You are visiting United States

If this is incorrect,

14-Jan-2025

For nearly a century, the Japanese optics manufacturer Olympus embodied its mythical name, synonymous with the abode of the gods. 1Today, the company is a world leader in precision optics, listed on the Tokyo Stock Exchange and employing over 28,000 people. 2In 2011, the company posted sales close to $10 billion. 3However, that same year marked the moment that the company fell from grace by becoming associated with one of the longest and largest frauds in modern history, totalling $1.7 billion. 4

With the Tokyo Stock Exchange encouraging companies to improve their corporate governance in recent years, we view the Olympus fraud as a valuable case study for analysis. Although Comgest did not hold the company back in 2011, we believe that the lessons learned from this incident can inform our future investment decisions. To uncover quality growth opportunities aligned with Comgest’s investment approach, our investment team is dedicated to conducting bottom-up research with the utmost diligence. Our long-term analysis reveals that misjudging quality can be far more costly than miscalculating growth. Just as we learn from our own mistakes, we believe it’s equally important to learn from the missteps of others.

The Olympus affair came to light on 13 October 2011, when CEO Michael Woodford, a British citizen appointed just two weeks earlier – a rarity in Japan’s corporate landscape – questioned the company’s $2.2 billion acquisition of a medical equipment manufacturer, Gyrus, in 2008. 5His inquiry was met with silence from the Olympus’s Board of Directors.

In his book 6, Woodford himself concluded that his rapid appointment was partly due to his identity as a foreigner who did not speak Japanese. 7In his view, this made him a potential scapegoat for the company if the fraud surfaced publicly. Following his inquiry and despite his previous appointment as Executive Managing Director of the company’s European operations, Woodford was swiftly removed from his role as CEO by a collective vote. 8That same day, Woodford spoke to the Financial Times to provide an account of what he uncovered. 9While the Japanese press initially echoed Olympus’s statements, they eventually launched their own investigations. Consequently, on 8 November 2011 – a decade after the collapse of Enron –Olympus admitted that its accounting practices had been inappropriate. The company’s share price subsequently plummeted by more than 70%. 10To fully understand what happened, we need to go back in time.

Source: Comgest, Olympus company website

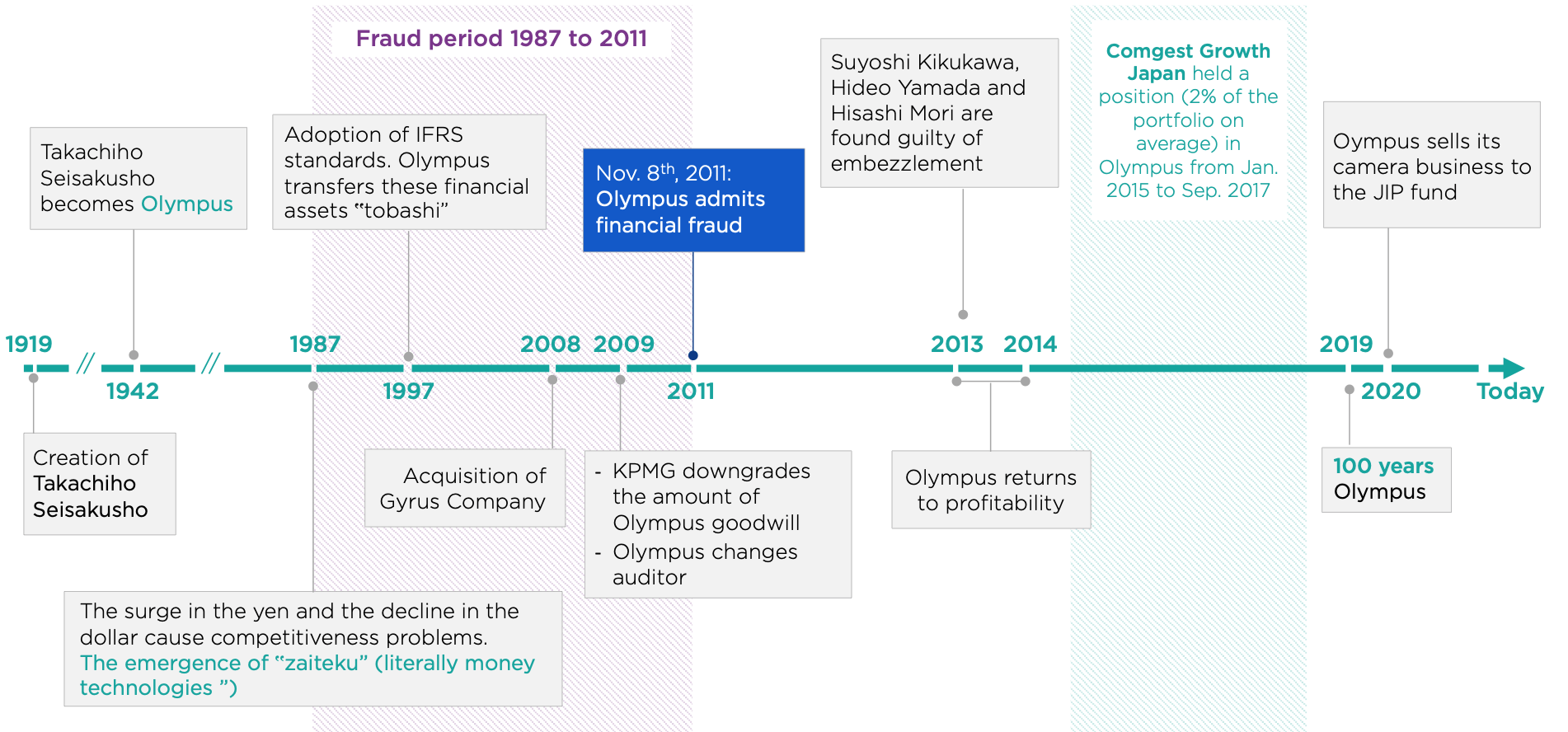

In the 1980s, the rising yen and falling dollar caused competitiveness challenges for certain Japanese companies, especially export companies whose costs were largely in yen while sales were in dollars. Investment banks, always eager to offer advice, recommended taking advantage of the strong yen. Zaiteku, meaning “money technology”, refers to a speculative investment strategy that transformed several wellestablished Japanese commercial companies into management-focused companies. Olympus decided to leverage this strategy to generate significant capital gains. However, by the late 1990s, the company had racked up over $1 billion in hidden losses due to these largely inflated acquisition payments. In response, the company decided to triple its capital investment to recover from its initial loss. Until 1997, Japanese accounting standards facilitated zaiteku, in some cases by allowing certain financial assets to be recorded at historical cost, which helped to conceal unrealised capital losses.

With Japan’s adoption of the International Financial Reporting Standards (IFRS) in 1997, accounting practices mandated that these investments be recorded at market value. This should have marked the end of the road for Olympus’s creative accounting and Japanese zaiteku practices. However, one year later, Olympus decided to transfer these financial assets into a tobashi (which translates to “flying away”) scheme, which aims to make losses disappear through complicated transactions or shell companies.

This manoeuvre, coordinated by Finance Director Hisashi Mori and internal auditor Hideo Yamada, allowed the company to write off the debt as an off-balance-sheet commitment, avoiding public disclosure. 11

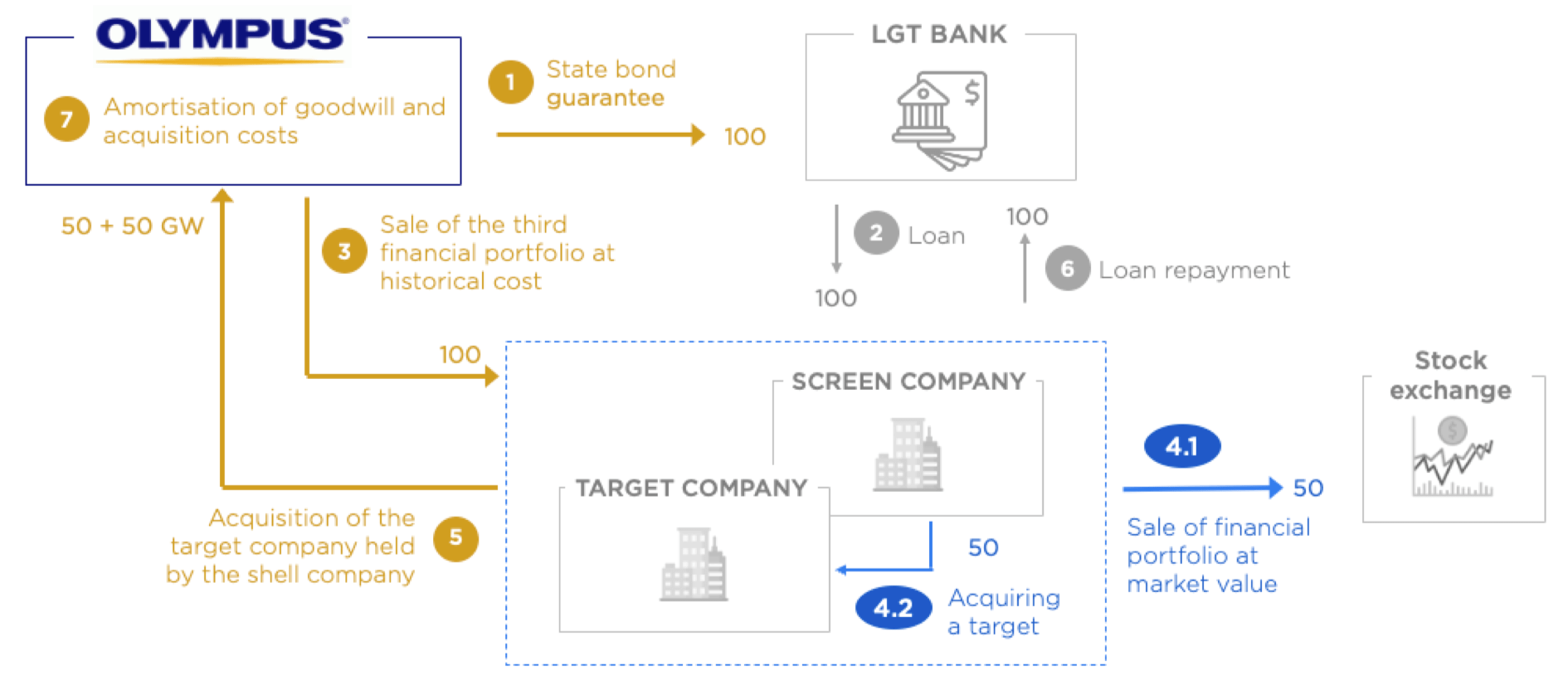

The financial tobashi plan outlined below enabled Olympus to transform its unrealised losses into intangible assets (“goodwill” 12) that would gradually be written off over time. This structure shielded the company’s income statement from a sudden, large loss in value that would have likely raised questions with investors.

Source: Comgest, Michael Woodford. Exposure: Inside the olympus scandal: How I went from CEO to Whistleblower. New York: Portfolio/Penguin, 2014.

In 2008, a final acquisition was made to eliminate the losses from past investments, at least on paper. The target was Gyrus, a British medical equipment manufacturer. Olympus paid nearly $700 million in consultancy fees 13for the $1.9 billion acquisition of Gyrus. 14The commission – over a third of the purchase price – far exceeded the industry norm of between 1% and 2% and was included as part of the goodwill. When reviewing this transaction, audit firm KPMG determined that the goodwill between 2008 and 2009 was overvalued, causing Olympus’s net income to plummet. 15As KPMG’s scrutiny intensified, Olympus decided to change its auditors to Ernst & Young (EY) in 2009.

On 3 July 2013, the former Olympus executives responsible for orchestrating the fraud escaped stiff prison sentences. Mr. Kikukawa, the group's former President, was given a 3-year suspended prison sentence with a 5-year probation period. His two accomplices, who fully acknowledged their responsibility, received 2.5- and 3-year suspended sentences respectively. Olympus, for its part, was fined around $7 million in Japan. 16

For context, Enron co-founder Jeffrey Skilling was initially sentenced to 24 years in prison in 2006 (later reduced to 14 years in 2013). Bernard Ebbers, former Chairman of WorldCom, received 25 years in 2005 for orchestrating what was the largest accounting fraud in US history. These verdicts, which took place around the same time as the Olympus affair, reignited a debate over corporate governance in Japanese companies, which had become known for their opaque Board of Governors. 17In the wake of the Olympus scandal, the country published reporting requirements modelled after the UK Stewardship Code in 2014. 18Launched in 2010, the UK Stewardship Code encourages institutional investors to engage with their investee companies responsibly and to take an active role in corporate governance. 19

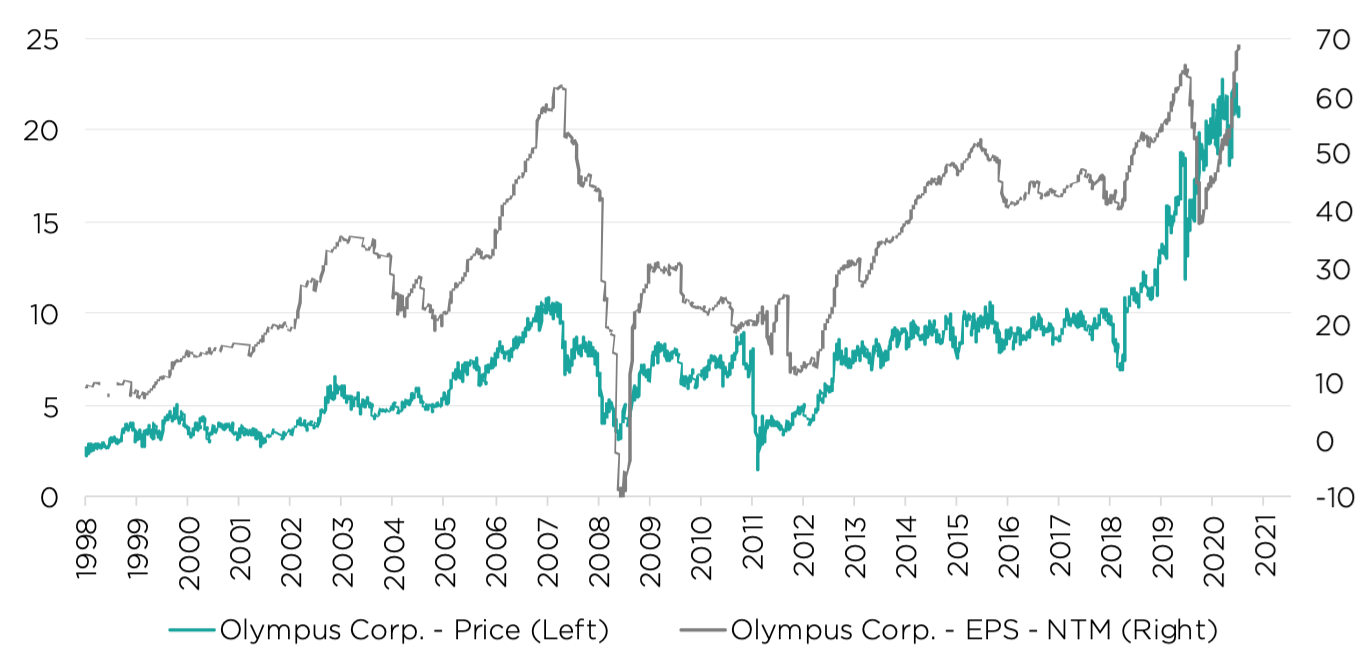

As long-term, quality growth stock pickers, Olympus should have seemed like a compelling investment case for Comgest at the time. The company’s consistent earnings-per-share (EPS) growth and its status as the world leader in precision optics aligned well with Comgest’s quality growth investment approach. From September 1998 to March 2008, Olympus’s EPS increased sevenfold and the share price nearly tripled.

Source: Comgest/Factset data as of 25-Jun-2024 expressed in local currency. Past performance is not indicative of future returns.

This sustained rise in EPS growth is something that we look for when analysing investment opportunities. However, it’s important to determine how much acquisitions contribute to this growth. At Comgest, we prioritise the visibility of organic growth over mergers and acquisitions. Based on our experience, visible organic growth stems from continuous internal investment across a wide range of business areas, such as production facilities, new technology or retail outlets. On the other hand, mergers and acquisitions can be unpredictable, with less visibility and more risk. Our investment team raised concerns about Olympus’s history of large-scale acquisitions and how it might impact the company’s potential for organic growth.

The Olympus scandal highlights how extra-financial considerations can help reveal a company’s quality. In our view, the fraud, facilitated by poor corporate governance, challenges traditional financial analysts to factor in extra-financial considerations, such as environmental, social and governance (ESG) criteria, when making investment decisions. During the period of this fraud, ESG research was primarily and solely conducted by financial analysts, without input from ESG specialists. Our Japanese investment team ultimately opted not to invest in Olympus due to our concerns about the company’s quality. In hindsight, we believe that our strict adherence to our quality investment approach spared us from a regrettable decision based only on EPS and share price.

During Comgest’s bottom-up investment research, we noticed that Olympus possessed a significant amount of goodwill, but decided not to pursue further investigation as the company was outside of our investment universe. According to our research notes, we excluded

Olympus from Comgest’s investment universe for the following reasons:

The Olympus affair offers several important lessons to investors. First, the complicity between company leaders and oversight bodies helped enable the fraud. Olympus’s corporate governance structure was severely flawed, and in some cases, entirely absent. When Woodford attempted to raise concerns about the Gyrus acquisition, he was directed to the CFO and former Chairman, both of whom were deeply involved in the fraud.

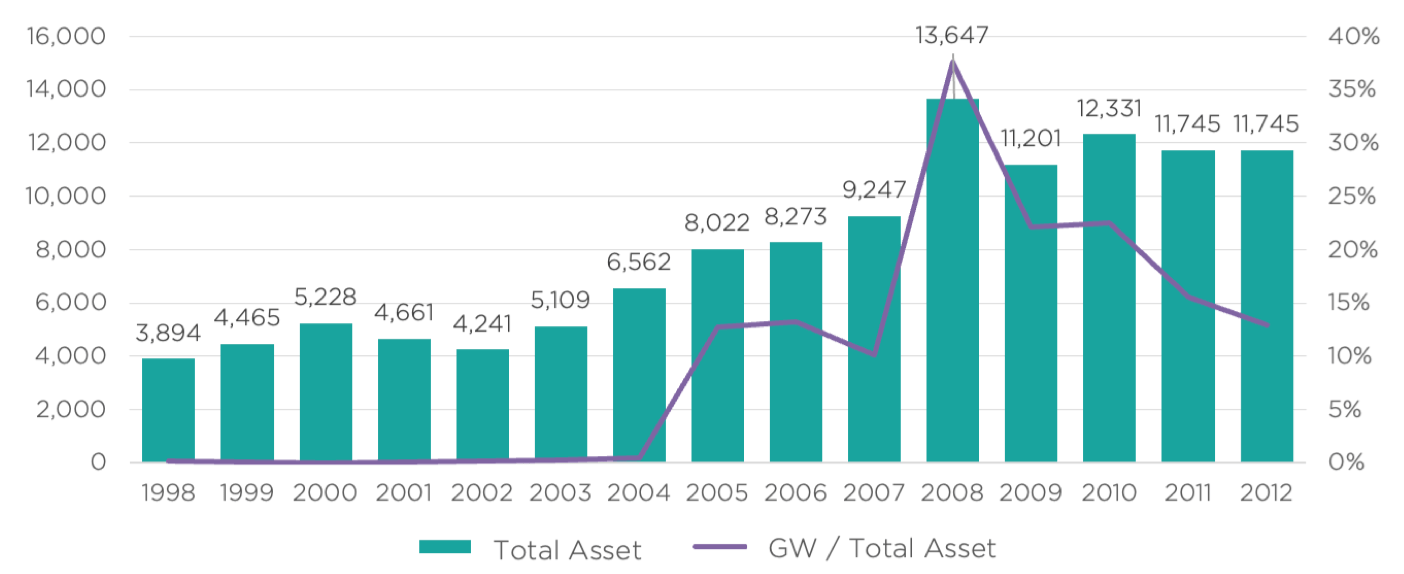

In our view, the Board of Directors lacked sufficient independence since twelve of its fifteen members were former Olympus employees. We believe that this structure hindered transparency and permitted the fraud to continue. Based on our research, fraud often stems from faulty accounting practices associated with acquisitions. Under IFRS, acquisition costs can be recorded as goodwill, which is a key area of interest in this case. In 1998, Olympus’s goodwill accounted for 0% of the balance sheet total, but by 2008, it exceeded one-third.

Source: Comgest/Factset data as of 25-Jun-2024 expressed in local currency. Past performance is not indicative of future returns.

Between 2007 and 2011, Olympus’s balance sheet doubled, yet these investments did not change its growth profile. From 2006 to 2008, the company’s balance sheet grew by an average of 19% annually, while revenue increased by 9%. However, from 2008 to 2010, annual revenue growth averaged just 2%, reflecting the time needed to integrate acquisitions. Additionally, the incremental return on invested capital fell by 80% per year from 2007 to 2009, suggesting the company was investing in highly troubled businesses or facing other significant issues.

It's also essential not to overestimate the role played by auditors and accountants. KPMG was Olympus’s auditor from 2002 to 2009, before being replaced by EY. Olympus removed KPMG after the auditor raised concerns about the company’s goodwill in 2008 and 2009. 20Despite certifying the accounts without reservation, neither KPMG nor EY faced prosecution. From our perspective, the auditors seemingly acted to protect themselves from legal repercussions rather than stepping forward as whistleblowers.

The Olympus scandal was marked by various accounting manipulations and financial manoeuvres. However, we believe that the root cause of fraud was insufficient governance. Following the scandal in 2011, Olympus made significant changes to its internal controls and governance practices.

Around the same time, Comgest established an ESG research team that tracked the evolution of Olympus’s governance practices. The company’s Audit Committee became a key focus. Olympus restructured the Committee to include four members - three of whom Comgest considered independent, including the Chair. However, diversity remained an area for improvement as all members were Japanese. The Compensation Committee, meanwhile, consisted of three members, including an American representing an activist shareholder. The Nomination Committee had four members, three of whom we considered to be independent and one from the same activist shareholder. An Ethics Committee was also established to promote values and integrity.

After the scandal, Olympus received a capital injection from Sony and collaborated on the manufacturing of new medical equipment. 21The company also redefined its corporate purpose to “making people's lives healthier, safer and more fulfilling.” 22We believe that this strategic refocus enabled the company to return to profitability in 2013. In line with our investment approach, we recognised Olympus's significant progress in enhancing its governance and corporate strategy, leading us to include the company in our Comgest Japan Equity strategy from January 2015 to September 2017. This investment was held for a relatively short time compared to our average six-year holding period of stocks in the portfolio. Lower-than-expected organic growth and our Quality Growth standards were the main reasons we decided to sell the stock

In 2020, under shareholder pressure, Olympus announced that it had sold its legacy business – cameras – to focus exclusively on medical equipment. This decision might seem trivial to someone unaware of the scandal and who might simply view Olympus as a struggling company. However, such a perspective overlooks the company’s descent from the top of the mountain. Being a large-cap company with a history of success does not guarantee fully independent governance practices. In our experience, complicity between independent governance bodies can turn what seems impossible into reality. By conducting an all-encompassing analysis of financial and extra-financial factors, we believe that investors can avoid costly mistakes.

Over the past decade, the Tokyo Stock Exchange has sought to improve governance at Japanese companies. Perhaps its recent decision to publish a list of companies with sustainable improvement plans will help bolster long-struggling stock prices and attract foreign investors. To date, much of their effort has focused on unwinding cross-shareholdings. We believe that this unwinding is a good thing as it relieves balance sheets of lowprofitability assets, but it does not guarantee an improvement in longterm performance for shareholders. Many companies have ignored the erosion of their market capitalisation for decades, and simply joining a category will not change this situation.

Comgest invests in only about 1% 23of the Japanese market, employing a survival of the fittest investment style that has been refined over decades. This strategy emphasises our commitment to evaluating a company’s long-term financial health, sustainability efforts and regular engagements with management, competitors, customers, and suppliers – as we aim to deeply understand the quality and long-term durability of the companies in which we invest.

1 Merriman-Webster, s.v. “ the abode of the gods (n.),” accessed 11-Nov-2024. ↩︎

2 “ Facts & Figures.” Olympus. Accessed November 15, 2024. ↩︎

3 Laricchia, Federica. “ Olympus: Net Sales 2007-2012.” Statista, March 31, 2012. ↩︎

4 Mesmer, Philippe. “ Olympus : a look back at a Japanese scandal.” Le Monde, 7-Nov-2014. ↩︎

5 Harlan, Chico. “Olympus Admits to Cover-up on Decades of Losses.” The Washington Post, 8-Nov-2011. ↩︎

6 Woodford, Michael. Exposure: Inside the olympus scandal: How I went from CEO to Whistleblower. New York: Portfolio/Penguin, 2014. ↩︎

7 Pilling, David. “ A gaijin blows the whistle,” Financial Times, 28-Nov-2012. ↩︎

8 Neate, Rupert. “ Michael Woodford: The Man Who Blew Whistle on £1bn Fraud.” The Guardian, 23-Nov-2012. ↩︎

9 “ Storms on Olympus.” Financial Times, 14-Oct-2011. ↩︎

10 Shellock, Dave. “ Olympus Fallout Hits Tokyo Securities Traders.” Financial Times, 8-Nov-2011. ↩︎

11 Tabuchi, Hiroko. “ Arrests in Olympus Scandal Point to Widening Inquiry into a Cover-Up.” The New York Times, February 16, 2012. ↩︎

12 Goodwill represents the difference between the market value and the net asset value of a company's balance sheet. ↩︎

13 “ Olympus Admits to Hiding Losses.” Wall Street Journal, 8-Nov-2011. ↩︎

14 Layne, Nathan, and Ben Hirschler. “ Olympus to Boost Surgery with $1.9 Bln Gyrus Deal.” Reuters, 19-Nov2007. ↩︎

15 Layne, Nathan, and Kirstin Ridley. “ Exclusive: Olympus Removed Auditor after Accounting” Reuters, 4-Nov-2011. ↩︎

16 “ Olympus Scandal: Former Executives Sentenced.” BBC News, 3-Jul-2013. ↩︎

17 Pesek, William. “ Nissan, Olympus and Fixing Japan Inc. Governance.” Nikkei Asia, 25-Nov-2018. ↩︎

18 Benes, Nicholas. “ A Crucial Change Is Needed to Improve Corporate Governance in Japan.” Financial Times, 14-Sept-2021. ↩︎

19 “ UK Stewardship Code.” Financial Reporting Council, 25-Sept-2023. ↩︎

20 Layne, Nathan, and Kirstin Ridley. “ Exclusive - Olympus Removed Auditor after Accounting Dispute.” Reuters, 4-Nov-2011. ↩︎

21 “ Sony, Olympus, and Sony Olympus Medical Solutions Collaborated in the Development of a Surgical Endoscopy System.” Sony Corporation - Sony Global Headquarters, 14-Sept-2022. ↩︎

22 “ Social Responsibility.” Olympus. Accessed 15-Nov-2024. ↩︎

23 As of 31-Dec-2023 ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).