You are visiting United States

If this is incorrect,

02-Jan-2024

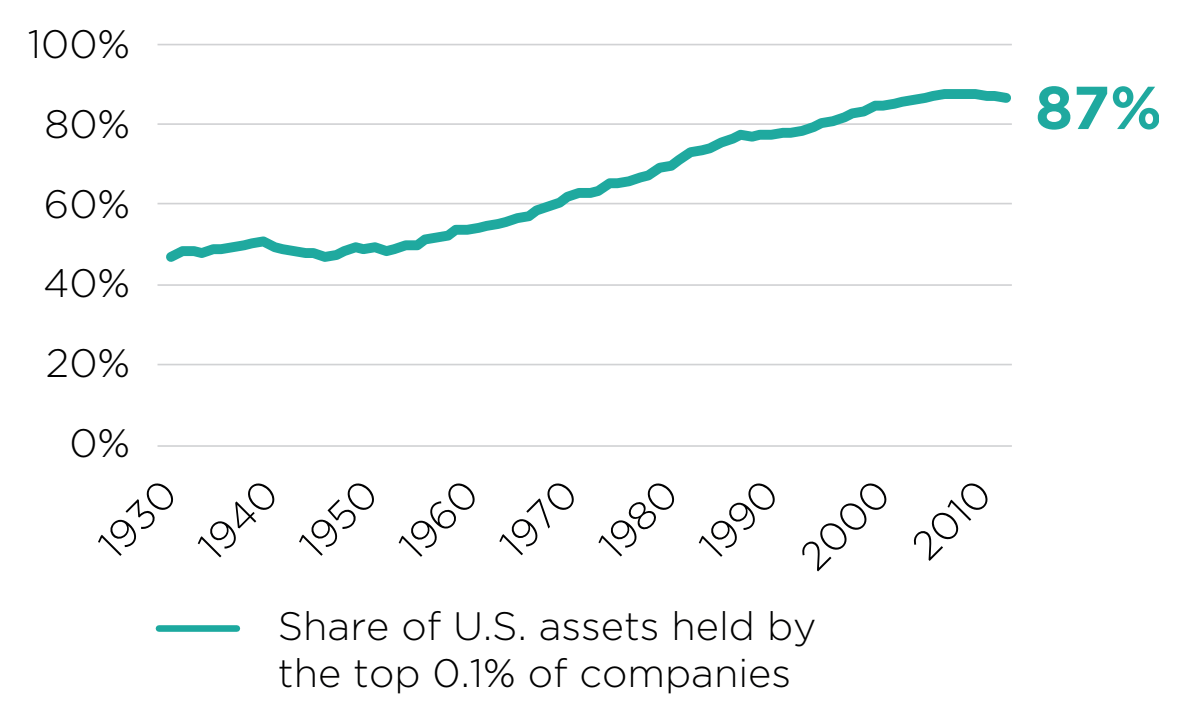

In the ever-evolving landscape of the American economy the “winner takes all” concept has been a subject of considerable debate. Although the number of companies in the US has grown by 50% over the past 30 years, their growth has not been equal. This can be clearly seen by the so-called ‘Magnificent Seven’, which dominate the US market and have driven many of 2023’s investment-focused headlines. As figure 1 illustrates, since the 1930s the share of the US economy of the top 0.1% of companies has risen to approximately 87%, up from 47%.1

Source: Chicago Booth Review, “Rising Corporate Concentration Continues a 100-Year Trend”.

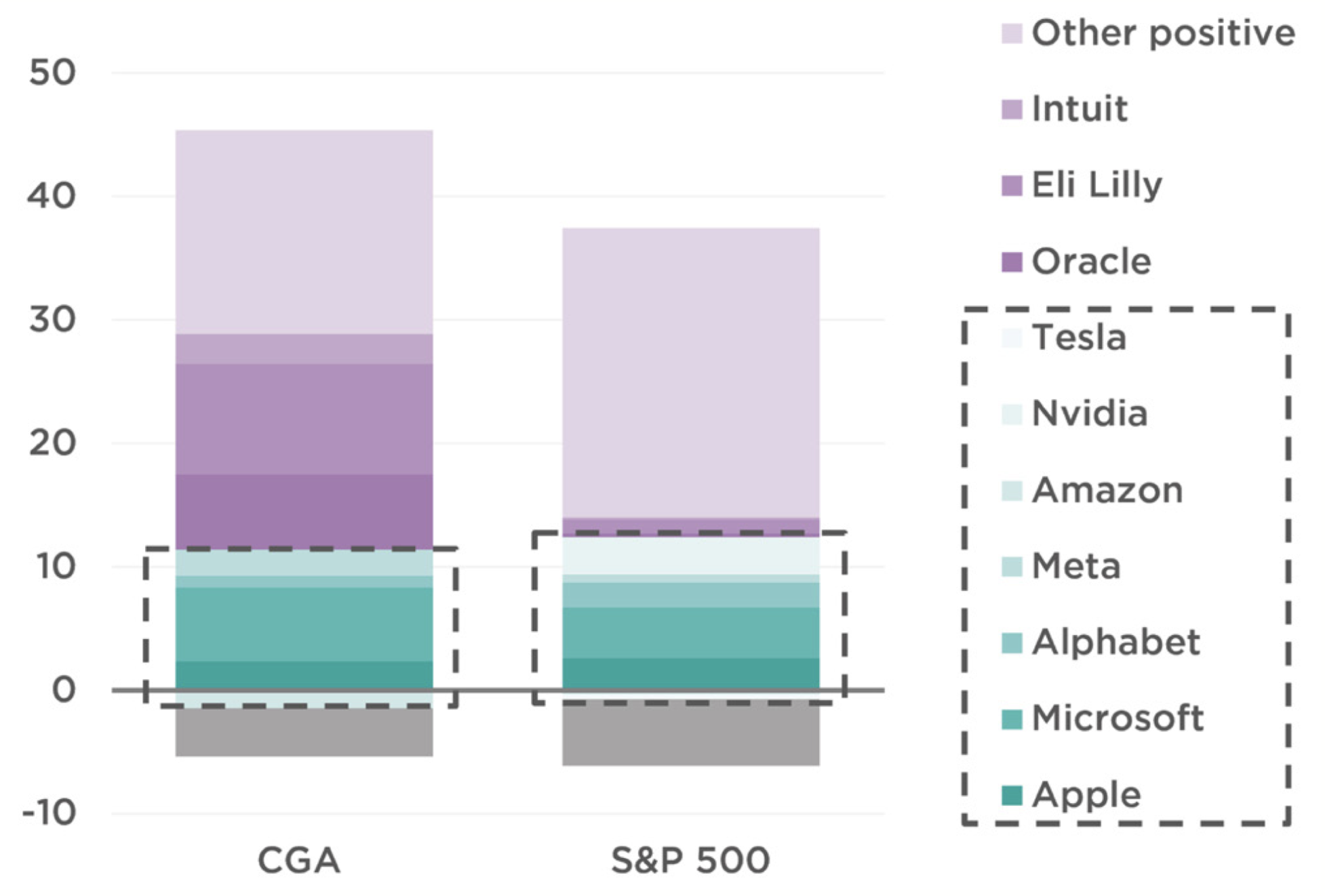

The ‘Magnificent Seven’ refers to the following companies: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

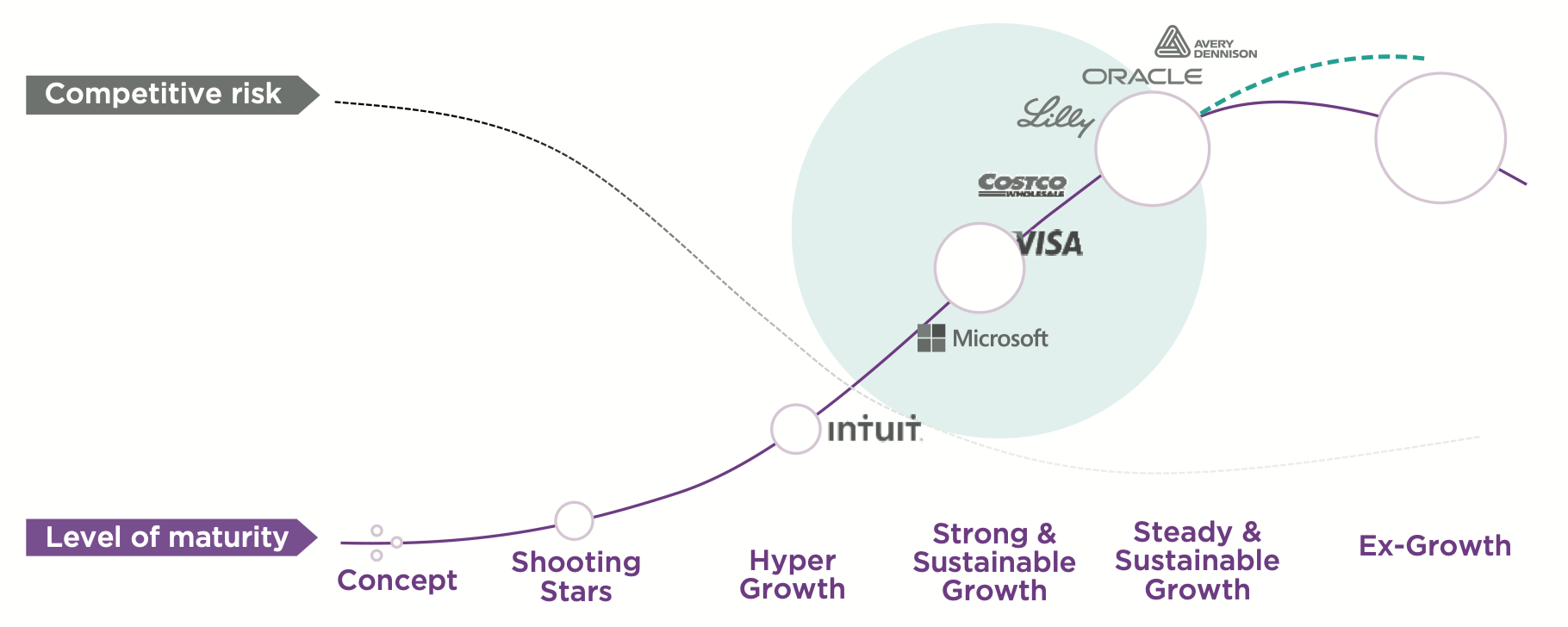

However, there are many other dynamic companies to be found in the US market and in Comgest’s US Equities strategy. For Comgest, a key ‘quality’ characteristic of our portfolio companies is visible growth – their business models are strong and stable with competitive advantages and brand recognition. One way to determine if a company meets our rigorous criteria is via our quality growth S-curve, which allows us to view companies in terms of their maturity and competitive risk, which lowers as a company matures. Over our years of research, three leading franchises – Eli Lilly, Microsoft, and Cintas – have long stood strong against new market entrants.

Within the US market, some companies experience exponential success and dominate their industries while others struggle to gain a foothold. Factors such as innovation, adaptability, and market dynamics play crucial roles in determining the trajectory of a business.

The size of the bubbles corresponds to the size of the companies. For illustrative purposes only. The securities discussed above are provided for information only, are subject to change and are not a recommendation to buy or sell the securities. The securities discussed herein may not be held in the portfolio at the time you receive this presentation.

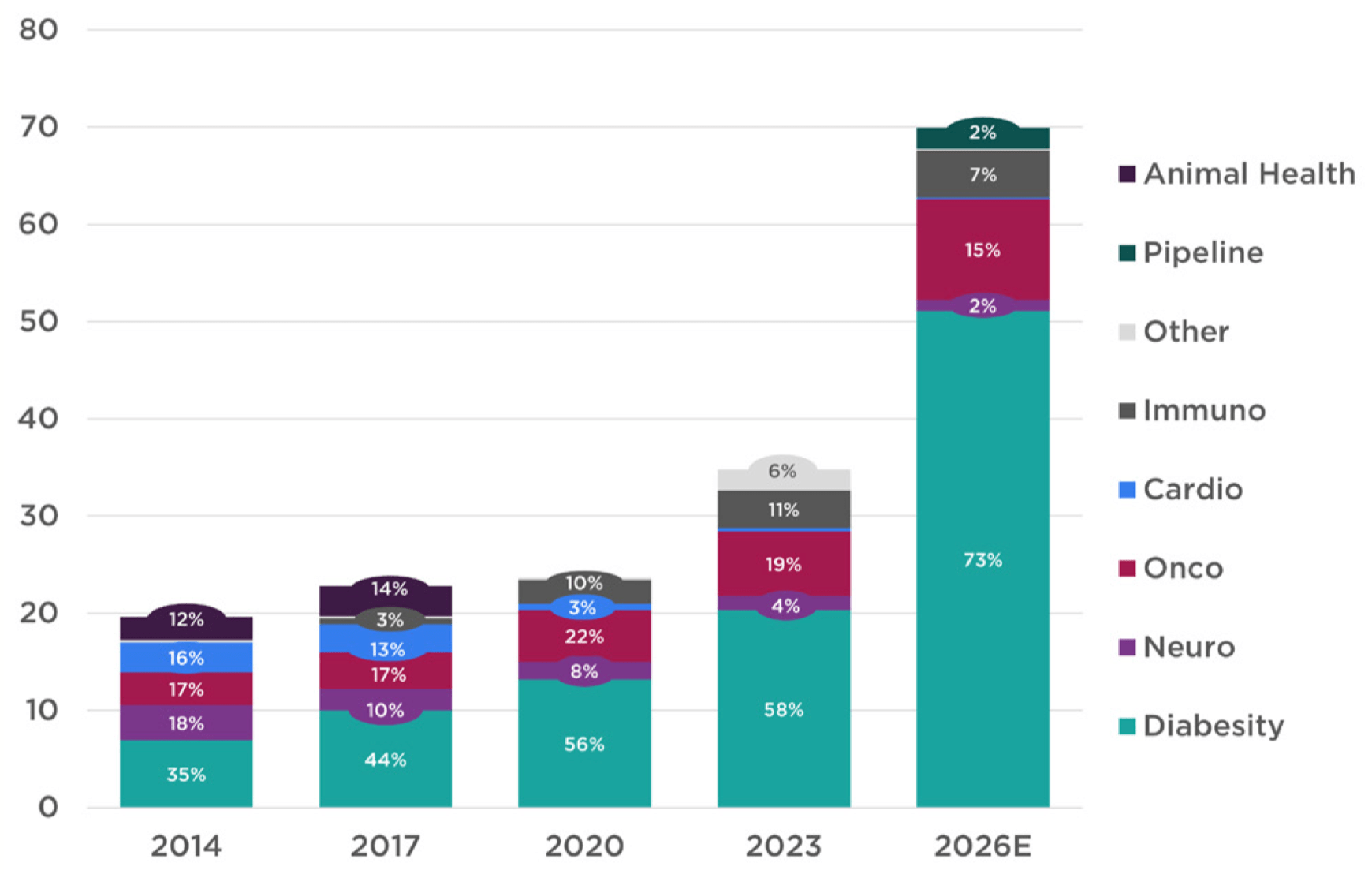

One example that exemplifies the dynamic nature of growth is the pharmaceutical giant Eli Lilly, which we’ve held since 2015. Founded in 1876, the company developed insulin to treat diabetes in 1923 and has remained a power player in the pharmaceutical industry by consistently innovating and adapting to changing market needs or patients.

Source: Eli Lilly, Comgest as of 31-Dec-2023. The securities discussed herein may not be held in the portfolio at the time you receive this presentation. The securities discussed are provided for informational purposes only, are subject to change and do not constitute a recommendation to buy or sell the securities. Any forecasts, projections or targets are indicative only and are not guaranteed in any way.

The company’s success can also be attributed to its high investment in research and development, resulting in groundbreaking pharmaceuticals that address a wide range of health issues, as figure 3 illustrates. As the world faces a growing pandemic of obesity and with 40% of the American population affected, Eli Lilly is likely to benefit from its duopoly with Novo Nordisk in the promising area of GLP-1 treatment. In November, the FDA approved Eli Lilly’s latest obesity drug, Zepbound that will compete directly with Novo Nordisk’s widely popular brand, Wegovy.2

Source: Corporate Filings and Comgest estimates. Data as of year end unless otherwise stated. For illustrative purposes only. The securities discussed herein may not be held in the portfolio at the time you receive this presentation. The securities discussed are provided for informational purposes only, are subject to change and do not constitute a recommendation to buy or sell the securities.Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

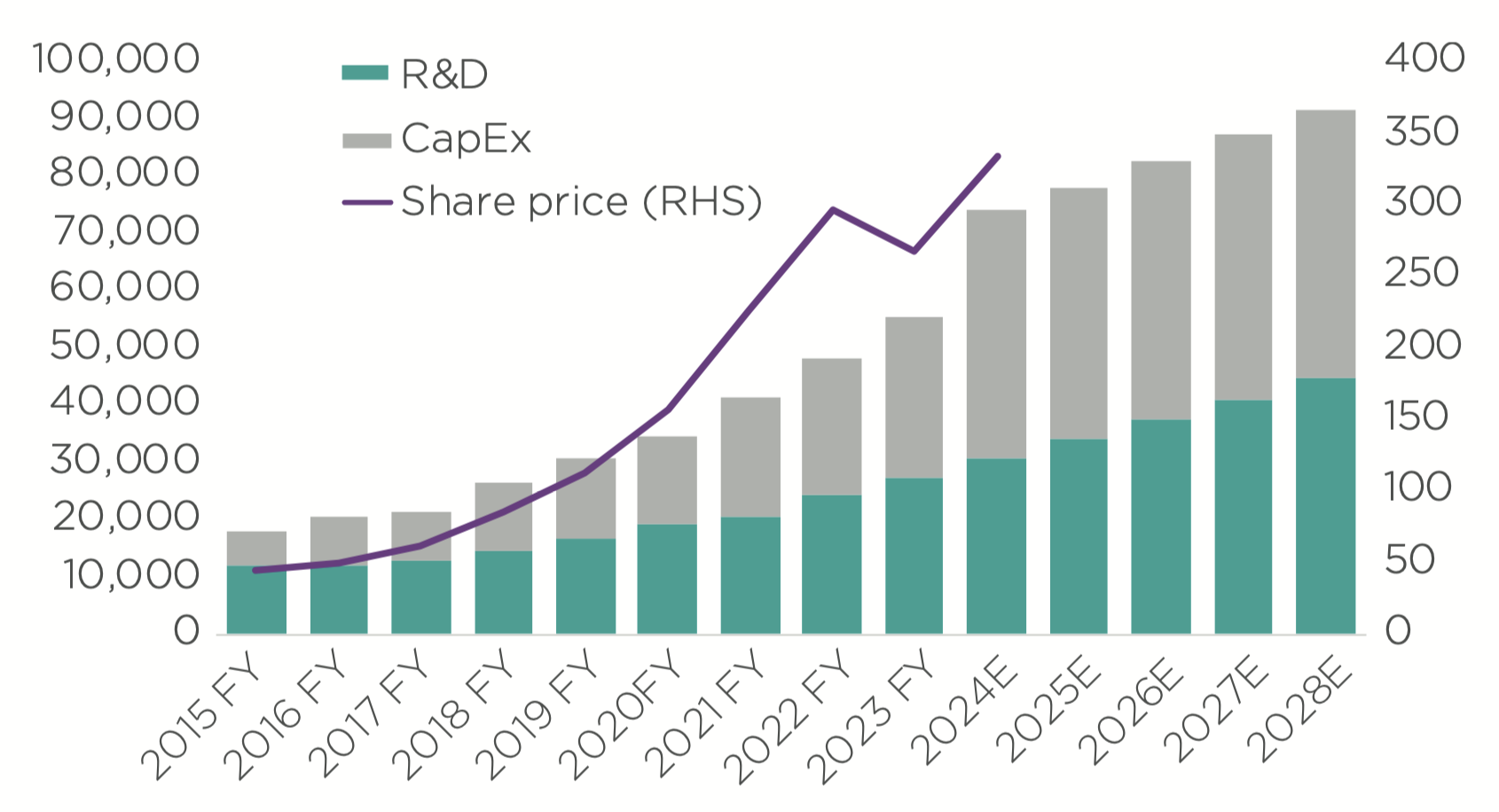

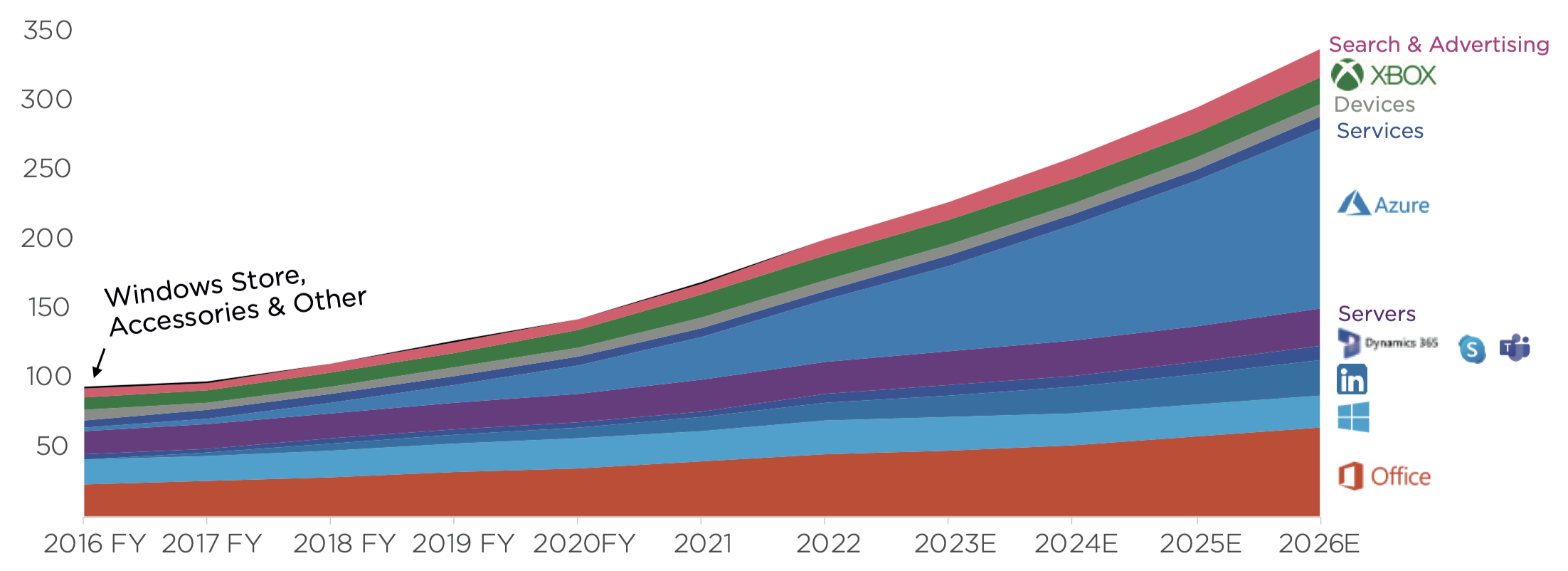

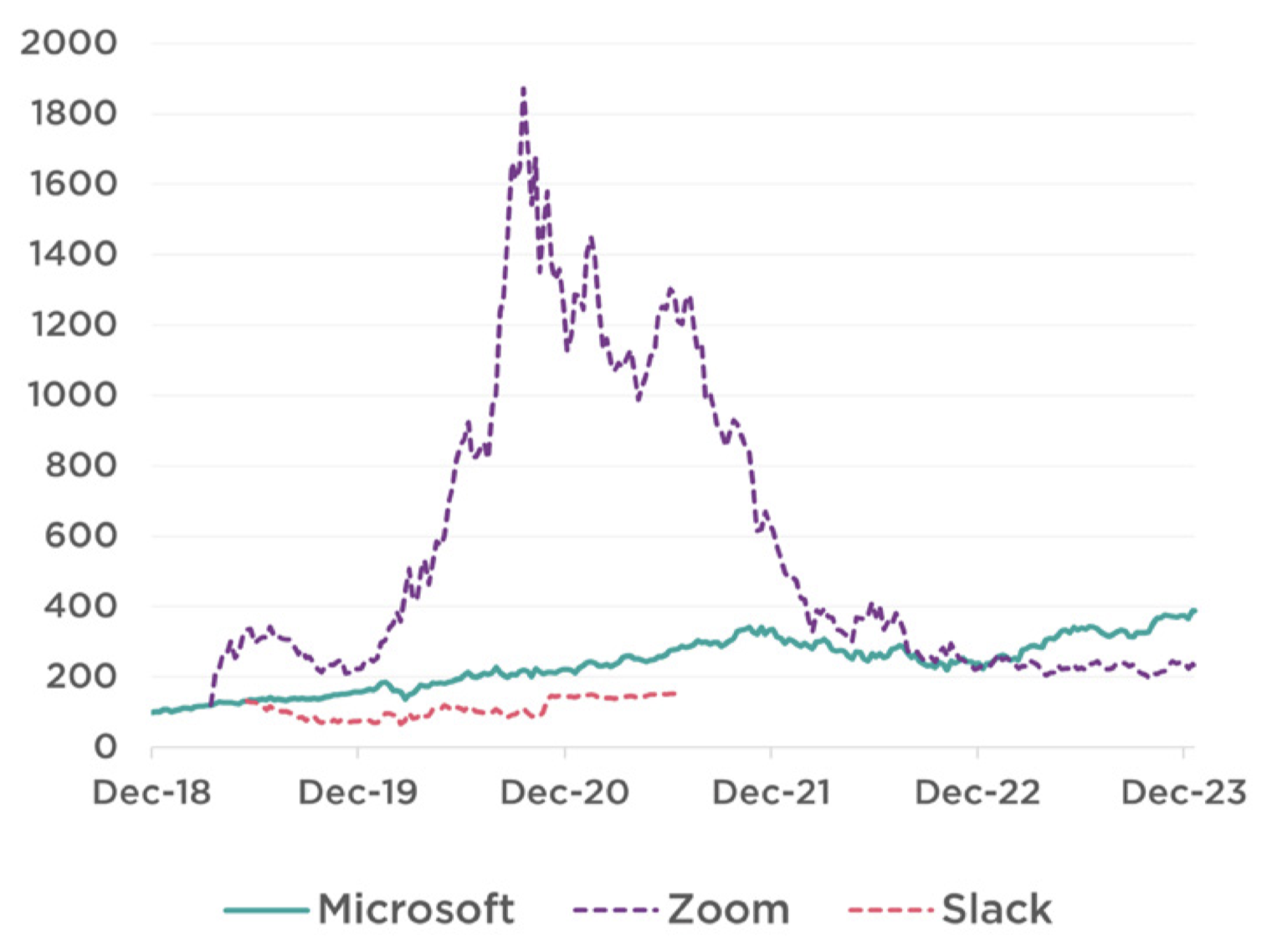

In the technology sector, Microsoft rose from its roots in 1975 to become a dominant force in providing a wide array of software solutions and services. The forward-thinking company’s success can be attributed to its continuous investment in R&D and CapEx – which is estimated to be around $70 billion each by 2024 and brand recognition with customer loyalty.

Microsoft’s staple Office and Windows products remain the industry standard for personal computers, solidifying the company’s position as an industry leader. According to our S-curve, see figure 2, Microsoft is a mature company, which is why we’ve held it since 2009. What makes Microsoft exciting from a quality growth perspective, is its ability to continually innovate and adapt to meet the new needs of its clients and to expand into adjacent technology sectors such as gaming or social media, as seen in figure 5. Not a company to rest on its laurels, Microsoft’s promising growth story is particularly strong in cloud computing (Azure), where it now competes with pioneer Amazon in this area.3There remains a strong growth trajectory especially given a third of the world’s population is still not connected to the internet.

Source: Corporate Filings and Comgest estimates. Data as of year end unless otherwise stated. For illustrative purposes only. The securities discussed herein may not be held in the portfolio at the time you receive this presentation. The securities discussed are provided for informational purposes only, are subject to change and do not constitute a recommendation to buy or sell the securities. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Source: Cintas website Doc and Amelia in their circus costumes. Doc was a self- proclaimed veterinari- an, animal trainer and trapeze artist. Amelia was the queen of the circus.

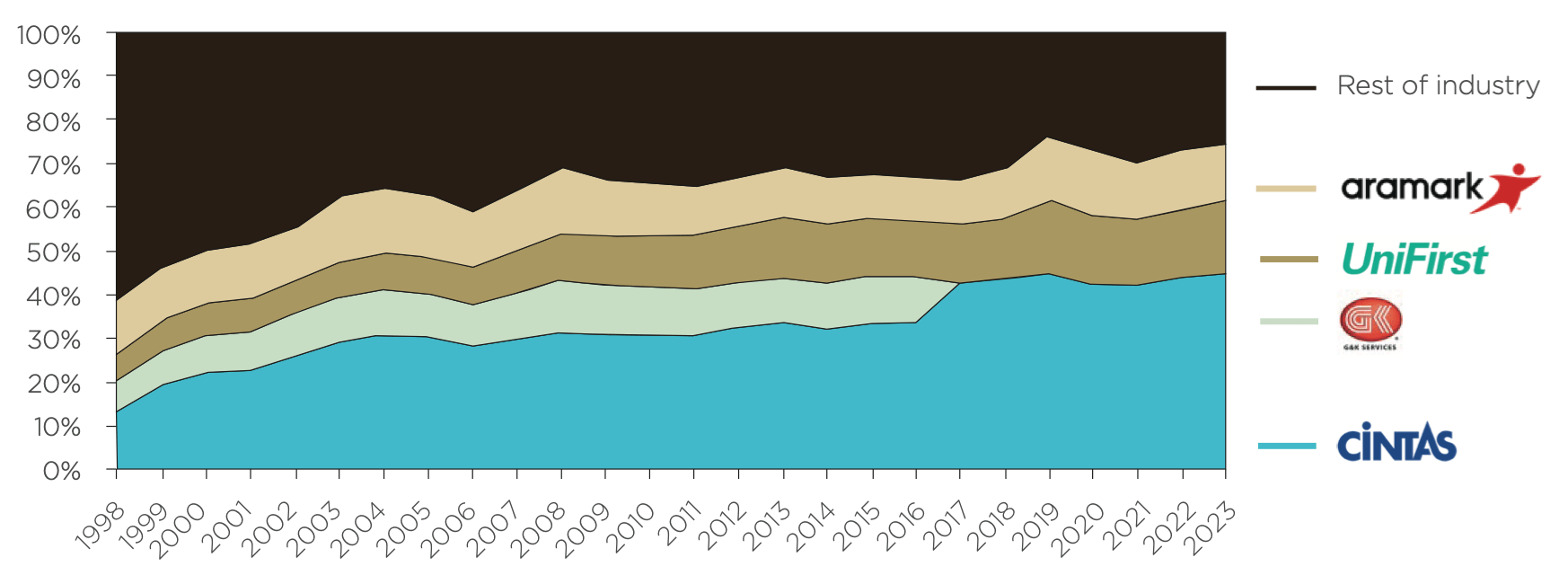

Cintas is a century-old, Cincinnati-based, family company whose origins lie in the circus, which was shuttered by the Great Depression. Despite their misfortune, founders Doc and Amelia Farmer then saw a revenue opportunity in old towels tossed out by factories, which they would then launder and sell back to companies. Cintas, which is a newer position in the strategy, has since evolved into the US leader with a 40% market share for uniform rental services and expanded into diverse areas such as facility services, first aid and safety products.

Cintas’ success lies in its scale and ability to provide cleaning services that are cheaper even when compared to a company internalising the cleaning costs themselves. As the largest company in the market, it has the widest network of delivery services and clients, which enables it to generate better revenue and margins. Cintas has built a robust business model in which every facility operates as a separate profit center, incentivising employees through a generous profit-sharing program and company ownership. The thriving company continues to take market share from its competitors, as illustrated in figure 6.

Source: Baird Equity Research, U.S. Department of the Census and company data. Note: global market share assumes Canadian market is 10-15% size of US market.

The hallmark of companies within the winner-takes-all paradigm is their ability to stand strong against new market entrants. These industry leaders not only establish themselves as dominant players but also create formidable barriers to entry for potential competitors. While the strategies employed by such companies may vary, they typically involve a combination of technological innovation, brand strength and expansion into adjacent industries.

As a major player in the pharmaceutical industry, Eli Lilly contributes significantly to the American economy and the country’s healthcare ecosystem. Despite the pharmaceutical industry’s risks associated with regulatory changes and market volatility, we believe Eli Lilly’s life-saving drugs in the areas of diabetes and obesity, which widely affects the American population, positions the company as an economic powerhouse and a key player in addressing public health challenges.

Source: Factset, Comgest as of 31-Dec-2023. The securities discussed above are provided for information only, are subject to change and are not a recommendation to buy or sell the securities. The securities discussed herein may not be held in the portfolio at the time you receive this presentation.

Microsoft’s influence on the American economy is multi-faceted as its products and services are integral to various industries, from personal computing to cloud services. With its “as a service” model, Microsoft today is powering productivity for clients and needs which it previously could not serve, from front-line workers to heavy back-office IT loads.

Cintas’ growth from a small family-owned company to an industry leader in uniform rental services, plays a crucial role in supporting other businesses. By providing essential services such as uniform rental, facility services, and safety products, the company contributes to the smooth operation of a wide range of industries. The company’s business model has evolved to combine physical products with service offerings, better positioning its competitive advantages.

The concept of the ‘winner takes all’ holds true for certain companies that have not only survived but thrived in the face of competition. The stories of Eli Lilly, Microsoft, and Cintas highlight the multifaceted nature of success – a blend of innovation, adaptability and strategic vision.

While companies such as the ‘Magnificent Seven’ dominate their respective industries, the landscape is not entirely devoid of opportunities for new market entrants. The key lies in understanding that not all growth is created equal. Success is not just about entering the market but about continuously evolving to meet the changing needs of consumers.

Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 31-Dec-2023 expressed in USD. Past performance does not predict future returns. Comgest runs a buy-and-hold contribution system which performs holdings-based analysis using the beginning of period weights of securities and their returns to calculate contributions. Returns are therefore not derived from the actual portfolio return and may not reconcile with the calculation of performance which is based on the net asset value (NAV). Price Return is calculated taking into account a stock’s entry or exit date over the period, if relevant.

As investors navigate the stock market, the performance of companies like Eli Lilly, Microsoft, and Cintas can provide valuable insight. The winner may take a significant share, but the market itself remains a vibrant ecosystem where both new and venerable players can make their mark with the right blend of innovation and strategic thinking.

This is why Comgest’s US Equities portfolio is invested in a variety of sectors and a range of small-, mid- and large- cap companies driving growth in the US economy. As seen in figure 8, over three years, the performance of the Magnificent Seven is barely a quarter of our performance due to our diversification. Historically, it is this diversity that has helped us to reduce volatility and be resilient in a volatile market environment.

1 Jacobs, Rose. Rising Corporate Concentration Continues a 100-Year Trend, Chicago Booth Review,15-Aug-2022.

2 https www nytimes com 2023 11 08 health fda tirzepatide obesity zepbound wegovy html

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

S&P Dow Jones Indices LLC (“SPDJI”). S&P is a registered trademark of S&P Global (“S&P”); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest’s fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information.

MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest Italia is the Italian branch of Comgest Asset Management International Limited, enrolled in the Milan Companies Register with no. MI-2587566 and in the CONSOB register with no. 191. Its registered office is at Via Del Vecchio Politecnico 9, 20121, Milan, Italy.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).