You are visiting United States

If this is incorrect,

04-Mar-2025

Investors devote much attention to a company’s tangible assets, such as inventory, equipment, machinery, buildings and more. Yet, human capital, including employee knowledge, skills and experience, is typically undervalued. From our experience, strategy matters, but people make the difference. Just look at Hermès, where human capital isn’t just an asset—it’s the quiet force behind its long-term success.

In the heart of Paris, near the Louvre and the Tuileries Gardens, lies Rue Saint-Honoré, a street lined by upscale fashion boutiques and luxury hotels. At the intersection of Rue Royale, the street becomes the prestigious Rue du Faubourg Saint-Honoré: home to ambassadors, government officials and the Élysée Palace—the residence of the French President. Overlooking the neighbourhood, a rooftop statue of a man on horseback stands tall, flanked by two orange flags. Just behind him, in bold black lettering, the words "Hermès Sellier" marks a legacy of craftmanship.

For 145 years, this address—24, Rue du Faubourg Saint-Honoré—has served as the flagship store of the French leather goods company Hermès. Once home to the company’s workshops, where artisans honed their craft, the building remained a creation hub until 1992, when production moved to Pantin, a Parisian suburb. 1Since its founding as an equestrian harness-maker in 1837, Hermès has championed the handcrafted excellence of its goods. From saddles to silk scarves, ties and bags, the company’s range has grown over nearly two centuries—but in our view, its commitment to quality remains unchanged.

At Comgest, we acknowledge that determining the value of a company is not a straightforward process. Investors typically begin by conducting a traditional financial analysis, examining a company’s balance sheet and tangible assets. As long-term active managers, we also believe that intangible assets—like human capital—can play a critical role in helping us identify companies capable of delivering sustained returns.

Hermès has leveraged its highly skilled artisans to establish a formidable competitive advantage and achieve long-term growth over decades. While products can be copied, the expertise, training and skills of Hermès’s artisans make each piece one of a kind. From our perspective, Hermès demonstrates that human capital expenditure (Human CapEx)—the process of investing in employees through training, reward structures and benefits—can strengthen organisational resiliency and drive longterm growth.

Upon entering any one of Hermès’s 52 workshops across France—known as ateliers—the silence is immediately striking. 2The company, which now employs around 7,300 artisans across France, has kept a humancentric approach to its production process. Absent are the humming of conveyor belts, clicking of sewing machines or the buzzing of automated tools. At any given atelier, between 250 and 300 artisans sit at shared tables, weaving and stitching bags that will sell for anywhere between €7,000 and €30,000 depending on the model. 3The company’s iconic Birkin and Kelly bags—named after actresses Jane Birkin and Grace Kelly—are made by a single artisan and can take around 16 to 18 hours from start to finish. 4After spending years—sometimes decades—creating bags, artisans at Hermès are usually able to produce different models from memory.

Pictured: The “saddle stitch” remains one of Hermès’s most recognisable design features. Source:

Hermès website

Pictured: The “saddle stitch” remains one of Hermès’s most recognisable design features. Source:

Hermès website

These artisans undergo years of rigorous training to master the techniques that have long distinguished the quality of Hermès’s products. One of the most notable design features of the company’s leather products is saddle stitching—or coudre— which cannot be replicated by a machine as it requires crisscrossing needles simultaneously through the same seam. 5From our perspective, this patient, handsewn process adds to the uniqueness of the company’s products.

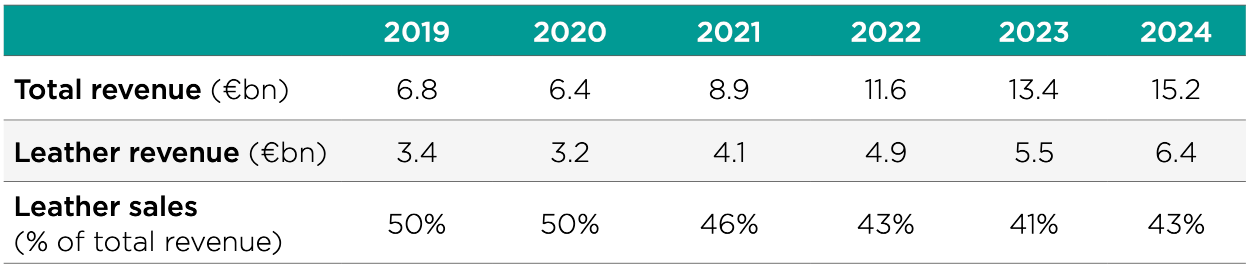

Unlike many businesses today devoting their attention to artificial intelligence, Hermès remains dedicated to its handcrafted heritage. The company has maintained a steadfast focus on building, recruiting and retaining a workforce of highly skilled craftspeople, especially as the demand for its leather products has grown between 6%-7% in recent years (as seen in figure 1). 6Our research estimates that to support this growth, the company will need an additional 3,000 artisans by 2027. 7

Source: Comgest/ Hermès Universal Registration Document and Annual Financial Report.

Over the past forty years, the rise of fast fashion and technology has resulted in declining rates of qualified artisans and craftspeople. 8In France, as older generations of artisans are preparing to retire, the luxury industry is facing a labour shortage. In 2022, the Boston Consulting Group and the Comité Colbert, a business association of French luxury brands, estimated that 85% of fashion houses face recruitment challenges. 9

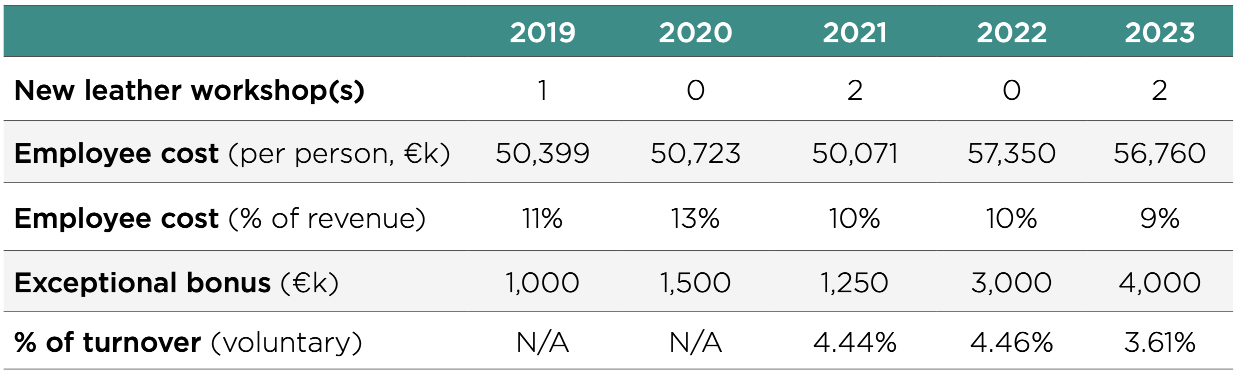

To address this growing shortage, Hermès has accelerated new leather workshop openings across eleven different regions in France, aiming to build the next generation of artisans through apprenticeships (as shown in figure 2).

Source: Comgest/ Hermès Universal Registration Document and Annual Financial Report.

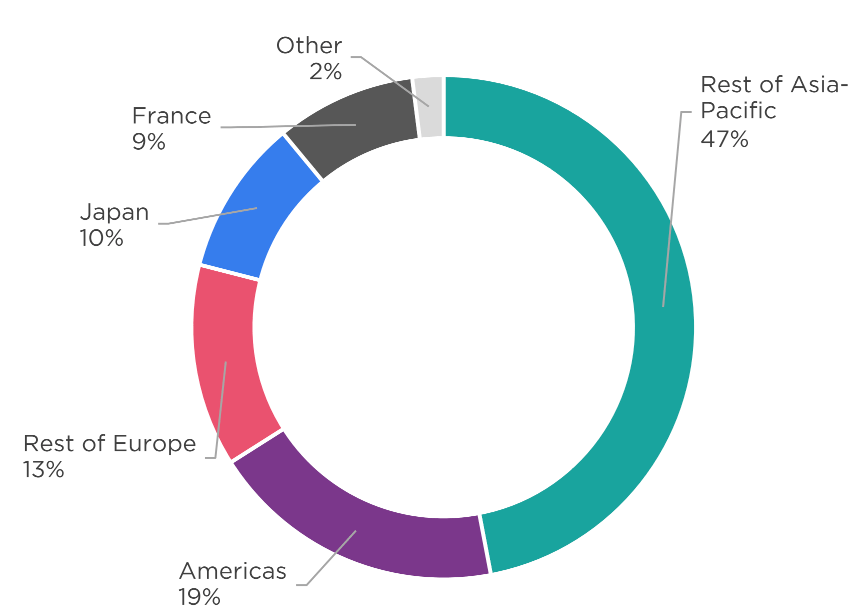

Source: Hermes/Statista 2024

While France only contributes 9% to Hermès’s global revenue (see figure 3), the company makes all its leather goods within the country. In 2025, the company will open its 24th leather workshop in L'Isle-d'Espagnac, located in the Nouvelle-Aquitaine region of Southwest France. 10Every year, Hermès trains around 600 new graduates at its proprietary training schools. 11In 2021, the company launched the École Hermès, which provides training courses accredited by the French Ministry of Education, to train students in cutting, stitching and other sewing techniques. 12The company’s nine knowhow ( savoir-faire) workshops are strategically located in rural locations around France where there are generally fewer alternative job opportunities. 12Whereas in previous generations Hermès recruited young people between the ages of 16 and 18, the company has since expanded its recruiting efforts to individuals with prior work experience looking for career or lifestyle changes. 13

As long-term investors, we seek to include companies like Hermès in our portfolios because they pursue growth, but not at the expense of quality. Despite a shrinking supply of artisans, the company has doubled down on attracting new talent through its specialised training programs. Based on our experience, Human CapEx functions over a longer time horizon than traditional forms of capital expenditure. While buying a new office is listed on a company’s financial report, investments aimed at attracting new employees through training or educational programmes are rarely included. As investors in the company since September 2014, we have developed a deep understanding of the company’s competitive advantages. Among these is the Hermès handsewn craftsmanship that ensures each product is one of a kind.

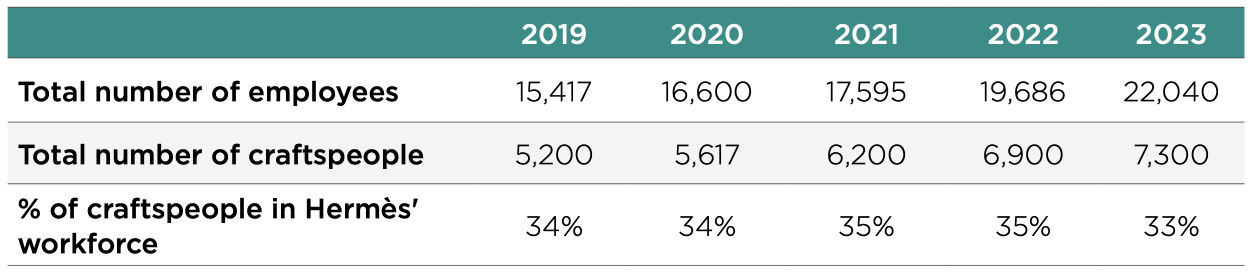

As part of our investment research, we evaluate employee compensation, benefits, and career advancement opportunities to determine if a company aligns with our quality growth criteria. From our experience, companies that rapidly expand often face high employee turnover and frequent hiring and firing cycles. We believe that such turnover is detrimental to long-term growth, as it prevents the establishment of a stable and lasting corporate culture. Comgest prefers to invest in companies, like Hermès, that invest in their employees and have low staff turnover. Over the years, Hermès has steadily increased its employees and craftspeople (as seen in figure 4). We believe that investments in Human CapEx can create generations of skilled employees and save costs by fostering in-house talent.

Source: Comgest/ Hermès Universal Registration Document and Annual Financial Report.

Hermès’s commitment to building a loyal and qualified workforce is heavily rooted in the company’s culture. The company pays above minimum wage in all locations and provides several non-financial benefits, such as parenthood protections, health and life insurance, as well as retirement and disability plans that cover 90% of its employees, with a target to provide these benefits universally by 2026. 14In recent years, Hermès has increased the number of bonuses provided to employees and has increased annual wages between 8%-9% since 2019. 15Around 80% of the company’s employees are also part of a profitsharing scheme, which gives them a stake in the company’s long-term performance. 14As a result of these expenditures, Hermès has one of the lowest voluntary employee turnover rates in the luxury industry (less than 5% in 2023), with 30% of all employees having worked at the company for over a decade. 16

Given the global shortage of artisans, we consider retaining skilled workers as key to Hermès’s long-term business strategy. These seasoned employees not only craft the coveted Birkin and Kelly bags to the highest quality, but they also pass down their specialised knowledge to mentor the next generation of artisans. For example, Hermès’s signature saddle stitch and other craftsmanship techniques can only be learned through hands-on practice. To keep their skills sharp, employees train three days a week, with the goal to increase it to five days in the future. All of this ensures that the company’s competitive edge— its quality—endures.

Pictured: Hermès store and workshop at 24, Rue du Faubourg Saint-Honoré in 1880. Source:

Hermès website

Pictured: Hermès store and workshop at 24, Rue du Faubourg Saint-Honoré in 1880. Source:

Hermès website

Despite its prestigious location among Paris’ powerbrokers, Hermès remains deeply rooted in its humble origins as an equestrian harness and saddle maker. The company’s commitment to craftsmanship is exemplified by Pierre-Alexis Dumas, a sixth-generation Hermès family member who today is a member of the company’s Executive Committee. As a young boy, Dumas learned the saddle stitch from Hermès artisans in the upstairs workshops of 24, Rue du Faubourg St.Honoré. 17

As the company’s current Artistic Executive Vice-President, Dumas now makes pivotal decisions related to the company’s product design and creative direction. 17Our experience suggests that a founding family can anchor a company as a source of stability and cultural values. At Hermès, the founding family’s personal understanding and respect for the company’s artisanal heritage demonstrates their dedication to the company’s longterm vison. Based on our research, we believe the family recognises Human CapEx as being key to developing and retaining top talent, as well as to preserving the craftsmanship that has been the company’s competitive edge for almost two centuries.

As long-term, quality growth investors, we believe that it’s essential to consider both a company’s financial and non-financial aspects. Since Comgest’s inception four decades ago, we have integrated extra-financial research into our investment process, helping us build comprehensive analyses of our portfolio companies. For investors like us, culture plays a role in a company’s long-term trajectory. This culture is shaped by the people behind the brand, which is why we see Human CapEx as key to fostering employee loyalty, innovation and productivity. By investing in people and culture, we believe that companies are better positioned to weather challenging times and achieve sustainable earnings growth over the decades ahead. Behind its venerable seams, Hermès’ continued commitment to craftsmanship, culture, and human capital weaves together the company's legacy of timeless quality, helping ensure the brand’s enduring success, stitch by stitch.

1 “ Six Generations of Artisans.” Hermès. Accessed 27-Jan-2025. ↩︎

2 “ A House of Artisans and Human Values.” Hermès. Accessed 27-Jan-2025. ↩︎

3 Klasa, Adrienne. “ Wanted: People Who Can Learn to Make €22,000 Handbags.” Financial Times, 7-Apr-2023. ↩︎

4 Comgest analyst research notes 3-Sept-2024. ↩︎

5 “Coudre, one of Hermès know-how.” Hermès. Accessed 27-Jan-2025. ↩︎

6 Spencer, Mimosa, and Silvia Aloisi. “ Production Caps Curb Growth at Luxury Handbag Maker Hermes.” Reuters, 18-Feb-2022. ↩︎

7 Comgest analyst research notes 3-Sept-2024. ↩︎

8 Satow, Julie. “ In a World of Fast Fashion, They Take Pride in Taking Their Time.” The New York Times, 25-Jul2024. ↩︎

9 “ Luxury Outlook 2022: Advancing as a responsible pioneer Rarity, sustainability, exclusivity, new experiences, and new territories.” Boston Consulting Group and Comité Colbert, June 2022. ↩︎

10 “ Hermès Continues to Invest in Its Production Capacity and Announces the Creation of Two Leather Goods Workshops with 500 Jobs, by 2026.” Hermès, 15-Mar-2022. ↩︎

11 Comgest analyst research notes 3-Sept-2024. ↩︎

12 “ L’École Hermès Des Savoir-Faire.” Hermès. Accessed 27-Jan-2025. ↩︎

13 Klasa, Adrienne. “ Wanted: people who can learn to make €22,000 handbags.” Financial Times, 7-Apr-2023. ↩︎

14 “ Hermès 2023 Vigilance Plan.” Hermès. Accessed 27-Jan-2025. ↩︎

15 Garnier, Juliette. “ Hermès Grants €4,000 Bonus to All Employees.” Le Monde, 17-Feb-2023. ↩︎

16 “ 2023 Universal Registration Document Including the Annual Financial Report.” Hermès, 26-Mar-2024. ↩︎

17 Alfonsi, Sharyn. “ Take a look inside Hermès with artistic director Pierre-Alexis Dumas.” CBS News, 15Dec-2024. ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).