You are visiting United States

If this is incorrect,

04-Feb-2025

In recent years, investor focus in Japan has shifted towards cyclical stocks, including automotives, commodities and financial services. These stocks have demonstrated strong performance on the back of a historically weak Japanese yen and previously rising global interest rates. Comgest believes that Japanese companies exposed to structural growth trends – such as digitalisation, ageing populations and Asia’s growing middle class – are less dependent on short-term economic cycles and more likely to deliver consistent long-term returns.

Japan is globally renowned for its rich cultural exports. From sushi and ramen to anime and video games, Japanese products continue to innovate and captivate consumers. The country’s companies are synonymous with efficiency, reliability and technological advancement. Despite the daily use of Japanese products by companies and consumers, Comgest believes that Japan remains largely misunderstood by investors. Japanese companies often receive less analytical coverage than their counterparts in the United States and Europe.

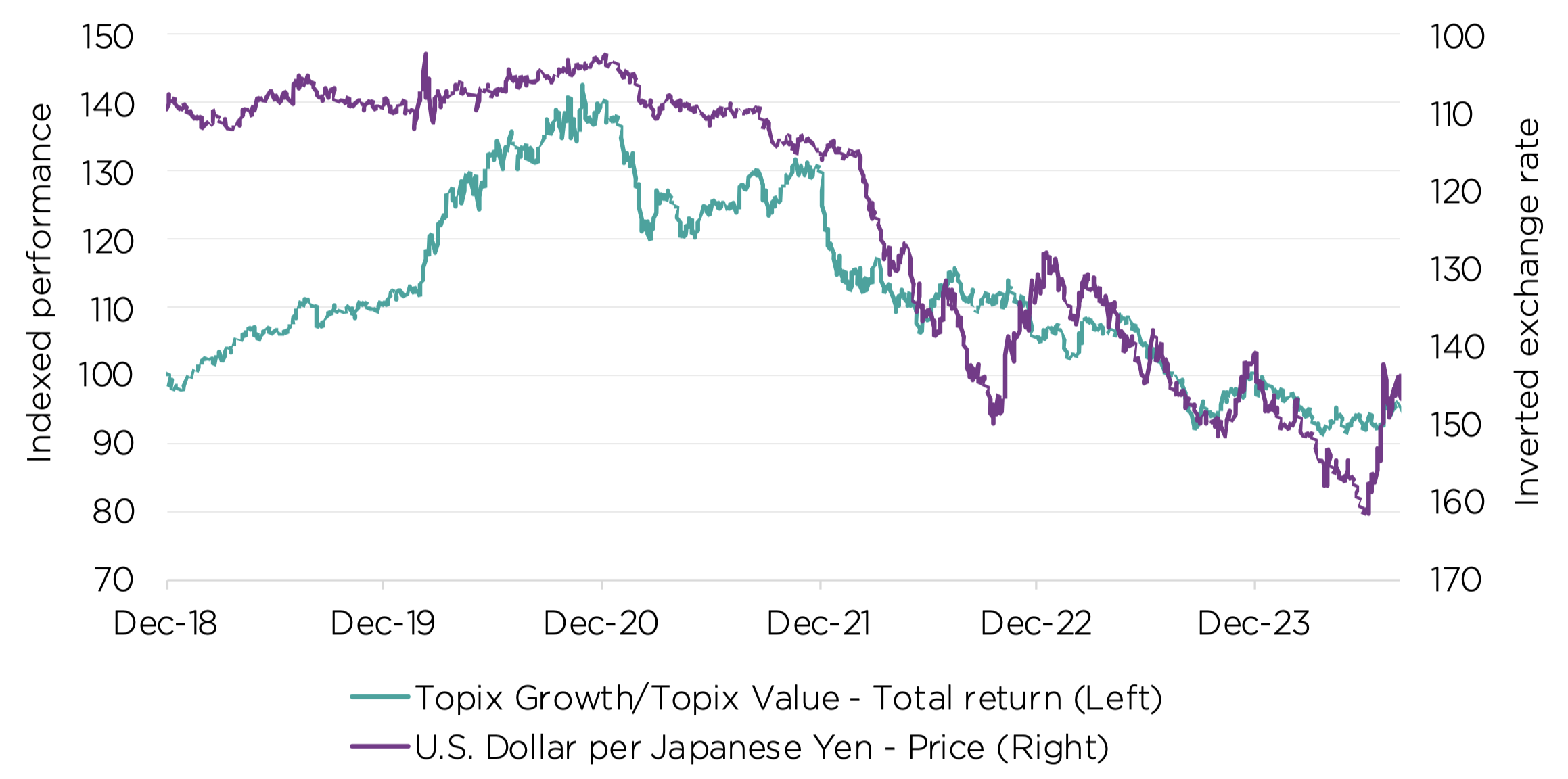

As a result, we believe that there is an investor tendency to follow the crowd when it comes to investing in Japan. For instance, since mid-2021, investor sentiment in Japan has gravitated to the so-called value sectors, which encompass cyclical products like automobiles, commodities and banks. In our view, this trend underscores a lack of investor research and attention paid to Japan. From our perspective the recent value rally has been driven not by quality or company fundamentals, but by a weak yen and the high liquidity associated with cyclical stocks, as shown in figure 1.

At Comgest, we seek global companies that dominate highly concentrated markets. We aim to build our portfolios with companies that possess competitive advantages, high barriers to entry and pricing power that we believe makes them capable of sustainably growing their earnings. As long-term quality growth investors, we tend to avoid cyclical sectors. In our experience, the company fundamentals behind cyclical rallies tend to be weak and overly reliant upon macroeconomic conditions. Our Japanese equities strategy is supported by several long-term growth drivers, including digitalisation, ageing global population, productivity enhancers and the rise of Asia’s middle class.

Past performance is not indicative of future returns.

Returns may increase or decrease as a result of currency fluctuations. Source: Factset data as of 30-Nov-2024 expressed in local currency. Indices: Topix Growth, Topix Value, Topix. Indices are used for comparative purposes only and the Strategy does not seek to replicate the indices.

Despite its reputation for technological leadership, Japan has been a late adopter to cashless payment methods. 1The country has remained a cash-based society for much longer than other developed economies. In 2018, Japan’s Ministry of Economy, Trade and Industry (METI) published "Cashless Vision,” a plan of proposed measures aimed to achieve 40% cashless payments by 2025. 2According to METI, cashless payments have increased in Japan from 13.2% in 2010 to 39.3% in 2023. 3

We believe that Japan’s gradual shift towards cashless payments presents long-term growth opportunities for investors. GMO Payment Gateway, the country’s largest cashless payment company, offers companies with a wide range of cashless services, including in-store payment terminals and digital payroll technology. Founded in 1995, the company has achieved consistent revenue and profit growth over the past 19 years. 4GMO Payment Gateway has consistently achieved its earnings growth targets since 2005, despite facing challenges, such as the 2008-2009 Global Financial Crisis, 2011 Fukushima Earthquake and the COVID-19 pandemic. 4

GMO Payment Gateway’s revenue model employs a tiered approach, targeting businesses of all sizes. The company generates revenue through initial sales for payment terminals recurring fixed charges, transaction volume charges and transaction value charges. 4In our view, Japan’s accelerating shift toward cashless payments could benefit established digital solutions providers, including GMO Payment Gateway, in the years to come.

The Japanese economic miracle, which took place between the 1960s and early 1990s, earned the country a reputation for innovation and highquality exports – especially automobiles and technology. 5Many of Japan’s leading businesses during this era became disciples of kaizen, a business philosophy based on continuous improvement, efficiency and quality. 6This approach, championed by industrial giants like Toyota 7, underscores the importance of maintaining a long-term perspective, identifying the root causes of inefficiencies, accelerating innovation and reducing waste.

Japan’s push for better productivity and manufacturing quality led to its early adoption of robotics and automation. 8Today, the country’s ageing population, declining labour force participation and low immigration rates, have further incentivised automation solutions. Keyence, a leading manufacturer of industrial automation equipment, exemplifies Japan’s rich expertise in this field. Founded in 1974, the company provides manufacturers with sensors, lasers and measurement systems essential for automating factory processes.

Keyence styles itself as a knowledge-based company with a team of consultants that work directly with suppliers to produce cutting-edge sensors that can spot microscopic assembly-line mistakes that could cost manufacturers time and money. As global workforces age and more processes become automated, we believe that Keyence will be well-placed to provide customers with solutions to keep their factories running in an efficient manner.

As the world becomes older and birth rates decline, countries are likely to face labour shortages. Japan, which has experienced a steady population decline since 2009, offers a glimpse into the future for other countries around the world. 9The country’s ageing population and declining birth rate have led to a significant labour shortage with 51% of companies reporting insufficient employees in May 2024. 10

The Japanese government, meanwhile, forecasted that the country’s labour force would decline by 12% between 2022 and 2024. The country is projected to face a shortage of nearly one million foreign workers by 2040, the number needed to meet its economic growth targets. 12Recruit Holdings, the Japanese recruitment agency that operates job listing platforms Glassdoor and Indeed, is leveraging technology to match qualified job candidates with employers in Japan and abroad. Launched in 1960, the company is one of Japan’s oldest and largest human resources company. To address its shrinking labour force, Japan is turning to both women and foreigners – groups that have been historically marginalised in Japanese workplaces.

From our perspective, Recruit Holdings can play a critical role in filling job openings by matching non-traditional job candidates with companies, such as women and foreign workers. While Japan has improved its female employment rate from 60.7% in 2012 to 72.4% in 2022 13, we believe that Recruit Holdings can continue to identify untapped home-grown talent and match qualified women candidates with employers.

Computer chips are the backbone of the global economy, powering an array of products from computers and smartphones to cars and medical devices. These chips, composed of billions of transistors – tiny switches smaller than a virus and invisible to the human eye – are fundamental to modern technology. 14In 1965, Intel co-founder Gordon Moore predicted that the number of transistors on a chip would double every two years, an observation known as “Moore’s Law.” 15This principle has shaped the industry’s relentless pursuit for smaller chips over the past six decades.

The recent rise of artificial intelligence, 5G connectivity and Internet of Things (IoT) devices have further amplified the demand for enhanced computing power and smaller chips. Consequently, semiconductor manufacturers require specialised equipment capable of ensuring design precision down to the nanometre.

Few companies in the semiconductor value chain have been able to keep pace with Moore’s Law and the industry’s appetite for shrinking chips.

DISCO, a Japanese maker of specialised equipment for the “back-end” stages of the semiconductor manufacturing process, has emerged as a key player. During the latter stages of this costly manufacturing process, the presence of a microscopic particle or production error, could result in a defective chip. 14DISCO produces a wide variety of products aimed at ensuring precision and cleanliness, including grinders, dicing saws, dicing blades and polishing pads. 16

Founded in 1937 as a grindstone manufacturer, Disco’s technologies now command 80% of the global back-end semiconductor manufacturing market. 17By the close of 2024, the global semiconductor industry grew by 19.0% year-over-year, reaching $627 billion in total sales.18 In our view, DISCO’s dominant position in the “back-end” stages of the semiconductor manufacturing industry makes it well-placed to benefit from future technological advancements and the growing demand for computing power. Despite rising geopolitical tensions between China and the United States, we believe that DISCO’s entrenched role in the semiconductor value chain is unlikely to be challenged due to its diversified client base. Unlike other semiconductor production equipment manufacturers, DISCO’s top customer contributes only 5% to total sales, reducing the potential impact of sanctions or trade measures. 17

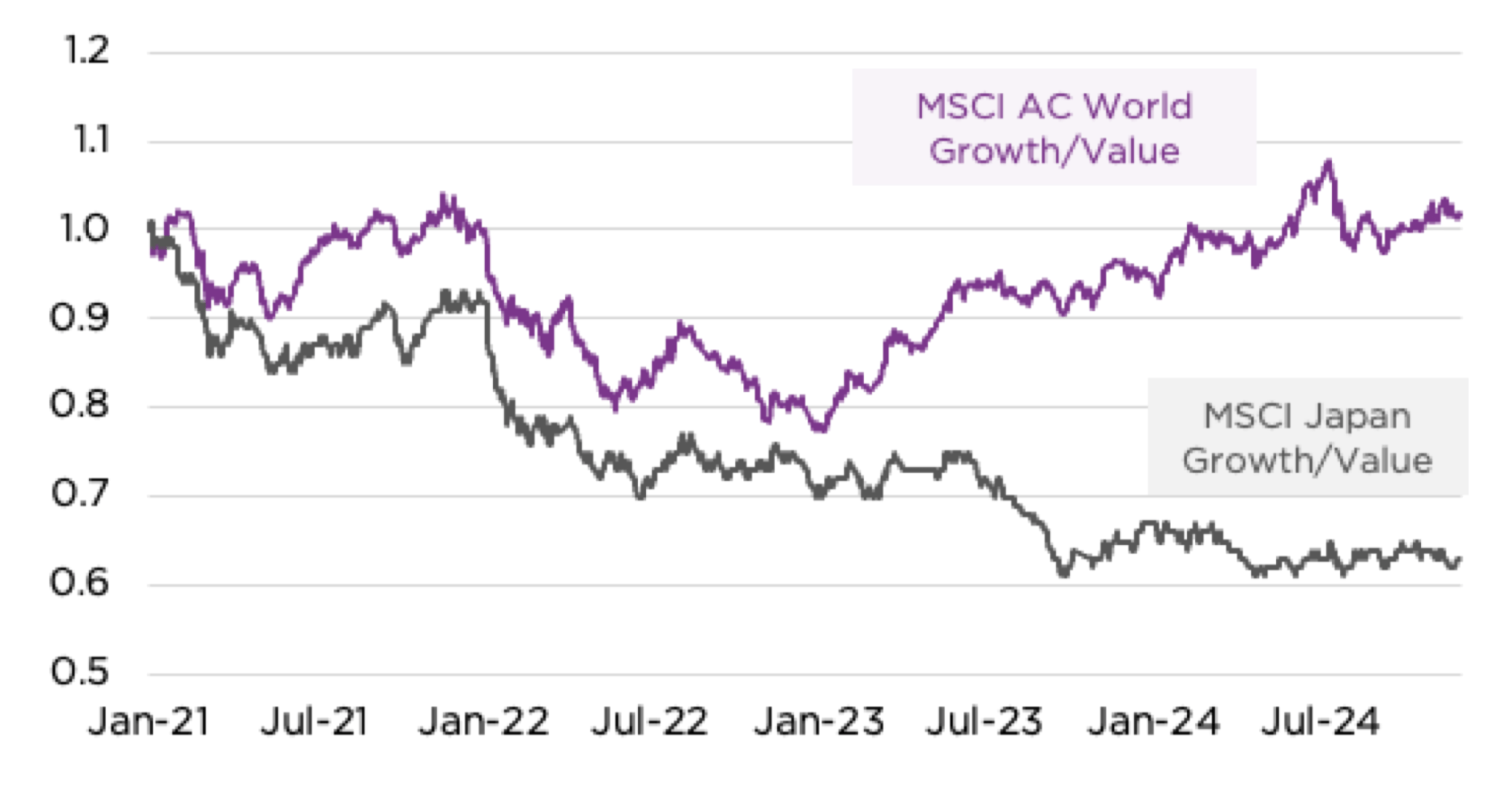

Past performance is not indicative of future returns. Returns may increase or decrease as a result of currency fluctuations. Source: Factset data as of 30-Nov-2024 expressed in local currency. Indices: MSCI AC World Growth Index, MSCI AC World Value Index, MSCI Japan Growth Index, MSCI Japan Value Index. Indices are used for comparative purposes only and the Strategy does not seek to replicate the indices.

Globally, value stocks are underperforming with Japan standing out as the notable exception (see figure 2). We believe that growth stocks are better positioned to deliver consistent long-term earnings than cyclical companies tied to short-term economic cycles.

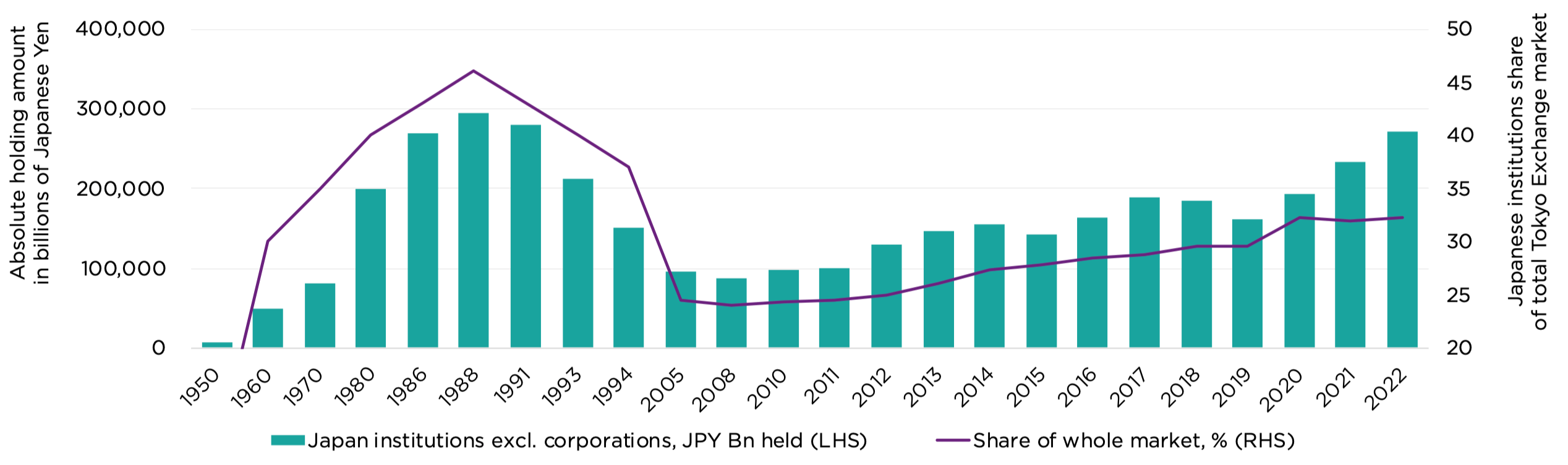

There are already signs that investors are starting to wake up to the news that value stocks are starting to fade. The resurgence of the Japanese investor, for instance, is a positive development for quality growth investors like Comgest. Japanese financial institutions have been buying more Japanese stock – now holding nearly 40% of the total share of the Tokyo Stock Exchange (see figure 3). From our perspective, Japanese investors are arguably among the best placed to determine where to find great Japanese companies. We believe that they are less likely to be interested in cyclical stocks that are likely to fade away in the future, but companies with strong fundamentals that should deliver consistent returns over the long term.

Source: Tokyo Stock Exchange

Despite Japan’s recent value rally, we maintain our conviction that companies with quality growth attributes that are exposed to structural trends, such digitalisation, ageing populations and Asia’s growing middle class, should be better positioned for substantial long-term earnings growth. While the market has leaned toward short-term value plays, we believe that these structural growth drivers should continue to accelerate in the future. Our Japan Equities strategy will continue to filter out the market noise, focus on our long-term investment horizon and follow our quality growth approach.

1 Lewis, Leo. “ Cash Is No Longer King in Japan as Use of Coins Drops Sharply.” Financial Times, 11-Jul-2023. ↩︎

2 Kutty, Naoko, and Naoko Tochibayashi. “ How Japan Is Moving towards a Cashless Society with Digital Salary Payments.” World Economic Forum, 20-Sept-2024. ↩︎

3 “ 2023 Ratio of Cashless Payment Among the Total Amount Paid by Consumers Calculated.” Japanese Ministry of Economy, Trade and Industry, 29-Mar-2024. ↩︎

4 GMO Payment Gateway. “ Financial Results Briefing for FY2024.” GMO Payment Gateway, 13-Nov-2024. ↩︎

5 Crawford, Robert. “ Reinterpreting the Japanese Economic Miracle.” Harvard Business Review, February 1998. ↩︎

6 Kerbache, Laoucine. “ Kaizen: We Can See Clearly Now!” HEC Paris, 15-May-2012. ↩︎

7 “ What Is Kaizen and How Does Toyota Use It?” Toyota, 31-May-2013. ↩︎

8 Deng, Liuchun, Minako Fujio, Xin Lin, and Rui Ota. “ Labor Shortage and Early Robotization in Japan.” Economics Letters, December 2023. ↩︎

9 Yokoyama, Erica. “Japan’s Population Falls at Record Rate.” Time, 25-July-2024. ↩︎

10 Inoue, Yukana. “Japan’s Labor Crunch Persists despite Slight Improvement.” The Japan Times, 6-May-2024. ↩︎

11 Oi, Mariko. “ Can Ai Help Solve Japan’s Labour Shortages?” BBC News, 19-Apr-2024. ↩︎

12 Komiya, Kantaro. “ Japan Faces Shortage of Almost a Million Foreign Workers in 2040.” Reuters, 4-Jul-2024. ↩︎

13 Jones, Randall S. “ Addressing Demographic Headwinds in Japan: A Long-Term Perspective.” OECD, 2024. ↩︎

14 Rodgers, Lucy, Dan Clark, Sam Joiner, Bob Haslett, Irene de la Torre Arenas, and Sam Learner. “ Inside the Miracle of Modern Chip Manufacturing.” Financial Times, 28-Feb-2024. ↩︎

15 Tardi, Carla. “ What Is Moore’s Law and Is It Still True?” Investopedia, 2-Apr-2024. ↩︎

16 “ Product Information.” DISCO Corporation. Accessed 3-Jan-2025. ↩︎

17 Comgest interview with company representative, April 2019 ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised. This letter contains certain forward-looking statements, opinions and projections that are based on the assumptions and judgments of Comgest and the Strategy with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Comgest or the Strategy. Other events which were not taken into account in formulating such projections, targets or estimates may occur and may significantly affect the returns or performance of any Strategy managed by Comgest. Because of the significant uncertainties inherent in these assumptions and judgments, you should not place undue reliance on these forward-looking statements, nor should you regard the inclusion of these statements as a representation by Comgest that the Strategy will achieve any strategy, objectives or other plans. For the avoidance of doubt, any such forward looking statements, opinions and/or assumptions.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by JPX Market Innovation & Research, Inc. or affiliates of JPX Market Innovation & Research, Inc. (hereinafter collectively referred to as "JPX") and JPX owns all rights and know-how relating to TOPIX such as calculation, publication and use of the TOPIX Index Value and relating to the TOPIX Marks. S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index. MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages ( www.mscibarra.com).

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).