You are visiting United States

If this is incorrect,

06-Nov-2024

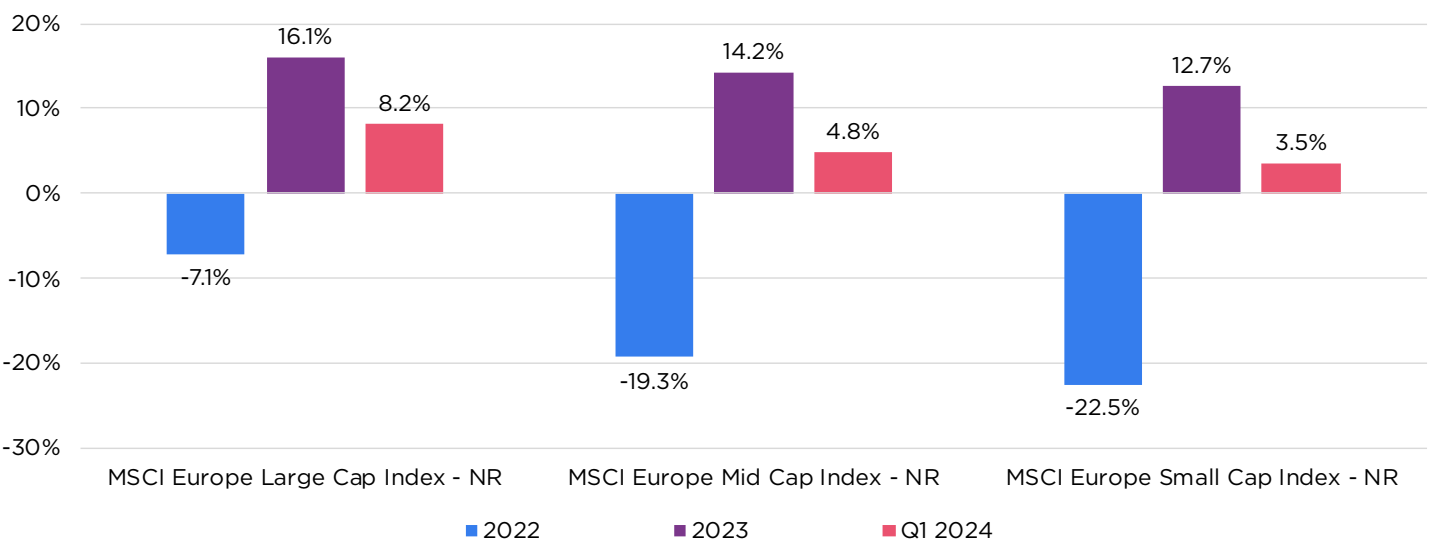

SMID caps have underperformed in recent years. Despite this trend, we believe that there are several examples of smaller companies in Europe that possess the right mix of quality characteristics and growth drivers to potentially deliver substantial returns over the long run.

In recent years, smaller companies have fallen out of favour with investors as large-cap companies have recorded outsized returns (as shown in figure 1). The outperformance of large-cap companies in the United States (especially the so-called “Magnificent Seven” stocks 1) and Europe (as highlighted in our earlier paper, “Giant Steps for Europe”) has dominated news headlines and diverted investor attention away from the small- and medium-sized companies of Europe. 2Higher global interest rates over the past three years also reduced investor interest in smaller companies. These companies generally carry a higher share of debt and promise higher growth, making them disproportionately affected by higher interest rates.

Source: Comgest/Factset. Data in EUR at 31-Mar-2024. *Large Cap data for MSCI Europe Large Cap Value vs MSCI Europe Large Cap Growth; Mid Cap data for MSCI Europe Mid Cap Value vs MSCI Europe Mid Cap Growth; Small Cap data for MSCI Europe Small Cap Value vs MSCI Europe Small Cap Growth.

We believe that this overly simple analysis – based on large-cap performance, interest rates and other macroeconomic developments – neglects the promising long-term growth potential of certain smaller companies in Europe.

There is a wide range of performance outcomes in the small- and medium-capitalisation (SMID cap) company universe 3, which is why we believe that active management and selective stock-picking are critical. Small- and medium-sized companies are the backbone of the European economy, accounting for nearly two-thirds of all jobs and more than half of the continent’s value added. 4Being able to narrow this immense universe of stocks and separate the winners from the losers requires extensive research.

Smaller companies tend to carry more debt in their balance sheets have stronger operating leverage and more limited regional footprints than large-cap alternatives. Despite these challenges, we believe that there are several examples of SMID cap companies with the enduring competitive advantages of established market leaders. Many of these companies operate in niche markets, such as payment platforms, restaurant vouchers or professional kitchen equipment, yet they are industry leaders. While investing in SMID caps involves risk, we believe that those managers who can spot quality SMID caps can potentially achieve substantial long-term returns.

At Comgest, our investment philosophy is not constrained by size. We aim to build our portfolios with quality companies with enduring competitive advantages, irrespective of their size or market capitalisation. Our disciplined and rigorous investment approach aims to identify distinct drivers of growth and focus on companies that we believe are poised for sustained earnings growth. For our Comgest Growth Europe Smaller Companies strategy we target mid-teens earnings per-share growth over our five-year forecasting period versus low-teens for our large cap flagship Comgest Growth Europe strategy.

The value for long-term investors in our Comgest Growth Europe Smaller Companies strategy lies in benefiting from the small cap effect, which should offer higher long-term earnings growth and greater appreciation potential compared to large cap companies. The recent underperformance of our Comgest Growth Europe Smaller Companies strategy compared to our large- and mega-cap strategies may present an excellent opportunity to invest in the dynamic earnings growth of highquality smaller European companies.

While there are common threads across industries, we believe that there is no “one size fits all” approach when it comes to identifying the competitive advantages that set certain European SMID caps apart. We have observed that the competitive advantages of European SMID caps can take many forms, including serving as a linchpin for global supply chains, leveraging in-house innovation and maintaining a strong brand presence.

In some cases, large caps are highly dependent upon smaller companies. The intricate global supply chains of many of the world’s leading companies are composed of SMID caps. In the semiconductor industry, for instance, companies require highly specialised tools and pieces of equipment to produce their end products – many of which are only manufactured by a handful of smaller companies.

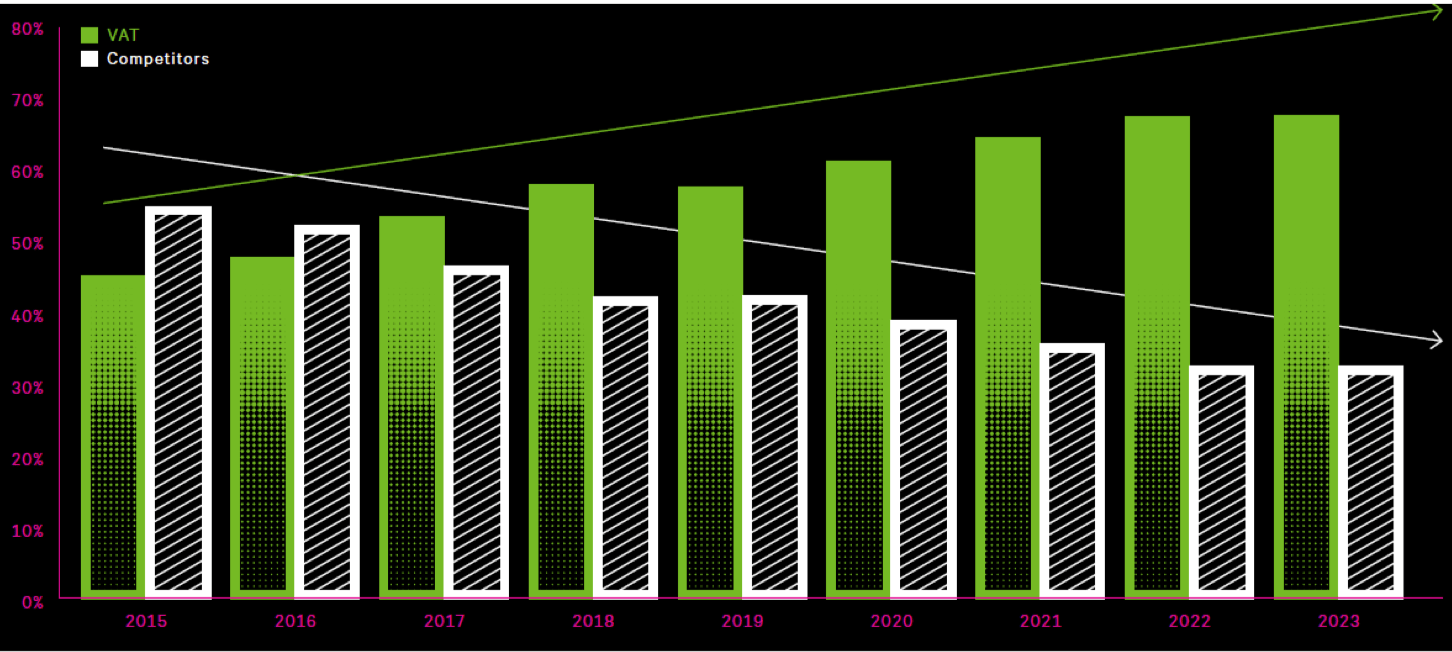

VAT Group, the Swiss industrial equipment manufacturer, is one of the leading suppliers of high-end vacuum valves used by leaders in the semiconductor industry. Vacuum systems are used at various points of the semiconductor manufacturing process to reduce contamination and regulate temperatures. Dust, for instance, can disrupt the manufacturing process and cause costly defects to the chip manufacturing process.

Sources: Sources: VAT / Company website. “VAT Annual Report 2023.” *Market share includes semiconductors, LEDs and hard disks. Data on positions held are provided for information purposes only, are subject to change and constitute neither a recommendation to buy nor a recommendation to sell the securities displayed. The securities presented in this document may not be held in portfolio at the time of receipt of this presentation. All projections and estimates are provided for information purposes only and are not guaranteed.

Founded in 1965, VAT Group has steadily grown its share of the semiconductor valves market from 54% in 2015 to around 70% in 2023 (as seen in figure 2). 5In 2022, VAT Group had the highest installed base in the market with 1.5 million valves installed. 6As a leading provider of semiconductor valves, the company’s quality is trusted by many of the world’s leading semiconductor manufacturers, such as ASML, TSMC, Intel and Samsung. VAT Group also boasts the broadest portfolio of products on the market, including 8,000 customer-specific products and 2,500 standard products. 7We believe VAT Group’s market share, as well as their close relationships with the world’s leading semiconductor manufacturers, should serve as high barriers to market entry for potential competitors.

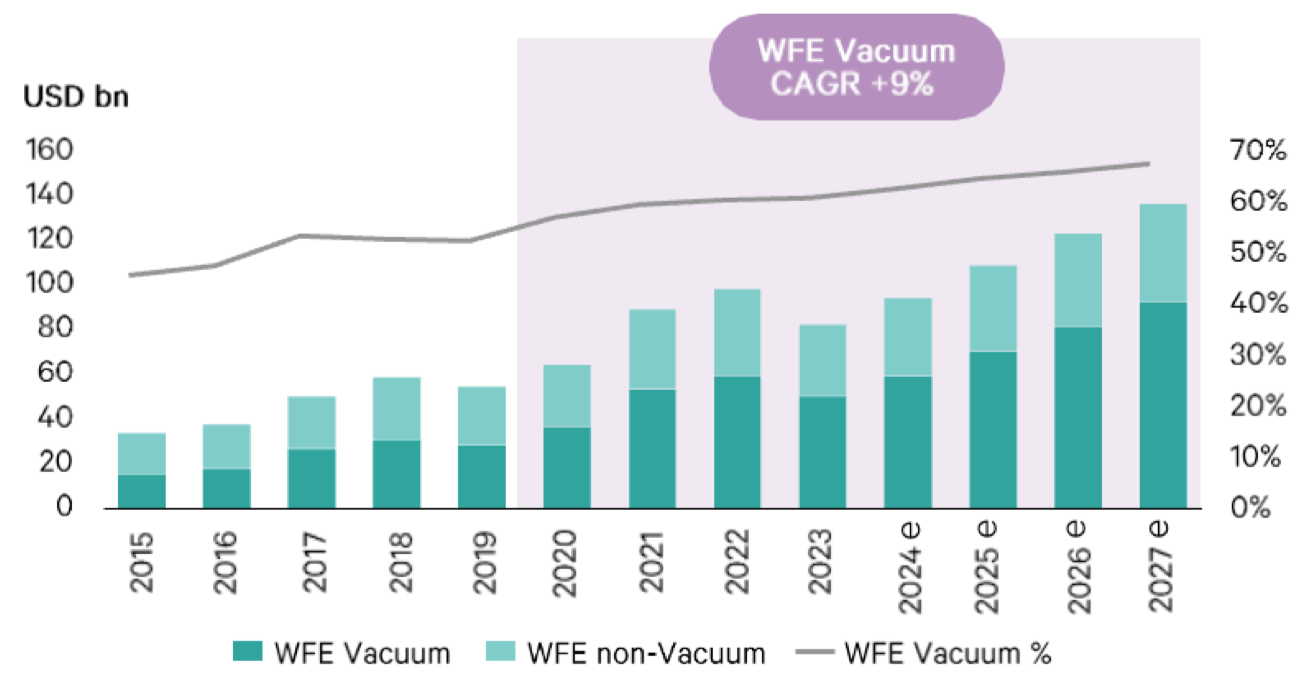

In our view, VAT Group also benefits from a variety of long-term growth drivers, including digitisation and artificial intelligence. Based on these trends, the company expects the semiconductor equipment market (also known as wafer fab equipment “WEF”) to grow at a 9% compound annual growth rate until 2027 (see figure 3). We believe that VAT Group is well-positioned to take advantage of this growing demand, especially as the semiconductor manufacturing process becomes more complex and manufacturers race to produce smaller chips. With little debt, an experienced management team, as well as high returns on capital and margins 8, we believe that VAT Group has many of the durable competitive advantages that separate quality growth companies from the rest of the pack.

Sources: VAT / Compagny website/ VLSITechInsights Inc / Investor Deck Winter 2023. *WFE = Wafer Fab Equipment. Data on positions held are provided for information purposes only, are subject to change and do not constitute a recommendation to buy or sell the securities displayed. The securities presented in this document may not be held in portfolio at the time of receipt of this presentation. All projections and estimates are provided for information purposes only and are not guaranteed.

Although smaller companies typically have smaller research and development budgets than their larger peers, their dedication to niche markets can sometimes make them technological leaders – even against bigger competitors. In other words, they are big fish in a pond too small for their larger peers.

German manufacturer Carl Zeiss Meditec, for instance, has established leading positions in the eye-related medical technology industry due largely to its highly innovative laser technology. As of August 2024, the company was the market leader for microsurgery visualisation (> 60%), refractive surgery (> 35%) and fragmented eye diagnostics (~20%). 9

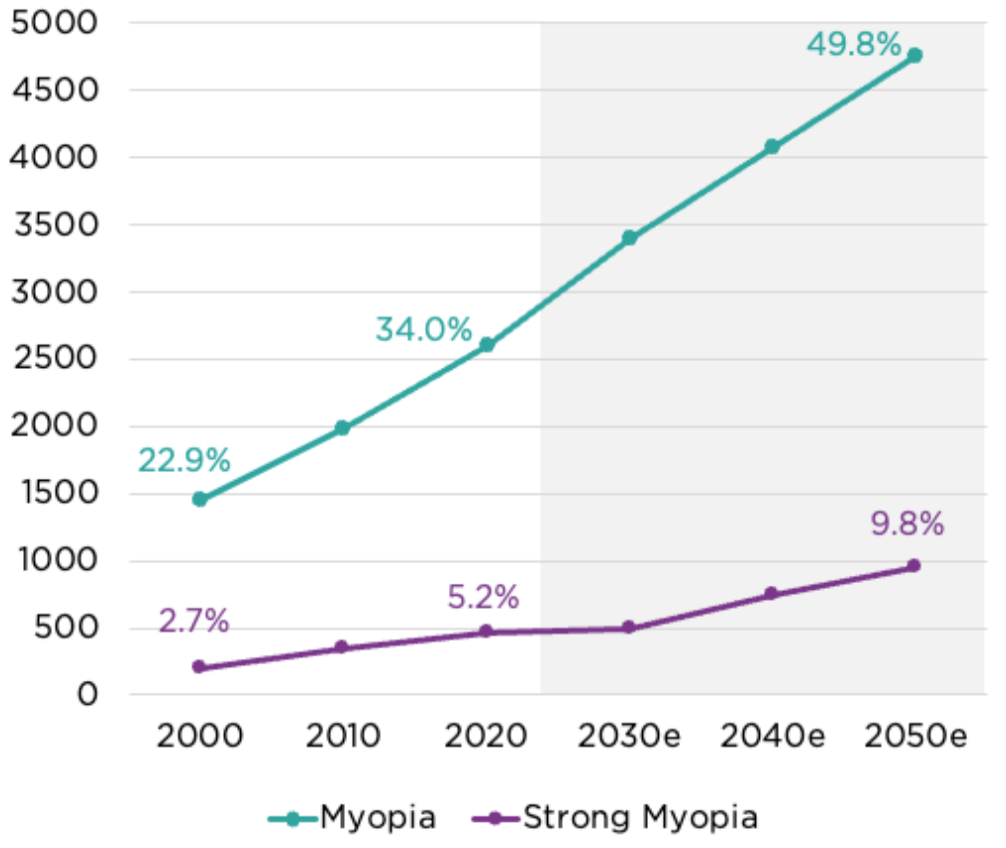

Notably, the company has released an innovative laser vision correction software called “SMILE,” which is less invasive than other forms of refractive surgery, including LASIK. In particular, the incision size of SMILE is about two millimetres compared to 24 millimetres for LASIK. The worldwide presence of myopia, also known as “shortsightedness”, has grown from 22.9% in 2000 to 34.0% in 2020 and is expected to grow to 49.8% by 2050 (as shown in figure 4).

Sources: Carl Zeiss Meditec / Company website / Estimates American Academy of Ophthalmology / BGN Eye Clinic Lasik Surgery In Korea.

Given this unfortunate rise in myopia and a growing global ageing population, we believe that demand for refractive surgery will only rise in the future. In our view, Carl Zeiss Meditec’s laser technology should be well-positioned to provide patients with solutions and treatments for their eye-related conditions. Based on our experience, we believe that Carl Zeiss Meditec’s innovation lead in these eye-related medical technology sectors have the potential to transform into a sustainable competitive advantage with long-term benefits for shareholders over time.

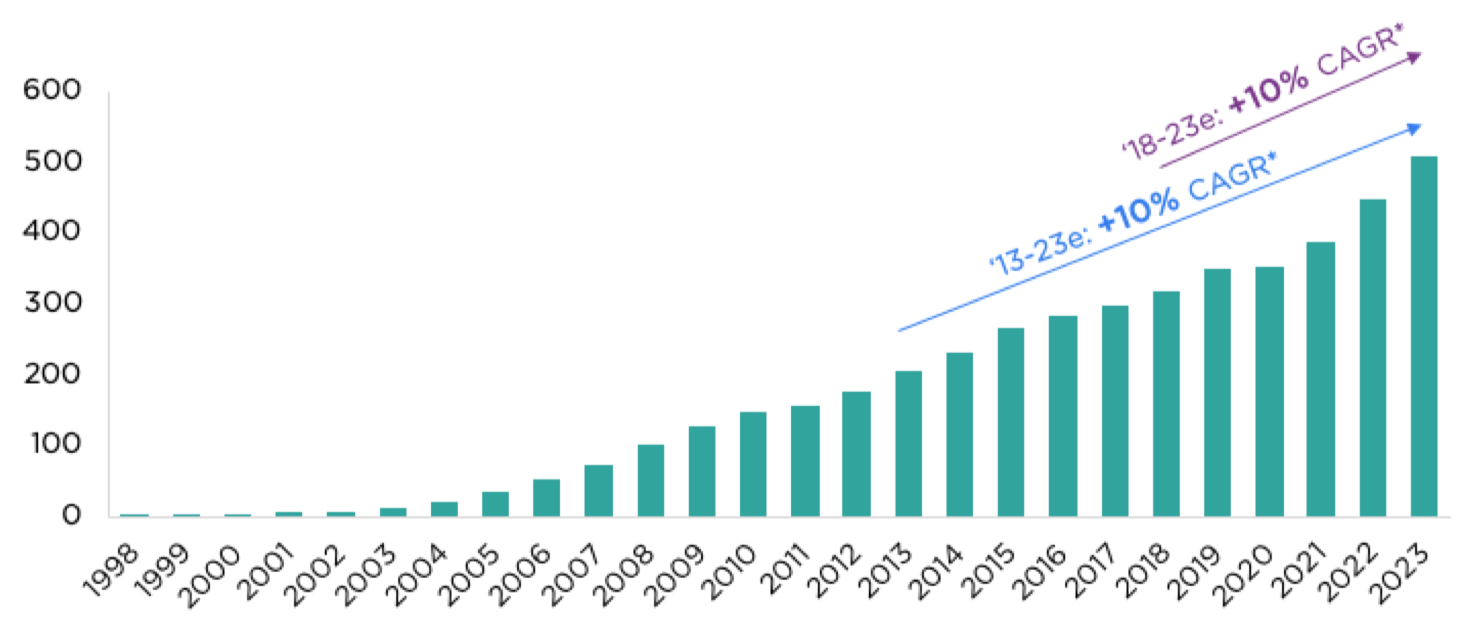

In our view, size has nothing to do with a company’s consumer reputation. With over 25 years of operation, Scout24, the leading German online listings platform, has built a strong brand presence in Germany.

The company’s real estate listing site, ImmobilienScout24.de, serves as a digital marketplace for real estate agents, tenants, homeowners and homebuyers.

Immoscout’s website attracts more than 19 million users a month and had an annual traffic increase from 1.5x to 2.0x between 2018 and 2023. 10In recent years, Scout24 has rolled out new products and innovative features to assist homeowners in accessing their property values and ensure compliance with local sustainability requirements.

Sources: Scout24. *CAGR: compound annual growth rate. Data on positions held are provided for information purposes only, are subject to change and constitute neither a recommendation to buy nor a recommendation to sell the securities displayed. The securities presented in this document may not be held in portfolio at the time of receipt of this presentation.

For homebuyers and tenants, the company has premium feature options, including exclusive listings and a cloud-based application folder for managing the required documents for transactions.

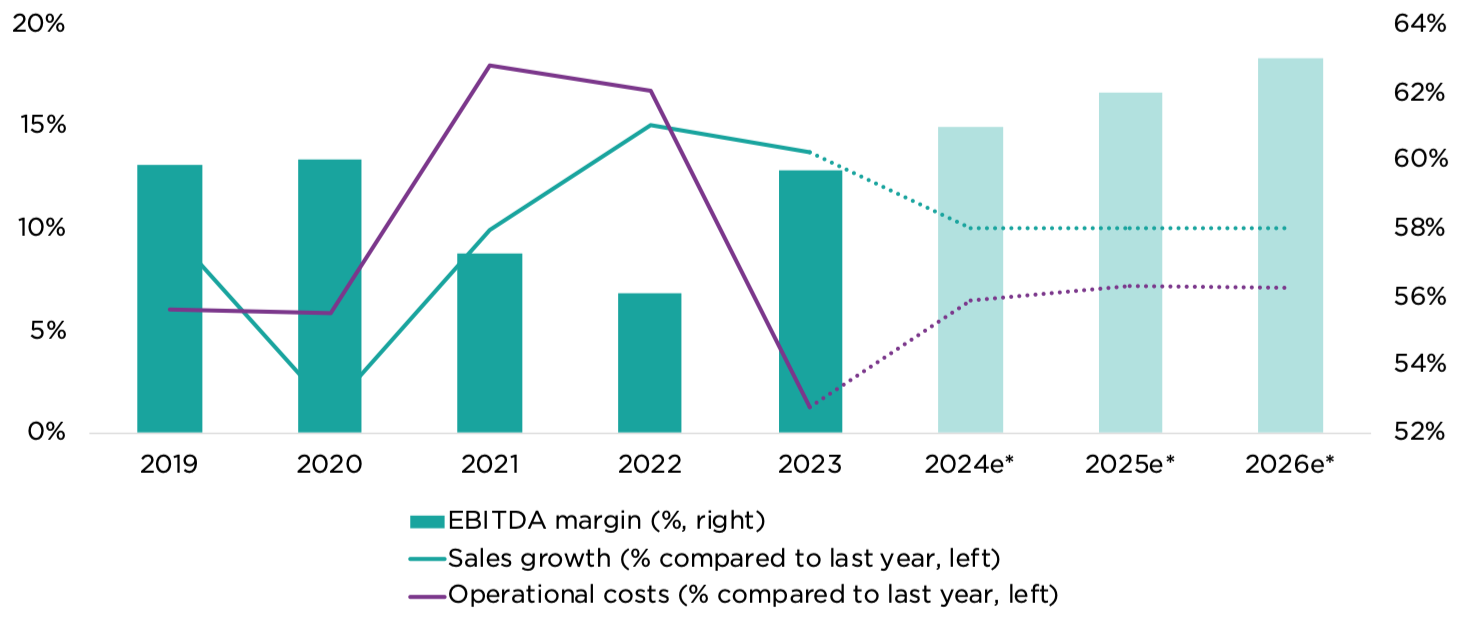

Faced with a challenging real-estate market, especially in Germany where higher interest rates and rising building costs have pushed up housing prices, Scout24 has achieved a 10% compound annual growth rate since 2013. 11In the wake of the COVID-19 pandemic, Scout 24 reinvested capital back into the company in 2021 and 2022, which helped increase sales growth. 12Following this period of expenditure, Scout24 focused on reducing its operational costs in 2023 and delivering improved profit margins 13Given the company’s long-standing presence and innovative solutions, we believe that Scout24 has the potential to continue to increase its earnings growth over the long term.

Sources: Scout24. *Estimates published by Scout24 Data on positions held are provided for information purposes only, are subject to change and constitute neither a recommendation to buy nor a recommendation to sell the securities displayed. The securities presented in this document may not be held in portfolio at the time of receipt of this presentation. All projections and estimates are provided for information purposes only and are not guaranteed.

We choose to invest in SMID caps because of their quality growth characteristics – not their size. Due to the recent underperformance of European SMID caps compared to their large-cap counterparts, we believe that there are several smaller companies with significant competitive advantages. In our view, the return of inflation – which peaked in June 2022 – led investors to overlook European SMID caps as they are generally considered to be more indebted and very susceptible to higher interest rates than larger companies.

As Eurozone inflation recedes, 14we believe that now is a prime opportunity to invest in small cap companies with strong fundamentals, such as VAT Group, Carl Zeiss Meditec and Scout24. These companies are niche market leaders and have proven that they can outlast challenging economic times, including the COVID-19 pandemic and higher interest rates, due to their strong competitive advantages.

Consistently overlooked by investors over the recent past, we see the opportunity to uncover quality growth small cap companies with potential long-term growth trajectories.

1 Includes Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. ↩︎

2 This paper can be found under the “Our Thinking/Investment Letters section of your local Comgest website. ↩︎

3 Refers to companies with a market capitalisation between $250 million and $10 billion. ↩︎

4 European Commission. “Annual Report on European SMEs 2022/2023 .” European Commission. Accessed 8-Aug-2024. ↩︎

5 Sources: VAT / Company website. “ VAT Annual Report 2023.” ↩︎

6 Source: VAT / Company website. “ VAT Summary Report 2022.” ↩︎

7 Source: VAT / Company website. “VAT Investor Deck Winter 2023.” ↩︎

8 Source: VAT / Company website. “ VAT Half-Year Report 2024.” ↩︎

9 Source: Carl Zeiss Meditec Group Investor Presentation August 2024. ↩︎

10 Source: Google Trends, Similarweb. ↩︎

11 Source: Scout24/Company website.Capital Markets Day Presentation 2024. ↩︎

12 Source: Scout24/Company website. Preliminary results for Q4/FY 2023. ↩︎

13 Source: Scout24/Company website. Preliminary results for Q4/FY 2023. ↩︎

14 European Commission.Spring 2024 Economic Forecast: A gradual expansion amid high geopolitical risks, 15-May-2024. ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

This is a marketing communication. Please refer to the fund prospectus and to the PRIIPs KID before making any final investment decisions. UK investors should refer to the UCITS KIID. These documents are available at our offices free of charge and on our website at www.comgest. com. Our Irish funds’ prospectus is available in English, French and German and our French funds’ prospectuses are available in French and may also be available in German. The KIDs are available in a language approved by the EU/EEA country of distribution. A more detailed description of the risk factors that apply to the funds is set out in the prospectus. The Comgest Growth funds mentioned herein are UCITS compliant sub-funds of Comgest Growth plc (CGPLC), an open-ended umbrella-type investment company with variable capital and segregated liability between sub-funds incorporated in Ireland and regulated by the Central Bank of Ireland. The investment manager may decide to terminate at any time the arrangements made for the marketing of its UCITS.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by JPX Market Innovation & Research, Inc. or affiliates of JPX Market Innovation & Research, Inc. (hereinafter collectively referred to as "JPX") and JPX owns all rights and know-how relating to TOPIX such as calculation, publication and use of the TOPIX Index Value and relating to the TOPIX Marks. S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index. MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. ( www.mscibarra.com).

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest Italia is the Italian branch of Comgest Asset Management International Limited, enrolled in the Milan Companies Register with no. MI-2587566 and in the CONSOB register with no. 191. Its registered office is at Via Del Vecchio Politecnico 9, 20121, Milan, Italy.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).