You are visiting United States

If this is incorrect,

16-Jan-2025

There’s a lot of buzz about the market being too concentrated these days. But what exactly does that mean and how does it shape the dynamics of global equity markets? Let’s unpack the implications.

The US stock market is becoming increasingly concentrated in just a handful of stocks. As we begin 2025, the so-called "Magnificent Seven" stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla) are looking strong in terms of market capitalisations despite a bumpy summer. In total, they accounted for over 31% of the S&P 500 and 21% of the MSCI All Country World Index (ACWI), as of the end of December 2024. 1Of this group, Nvidia, Microsoft, and Apple collectively accounted for a staggering $8 trillion in market capitalisation and about a fifth of the US stock market back in July 2024 – a level unseen since the 1960s. 2

Today’s concentration, driven by the rapid rise of artificial intelligence (AI) technologies, raises concerns about the diversification and sustainability of these leading stocks. As active stock pickers, we are less concerned about such risks. Our investment approach is not tied to specific sectors, geographies and benchmarks. Comgest’s Global Equity strategy (or, the “portfolio”) looks beyond indices and the Magnificent Seven and aims to offer investors exposure to leading quality growth companies that take advantage of long-term trends.

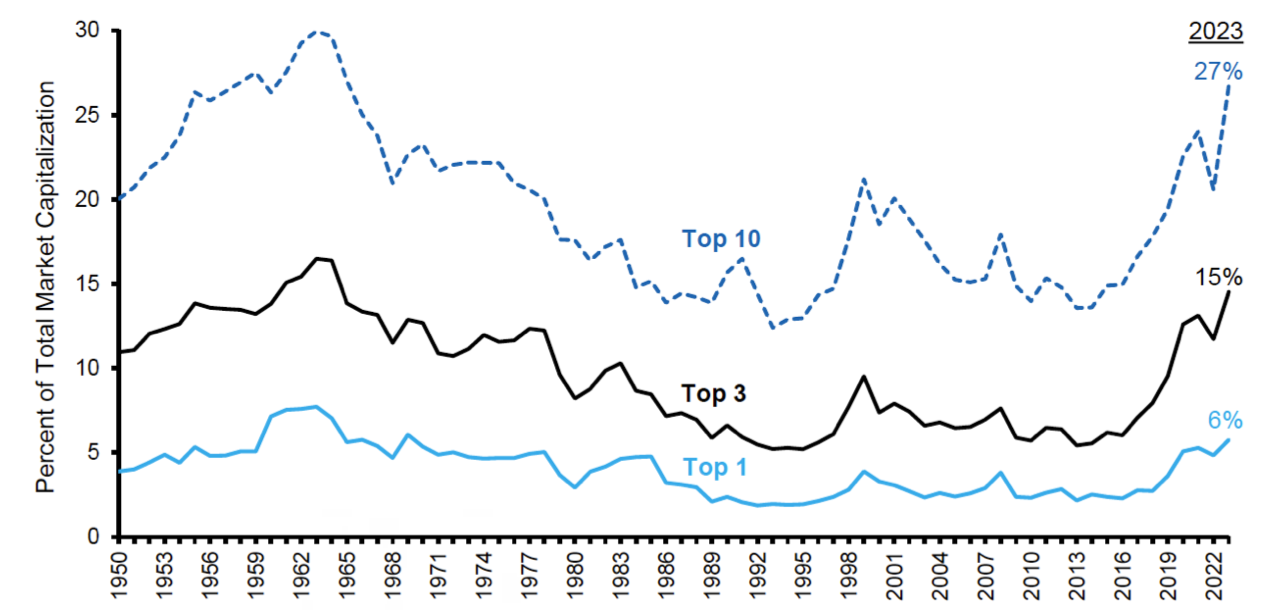

US market concentration is historically high, as figure 1 illustrates, but it’s not a new phenomenon.

During the early 2000s, Finland’s market concentration was over 80%, with mobile phone brand Nokia representing about two-thirds of the country’s total market cap at its peak. 3The US tech sector in the late 1990s to early 2000s was highly concentrated, with web start-ups comprising nearly a third of the S&P 500 before the dotcom bubble burst. 4Market concentration linked to the rise and fall of the dotcom bubble was striking: S&P 500 compound annual returns hit 23.5% from 1994-1999, and then slumped to 3.6% between 2000-2013. 4

Source: Morgan Stanley

What is new, however, about the current level of concentration is the speed at which it occurred. The weighting of the S&P 500’s top 10 stocks almost doubled, from 14% to 27%, in the decade between 2013 and 2023. 4The Magnificent Seven’s growth surge accounted for over half of the S&P 500’s impressive 26.3% gain in 2023. 4

As of the end of December 2024, the top 10 market capitalisations of the S&P 500 represented nearly 37% of the entire benchmark. 5But does this concentration reflect their underlying quality and competitive advantages? These companies’ profits represent a greater share of the benchmark’s total profits compared to their share of market capitalisation. This suggests that profitability is a key factor underpinning their market dominance.

The rise of passive investing could be another reason for this concentration. 6Passive ownership of the S&P 500 has increased over the past two decades from 18% to around 26% today. 7By trying to replicate an index, investors may find themselves heavily reliant on a few topperforming stocks, which could drag their portfolio down significantly if the stocks start to lose momentum.

Our concern with this investment strategy lies not just in market concentration, but the similarities shared by the top stocks. Nine of the top 10 contributors to the MSCI ACWI performance this year are AI-related stocks, with only American banking giant JPMorgan Chase standing apart. In contrast, our Comgest Global Equity strategy includes two AI contributors in the top 10 —Microsoft and TSMC— all of which were established technology leaders long before the commercial arrival of AI.

In recent years, the world has gradually embraced using generative AI tools. As the world's largest technology companies race to invest in AI, we believe there are still unresolved issues. In our view, there is still uncertainty surrounding consumer applications of AI and the risk of overbuilding infrastructure, which could result in underutilised data centres. Amid this uncertainty, we believe that the benefits of diversifying into other growth sectors can lead to steady and resilient performance, offering a buffer against potential market headwinds.

As active stock pickers, we leverage our bottom-up research to identify established companies that benefit from durable competitive advantages, including visible growth, healthy free cash flow, high barriers to entry and strong corporate culture. We seek quality companies that are wellpositioned to benefit from secular growth trends.

This is why we have built our Comgest Global Equity strategy to offer exposure not just to market leaders, but also key players in critical sectors made up of essential products, such as healthcare (22%) and critical data (10%). 8We believe this is a group of resilient stocks that should grow regardless of geopolitics and macroeconomic developments. In our view, they may not always be the high-flying growers, but they have the attributes to remain consistent, no matter the environment.

Such stability is increasingly valuable as recently introduced regulatory requirements are driving the need for more robust data management and cybersecurity solutions. 9Verisk, the US-based data analytics company, partners with global insurance providers to improve underwriting and claims outcomes. By using advanced data analytics, the company aims to mitigate fraud, analyse geopolitical risks and reduce risk for its clients.

From our perspective, Verisk’s proprietary data sets are a clear advantage over its competition. We believe that Verisk’s clients cannot operate without Verisk data, which has resulted in a clear pathway towards the firm being able to stay resilient in the face of turbulence. Between 2008 and 2023, Verisk’s revenue grew at a compound annual growth rate (CAGR) of 8.1%, reflecting steady and consistent growth each year. 10Even during the 2007-2009 Global Financial Crisis, when companies worldwide struggled, Verisk continued to expand. With an average annual sales growth rate of 7%, the business has demonstrated its ability to maintain a dominant position in this market.

We also believe that a global ageing population makes healthcare a trusted and diverse sector for investment in the wider economy. As of September 2024, Eli Lilly has been the leading contributor to our portfolio's net performance, accounting for 16% since its addition in 2017. 11The company has a rich history of conducting research and developing treatments across a wide variety of medical fields, including diabetes, oncology, and immunology. Before adding the stock to our portfolio, we believed that Eli Lilly had high margin expansion potential, despite experiencing a tough period of patent losses.

It's safe to say that Eli Lilly has surpassed our expectations. Over the past decade, the company has increased its margins by excelling in its core specialties and leveraging research and development to take hold of new opportunities in the significant new obesity market. 12Importantly, that new market creation was intimately tied to Eli Lilly's leadership in diabetes and its deep competitive advantage in the field. The unfortunate rise of the global obesity rate – affecting 1 in 8 people around the world – has created a growing market for Eli Lilly to offer treatment.

Environmental, social and governance (ESG) considerations are also intrinsic to our investment approach. We analyse these factors not for philosophical or ethical reasons, but because we think they enhance the quality of our long-term investment decisions. This broader, extrafinancial analysis is embedded into our fundamental research, providing deeper insights into a company’s potential for longevity and success.

The newest addition to our portfolio, Copart, an online auction marketplace for cars, has achieved a $50 billion market cap by collecting and stocking vehicles deemed “non-repairable” by insurance companies. The company’s deep relationships with automotive insurance companies and extensive network of junk yards have established sizeable moats for new entrants. At the same time, we believe that Copart’s profile as a circular, economy-focused company with a positive environmental footprint reinforces its competitive edge over rivals.

For our Comgest portfolio, looking at each company holistically and integrating non-financial analysis, enables us to better assess quality and supports our aim to deliver long-term, above-average, risk-adjusted returns to our clients. We focus on potential impacts to quality and growth over our five-year time horizon, and then monitor them for each of our key company investments.

With an investment team spread across the globe, our collaborative research approach helps reaffirm our convictions, uncover growth areas and review peer companies in various markets. This partnership approach is crucial as the global equity market narrows and the Magnificent Seven rise to unprecedented market caps. This summer’s brief sell-off highlighted the need for diversification.

While the Comgest Global Equity strategy includes a few of the Magnificent Seven stocks, our unconstrained approach enables us to invest in what we believe to be quality companies across a range of sectors, with a forward-looking lens and valuation discipline. We are confident that our portfolio is benefiting from diverse secular growth drivers. Drawing on nearly 40 years of experience, we strive to build resilient portfolios that should deliver sustainable, long-term earnings growth in all market conditions.

1 Source: Comgest/Factset, data as of 15-Jan-2025. ↩︎

2 Chisholm, Denise. “ Stock Market Outlook July 2024: Is the Stock Market Too Concentrated?” Fidelity, 24Jul-2024. ↩︎

3 Mauboussin, Michael J., and Daniel Callahan. “ Stock Market Concentration - How Much Is Too Much?” Morgan Stanley, 4-Jun-2024. ↩︎

4 Robert Milano, Chris Marx. “ So Why Don’t You Own It?” AllianceBernstein, 27-Aug-2024. ↩︎

5 Source: Comgest/Factset, data as of 15-Jan-2025. ↩︎

6 “ Passive Investing and the Rise of Mega-Firms.” London School of Economics and Political Science. Accessed 19-Nov-2024 ↩︎

7 Kostin, David, Ben Snider, Ryan Hammond, Jenny Ma, and Daniel Chavez. “ The Rise of Passive Ownership across the S&P 500 and Its Impact on Company Valuation and Performance .” Goldman Sachs, 1-Nov-2024 ↩︎

8 Comgest, percentage of holdings in the portfolio relative to the indicated theme as of 31-Aug-2024 ↩︎

9 Feingold, Spencer, and Filipe Beato. “ Cybersecurity Rules Saw Big Changes in 2024. Here’s What You Need to Know.” World Economic Forum, 17-Oct-2024 ↩︎

10 Source: Comgest, as of 31-Aug-2024 ↩︎

11 Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 30-Sep2024 expressed in EUR. Past performance does not predict future returns. Comgest runs a buy-and-hold contribution system which performs holdings-based analysis using the beginning of period weights of securities and their returns to calculate contributions. Returns are therefore not derived from the actual portfolio return and may not reconcile with the calculation of performance which is based on the net asset value (NAV). Total Return is calculated taking into account a stock’s entry or exit date over the period, if relevant. Average weight is calculated over the entire period and not only in accordance with a stock’s presence in the portfolio. The above equity exposures are provided for information only, are subject to change and are not a recommendation to buy or sell the securities. ↩︎

12 Fry, Erika. “ How Eli Lilly Went from Pharmaceutical Slowpoke to $791 Billion Juggernaut.” Fortune, 5-Aug-2024 ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

PProduct names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. S&P Dow Jones Indices LLC (“SPDJI”). S&P is a registered trademark of S&P Global (“S&P”); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest portfolios are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information.

MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. ( www.mscibarra.com).

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission.

Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).