You are visiting United States

If this is incorrect,

08-Oct-2024

Companies are more than their bottom lines. Most CEOs will say that their employees are their most valuable asset. We seek to identify those companies which are positively positioned for long-term success by looking past the bottom line and actively engaging on elements of “Human CapEx” and culture.

Assessing the value of a company can be a challenging process. Investors typically start by looking at a company’s financial standing – its book value, cash flow, market capitalisation, earnings, etc. Companies list their capital expenditure, or spending on goods and services, on their income statement. From these records, investors can see tangible investments, such as machinery purchases and building maintenance costs, which clarifies the company’s revenue, debt obligations and other expenses.

These numbers are essential, but they don’t tell the whole story. Spending on employees, including training and healthcare benefits, often gets lumped together with other costs on financial disclosures. At Comgest, we gauge how much companies are investing in their workforce. We see human capital (“Human CapEx”) – the knowledge and skills that people acquire throughout their lives – as a competitive edge for companies. 1

Companies and investors have increasingly turned to human capital management and social factors as a barometer for measuring sustainable corporate success. After the COVID-19 pandemic, companies have focused more on their softer benefits and offering office perks – from free parking to ping-pong tables – to retain workers and attract new talent. 2Many of these efforts aim to boost low employee engagement and stem the rise of “quiet quitting” – when employees disengage from their jobs and do the bare minimum to get by. 3According to a recent Gallup poll, around 62% of employees are not engaged at work, which costs the global economy an estimated US$8.9 trillion, or 9% of the global GDP, each year. 4

In our engagements, Comgest goes beyond office perks. Free cold brew coffee is nice, but we prioritise more substantial employee engagement strategies. We want to understand what steps a company is taking to ensure that their workforce drives sustainable earnings growth. During our investment research process, we analyse employee wage structures, benefits, training programmes and promotion opportunities to ascertain whether a company meets our rigorous quality growth standards.

As we see it, companies that invest in their employees are more likely to attract, retain and develop workforces capable of delivering enduring financial performance. Capital expenditure (“CapEx”) on new buildings, equipment and storage facilities can result in greater productivity and performance. 5Investments in human capital can achieve similar outcomes by motivating employees, increasing productivity, reducing staff turnover and strengthening a company’s reputation in their local community. Companies that invest in rigorous talent development programmes and attractive corporate cultures are set to pursue their long-term growth ambitions.

Based on our experience, fast-growing companies that aggressively expand their operations generally experience staff turnover punctuated by rapid rounds of hiring and firing. Constant staff turnover is not a recipe for long-term growth as its difficult to establish a consistent and enduring corporate culture. Comgest prefers to invest in stable growing companies that maintain a long-term vision and actively develop their workforce.

WEG, the Brazilian manufacturer of electric motors, exemplifies how a pioneering talent development programme can create generations of skilled employees and save costs by generating in-house talent. The company’s vocational training school – CentroWEG – equips young apprentices between the age of 16-18 with the technical skills and knowledge required to work at WEG. 6

From electrical engineering to chemistry and programming to administration, students receive a comprehensive education on how WEG operates. With over 39,000 employees in 37 countries, this programme has served as a hotbed for in-house talent steeped in the company’s history and values. Since 1968, 48% of graduates have become employees of the company with 122 going on to hold management positions. 7

WEG’s efforts to build a qualified workforce are deeply rooted in the company’s culture. The company also offers a profit-sharing scheme to give employees a share in the profits. This gives employees a stake in the company’s performance, which in turn, strengthens motivation and loyalty. WEG’s profit-sharing plan combined with other benefits, such as life and health insurance, creates a sense of belonging shared by employees. Maintaining an engaged workforce makes the company more attractive to external job seekers too.

As quality growth investors, we seek companies with competitive edges, but it’s really their culture that keeps those edges sharp. Figuring out the cost of a new research facility is relatively straightforward with financial disclosures. Defining a company’s culture can be more complicated as it’s unique to every organisation. We talk with employees and engage with leadership to evaluate how people interact and work together to achieve their goals. Culture is shaped by leadership, but also by a company’s history, mission and purpose.

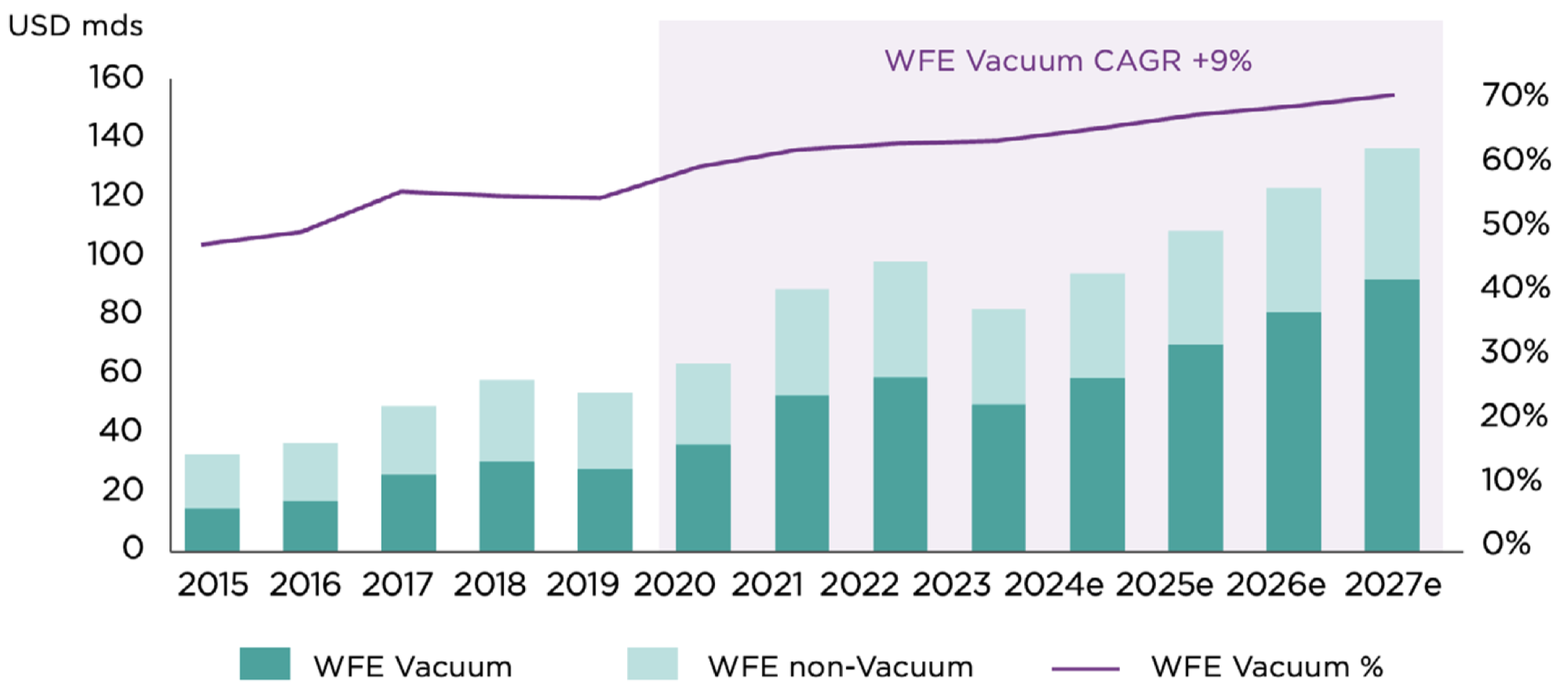

A company’s culture reflects how it invests in its employees and leverages its human capital. Consider VAT Group, the Swiss-based supplier of vacuum valves for the semiconductor industry. Technological advancements have created more demand for semiconductors and their associated components. The wafer fab equipment (WFE) market, which includes VAT Group’s vacuum valves, has recorded a compound annual growth rate of 9% in recent years (as shown in figure 1). The precise nature of semiconductor products has created a competitive employment market for highly skilled and technical experts. In response, the company has decided to lean into research and development (R&D) to create an innovation environment worthy of attracting highly qualified specialists. Over the past two years, the company has invested €50m in R&D. 8

Sources: VAT / Company website / VLSITechInsights Inc / Investor Deck Winter 2023. *WFE = Wafer Fab Equipment. Data on positions held are provided for information purposes only, are subject to change and constitute neither a recommendation to buy nor a recommendation to sell the securities displayed. The securities presented in this document may not be held in portfolio at the time of receipt of this letter. All projections and estimates are provided for information purposes only and are not guaranteed.

VAT Group maintains strong ties with leading engineering universities and research institutions, including The European Organization for Nuclear Research (CERN) 9, to further expand its talent pool and offer existing employees with the opportunity to continue research. Training programmes and financial support for further education are other factors that underscore the company’s low turnover rate (14%) and strong employee loyalty. 10

Human CapEx operates on a different timeline than other forms of capital expenditure. Investing in employees is hard to measure and isn’t likely to show up in quarterly reports or financial disclosures. Unlike buying new machinery, Human CapEx’s impact stretches over years and generations of employees. Companies, like VAT Group and WEG, know this firsthand. By investing in employee benefits, training programmes and development opportunities, both companies have cultivated in-house talent and prepared the next generation of leaders. Targeted investments in talented employees and promoting internal promotion are seen as key strategies for strengthening loyalty and motivation.

Since Comgest’s inception in 1985, we have engaged with thousands of companies. Based on our countless conversations with leadership, employees and customers we believe that culture is the glue that holds quality-growth companies together. Our bottom line is that we believe companies with long-term vison are more likely to take an active role in nurturing their workforce. That’s why we seek companies that value an inspired, engaged and forward-looking team. In our view, these companies are capable of weathering tough times and achieving sustainable earnings growth over the long term.

1 World Bank Group. “Human Capital Project.” World Bank, January 31, 2019. ↩︎

2 Lucy Warwick-Ching, “How benefits have overtaken pay as the key to hiring and keepin staff.” Financial Times, November 3, 2023. ↩︎

3 Klotz, Anthony C., and Mark C. Bolino. “When Quiet Quitting Is Worse than the Real Thing.” Harvard Business Review, September 15, 2022. ↩︎

4 Harter, Jim. “Is Quiet Quitting Real?” Gallup, January 19, 2024. ↩︎

5 Brinded, Tom, Erikhans Kok, Lucas Ponbauer, and Bevan Watson. “How Capital Expenditure ManagementCan Drive Performance.” McKinsey & Company, June 29, 2022 ↩︎

6 “Registration for CentroWEG 2024 is now open; find out how to participate.” WEG, February 23, 2024 ↩︎

7 Source: Comgest analyst conversation with company ↩︎

8 Source: VAT Group Annual Report 2023. ↩︎

9 “ Hunting for the Building Blocks of the Universe – with VAT Vacuum Valves.” VAT Group. Accessed August 21, 2024 ↩︎

10 Source: VAT Group Sustainability Report 2023 ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

This is a marketing communication. Please refer to the fund prospectus and to the PRIIPs KID before making any final investment decisions. UK investors should refer to the UCITS KIID. These documents are available at our offices free of charge and on our website at www.comgest. com. Our Irish funds’ prospectus is available in English, French and German and our French funds’ prospectuses are available in French and may also be available in German. The KIDs are available in a language approved by the EU/EEA country of distribution. A more detailed description of the risk factors that apply to the funds is set out in the prospectus. The Comgest Growth funds mentioned herein are UCITS compliant sub-funds of Comgest Growth plc (CGPLC), an open-ended umbrella-type investment company with variable capital and segregated liability between sub-funds incorporated in Ireland and regulated by the Central Bank of Ireland. The investment manager may decide to terminate at any time the arrangements made for the marketing of its UCITS.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest Italia is the Italian branch of Comgest Asset Management International Limited, enrolled in the Milan Companies Register with no. MI-2587566 and in the CONSOB register with no. 191. Its registered office is at Via Del Vecchio Politecnico 9, 20121, Milan, Italy.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).