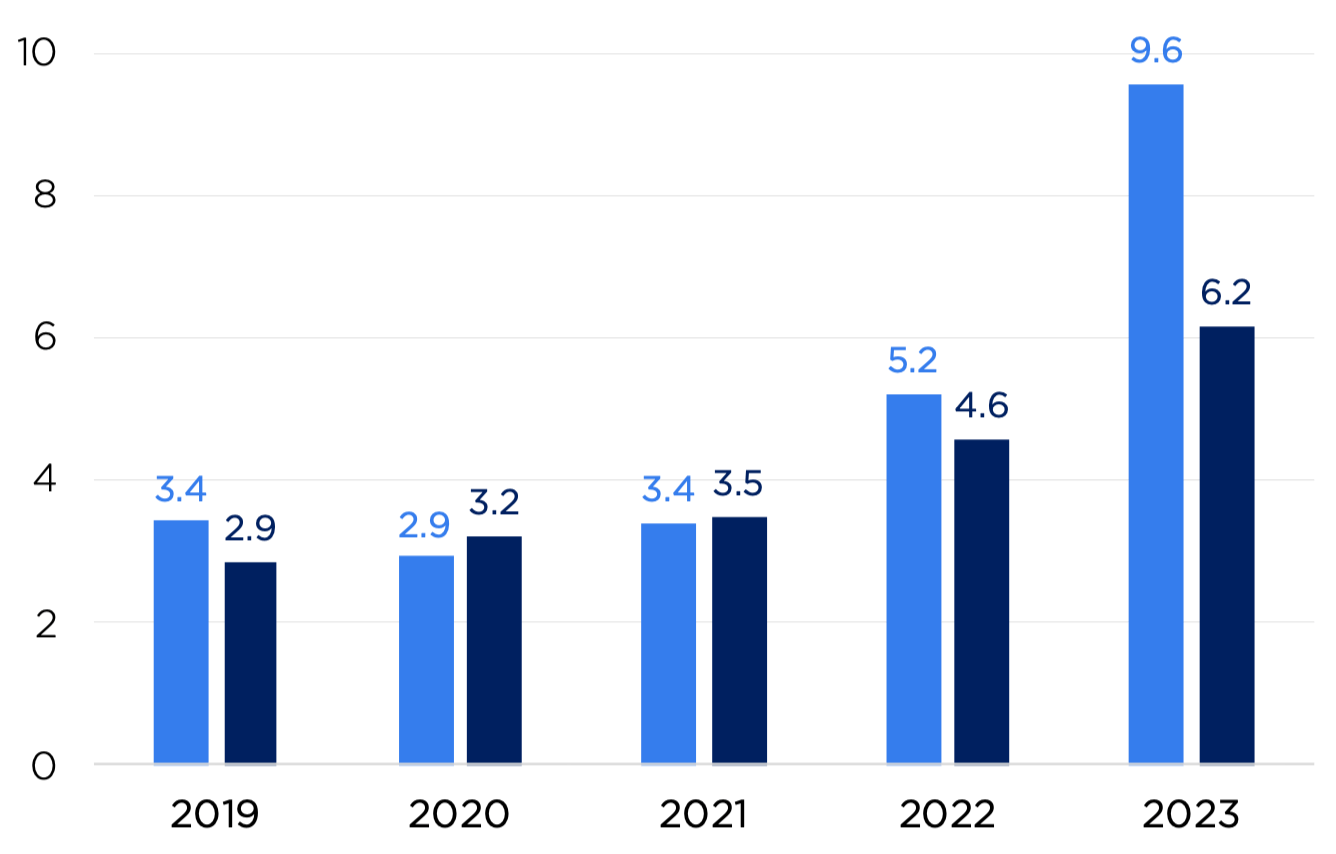

In our view, companies that reinvest their revenue gains into R&D and capital expenditures (CapEx) are well positioned for innovation and future growth. Over the past five years, both Novo Nordisk and ASML have increased their R&D and CapEx spending considerably, as seen in figure 3. ASML’s R&D and CapEx spending doubled from €2.9bn in 2019 to €6.2bn in 2023, while Novo Nordisk’s tripled from €3.4bn to 9.6bn over the same period.

By establishing sizable leads in the innovation race, both Novo Nordisk and ASML can fend off new entrants and challengers. At the same time, R&D investment can lead to the development of new ecosystems and adjacent markets, as was the case with Novo Nordisk’s GLP-1 treatment for diabetes, and now, weight loss.

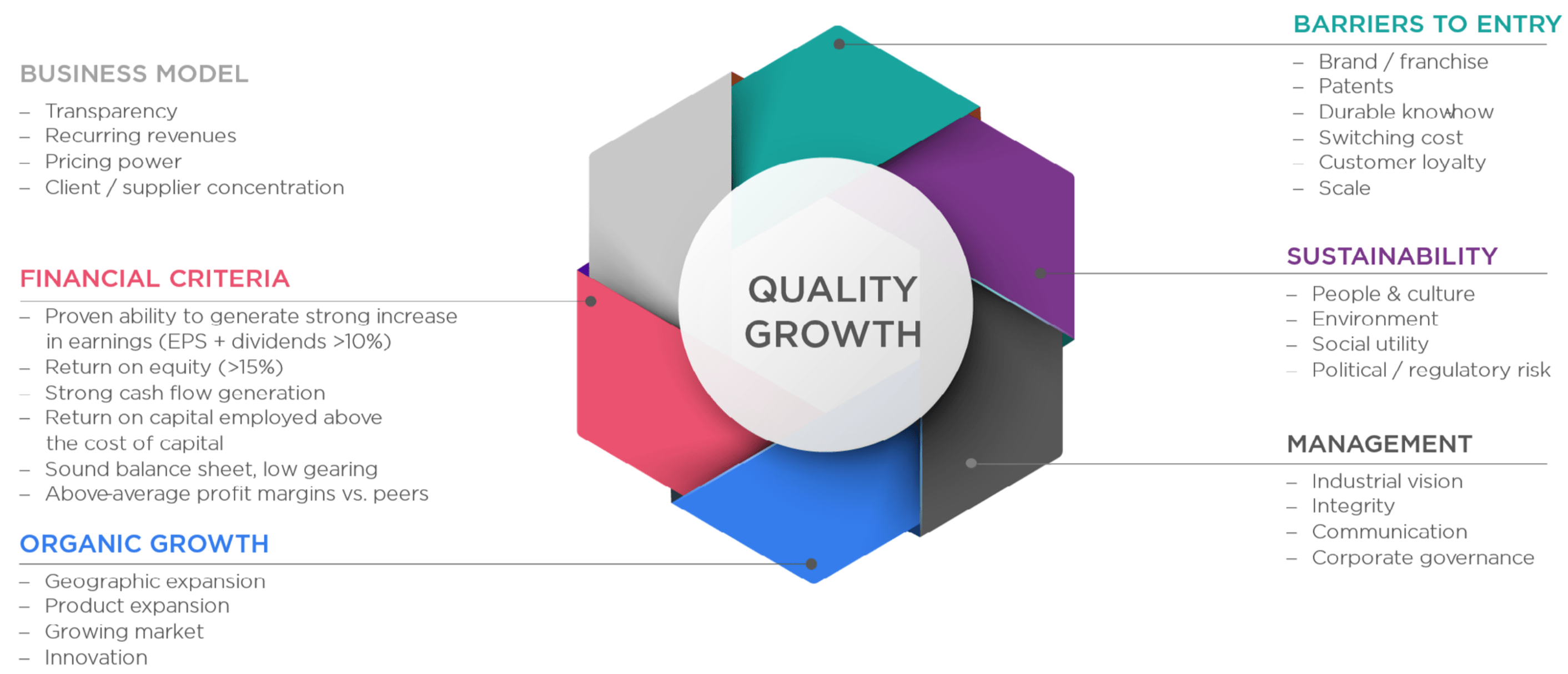

While Europe’s largest companies are witnessing a period of outperformance, the Comgest Pan Europe Equity Strategy extends beyond the elephants. Our investment philosophy transcends benchmarks, countries, sectors, and size. We focus on company-specific drivers of long-term quality growth whether the company is a mid-, large- or megacap. Our search for potential investments begins with a broad screening of the market to create a “watch list” of companies that meet our Quality Growth criteria (as shown in figure 4).

We conduct years of fundamental analysis, including meeting with management teams, suppliers, customers, and industry experts to gain a deeper understanding of a company’s business model. 5ESG analysis is fully integrated into this process to help determine the quality profile of these companies. When a company passes our initial screening process, we then include it as part of our investment watch list, where we continue our fundamental analysis using qualitative and quantitative methods. We also engage with management teams, suppliers, customers and industry experts to gain an in-depth perspective on the company.

Transitioning a company from our watch list to the Comgest Investment Universe requires unanimous investment team approval. These carefully selected quality companies are continually monitored, and we will wait to invest only when valuations are deemed attractive. Patience is key as this process can span from a few months to several years. Our valuation approach typically relies upon conservative, proprietary fiveyear forecasts of earnings and dividends. Comgest’s Pan Europe Equity Strategy invests with a three-to-five-year investment horizon, after building high-conviction through discussions with candidate companies and our team.

Based on this rigorous investment process, we believe that the French industrial group Schneider Electric has the qualities and characteristics that align with our durable Quality Growth approach and megacap portfolio companies. Founded 188 years ago as a mining company in the industrial city of Le Cruesot, France, Schneider Electric has transformed into one of the world’s leading electricity and power control companies. 6Today, the company produces a wide variety of products related to electricity and data management, such as sensors, transformers and software.

Schneider Electric offers clients products that reduce their carbon footprint and use energy more efficiently as well as a range of scalable power systems for datacentres used by large cloud services providers..

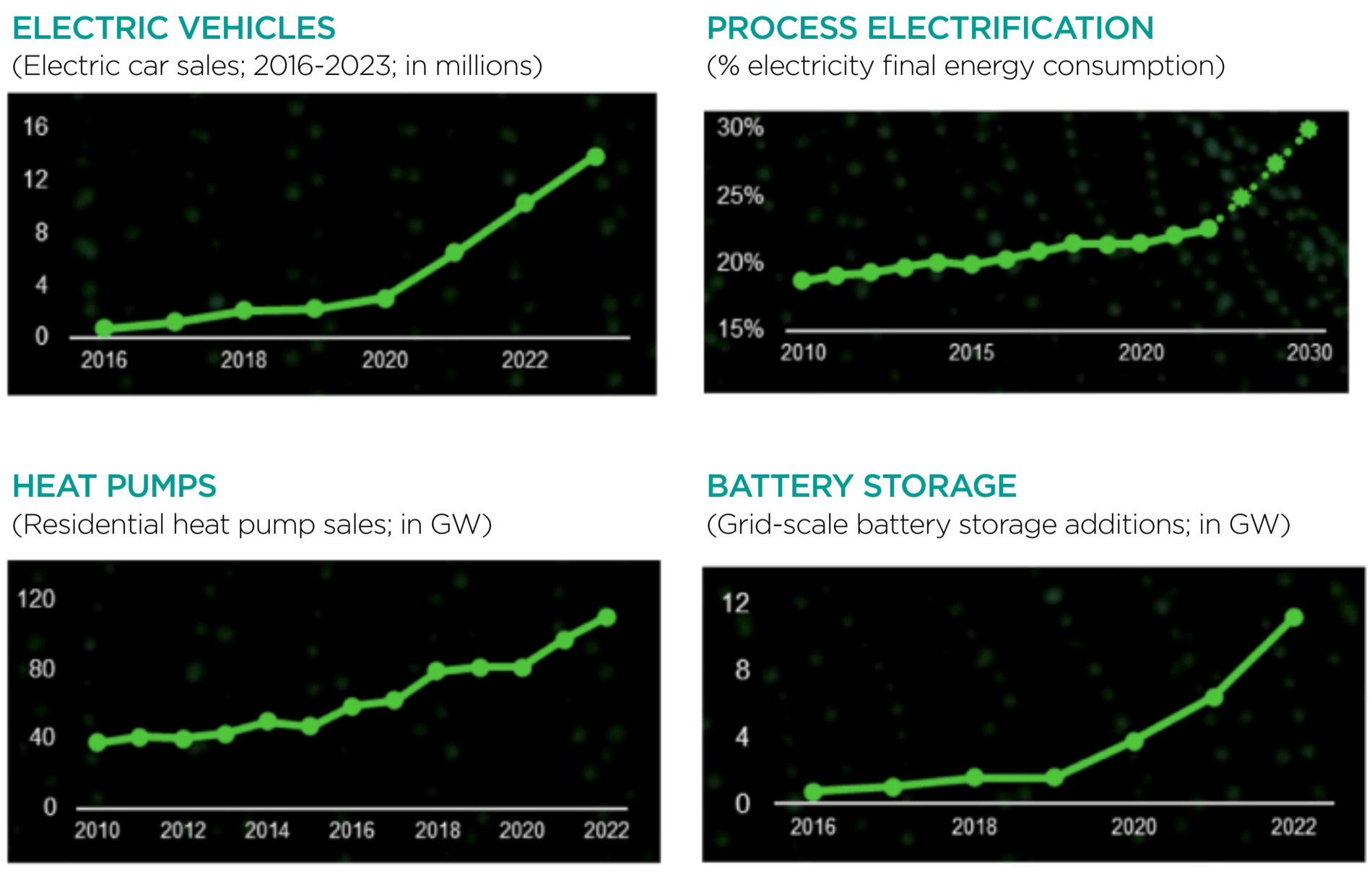

With a market capitalisation of €140bn, Schneider Electric is smaller than Novo Nordisk and ASML, but we believe the company has comparable competitive advantages and the potential to deliver doubledigit earnings-per-share growth over the long term. As countries and companies around the world commit to net-zero emission targets, there has been a significant increase in demand for products that can improve energy efficiency. The share of global electric vehicle sales, for instance, has increased from 4% in 2020 to 18% in 2023. 7Heat pumps (+11% yearto-date in 2023) and battery storage capacity (+40 GW in 2023) are also experiencing double-digit growth rates, according to the International Energy Agency. 8As the global energy transition accelerates, we believe that Schneider Electric is well placed to offer clients the products they need to reduce their carbon footprint and use energy more efficiently, as highlighted in figure 5. Schneider Electric further benefits from the rollout of datacentres by large cloud service providers, known as “hyperscalers”. Global datacentres require efficient and scalable power systems, and Schneider Electric offers a suitable product range for these clients.

Sources: Schneider Electric Capital Markets Day 2023 / IEA / Comgest. Data on positions held are provided for information purposes only, are subject to change and do not constitute a recommendation to buy or sell the securities displayed.

Assa Abloy, the Swedish door and lock specialist, is another large European company with enduring competitive advantages. Formed in 1994 with the merger of Swedish security company Assa and Finnish lock specialist Abloy, the company offers a wide variety of security solutions, including digital locks, keys, tags and automated entrances. 9Assa Abloy’s €31bn market cap may be smaller than the continental elephants of ASML and Novo Nordisk, but we believe it benefits from many of the same quality growth attributes as the mega-cap companies in our portfolio.

We consider Assa Abloy to be a big fish operating within a small pond industry, having found a successful formula for consolidating this niche market.

Assa Abloy acquires smaller competitors and leverages its global distribution and manufacturing network to generate cost and sales synergies. The global locks market is highly fragmented and Assa Abloy has seized on this by pursuing consolidation. Since 2018, Assa Abloy has acquired over 100 smaller companies, enabling it to enter new geographical areas and diversify its product offerings. Notably, the company made its largest acquisition in 2021 by purchasing Spectrum Brands’ Hardware and Home Improvement division for $4.3 billion, marking its entry into the US market. The company has demonstrated no signs of slowing down their pursuit of acquisitions with nearly 900 companies on their target list. 10In our view, Assa Abloy excels at integrating new acquisitions into its long-term strategy, demonstrating its quality and foresight. Despite the inherent challenges of mergers and acquisitions, which often see failure rates between 70%, Assa Abloy has honed a strategic approach to acquiring smaller competitors. In our view, the company’s expansion into new geographies reduces integration risks and maximises synergies. Assa Abloy’s well-oiled M&A machine has proven effective, enabling sustained double-digit growth while maintaining robust profitability, cash flow and capital returns.

Similar to the continental elephants ASML and Novo Nordisk, Assa Abloy has also established a competitive edge through product innovation.

The company spends twice as much on R&D as its next closest competitor 11, resulting in the release of several high-tech products, including smartphone-enabled and biometric locks. In 2023, the company registered over 230 patents and released over 430 new products. 12With traditional mechanical locks in decline, we believe that Assa Abloy is well-positioned to supply clients with upgraded electromechancial locks and the latest generation of secure access technology.

From our perspective, there are several underlying trends driving our portfolio’s performance, such as an ageing global population and the environmental transition. We believe that these trends are likely to continue in the future, irrespective of macroeconomic developments. These underlying trends help guide us when conducting bottom-up fundamental analysis and considering companies for portfolio inclusion.

While European mega-cap companies – the elephants – are currently experiencing significant growth, we believe that their success goes beyond mere size. In the same way that elephants use their trunks to dig for water or their large ears to radiate heat, quality-growth companies – like ASML, Novo Nordisk, Schneider Electric and Assa Abloy – leverage their own advantages in an effort to withstand their competition and overcome unforeseen crises. We value companies with exceptional longevity, visible growth, robust free cash flow, high barriers of entry and strong corporate cultures. Drawing on nearly four decades of experience, we consider these company-specific drivers of growth as markers of sustainable long-term success.

1 Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 31-Mar-2024 expressed in EUR. ↩︎

2 Refers to companies with a market capitalisation above $200 billion. ↩︎

3 Johnston, Ian, and Oliver Barnes. “ The Race to Develop the next Generation of Weight-Loss Drugs.” Financial Times, 01-Apr-2024. ↩︎

4 Clark, Don. The Tech Cold War’s ‘Most Complicated Machine’ That’s Out of China’s Reach. The New York Times, 24-May-2024 (subscription). ↩︎

5 Comgest. “ Our Investment Process.” Accessed 30-Aug-2024. ↩︎

6 Schneider Electric. “ History of Our Company, Brand and Innovation.” History of our company, brand and innovation | Schneider Electric Global. Accessed 26-Jun-2024. ↩︎

7 IEA. “ Global EV Outlook 2024 – Analysis.” IEA, April 2024. ↩︎

8 Monschauer, Yannick, Chiara Delmastro, and Rafael Martinez-Gordon. “ Global heat pump sales continue double-digit growth .” International Energy Agency, 31-Mar-2023. ↩︎

9 ASSA ABLOY Group. “ About the Assa Abloy Group.” ASSA ABLOY Group. Accessed 29-Aug-2024. ↩︎

10 ASSA ABLOY Group. “ Capital Markets Day 2024.” Website accessed 29-Aug-2024. ↩︎

11 Source: Comgest analyst and Company Reports. ↩︎

12 ASSA ABLOY Group. “ Capital Markets Day 2024.” Website accessed August 29, 2024. ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest Italia is the Italian branch of Comgest Asset Management International Limited, enrolled in the Milan Companies Register with no. MI-2587566 and in the CONSOB register with no. 191. Its registered office is at Via Del Vecchio Politecnico 9, 20121, Milan, Italy.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Cover image source: gettyimages