You are visiting United States

If this is incorrect,

05-Nov-2024

Over the past decade, U.S. growth and equities have consistently outperformed their global counterparts. For investors in the U.S., seeking returns elsewhere has seemed rather pointless. However, as market trends shift, investors fixating solely on index performance or geography may be overlooking significant opportunities to diversify in quality growth companies outside the United States.

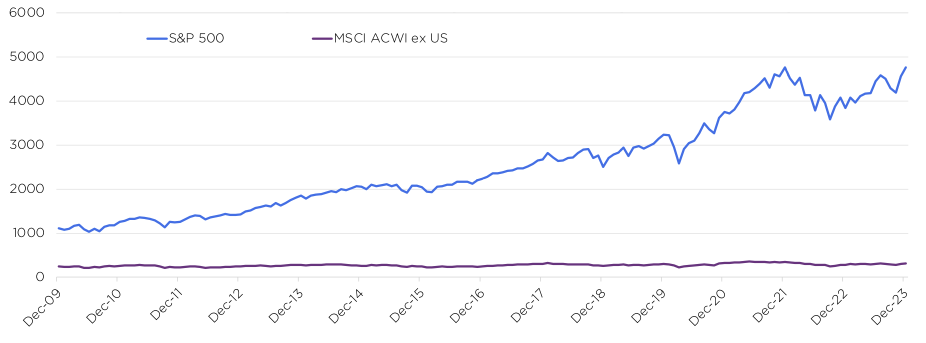

After nearly a decade of U.S. equity outperformance relative to international markets, why would American investors look anywhere else? This is a fair question. Since rebounding from the 2007-2008 Global Financial Crisis, the S&P 500 index has generated total returns of 13.11% versus 5.16% for global equity markets excluding the U.S., as represented by the MSCI World ex USA index (seen in figure 1).

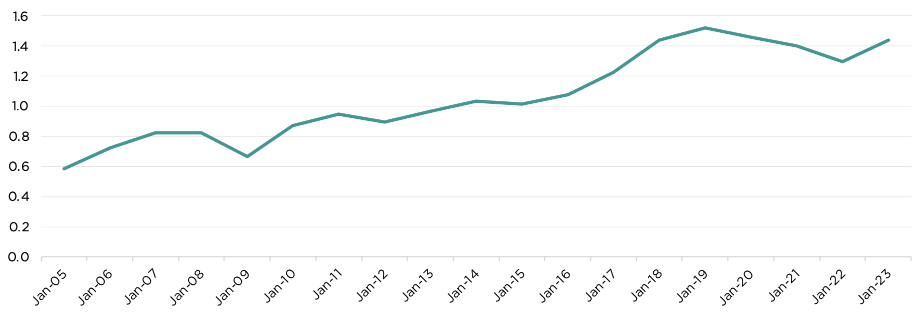

U.S. equities have experienced a remarkable run due to several factors. The U.S. economy is the largest in the world and possesses highly liquid markets which have been supported by markedly more monetary stimulus than in any previous period. Additionally, earnings growth, large-scale share buybacks and improved productivity have driven U.S. equity outperformance. The strength of the U.S. dollar has also led to inferior gains for international indices (priced in US dollar). Specifically, U.S. technology stocks, including the Magnificent Seven1, have capitalised on recent advancements in artificial intelligence, social media, electric vehicles and cloud computing. This, in turn, has resulted in elevated earnings-per-share growth for the S&P 500 index over the medium term, attracting high valuations.

Past performance does not predict future returns. Source: Comgest, Factset; as of 31-Dec-2009 to 31-Dec 2023.

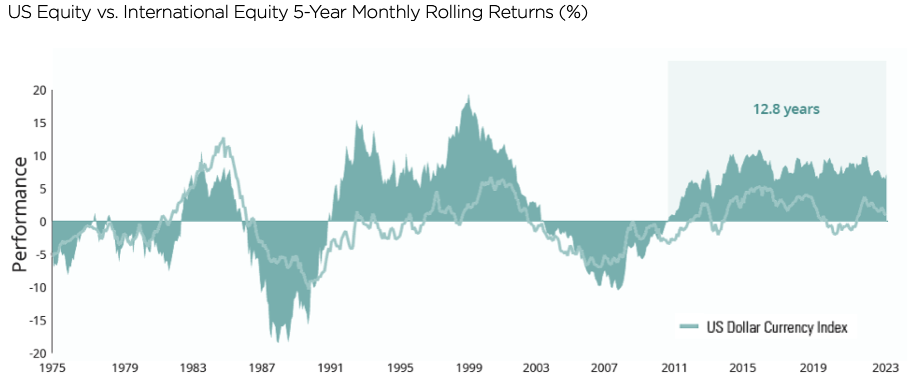

Markets tend to operate in cycles and rotations. The previous period of U.S. market outperformance, from 1994-1999, was sparked by euphoria around the technology boom and the spread of computers.2After the dot-com bubble burst in 2000, capital flowed back to the fundamentally improving emerging markets, sparking their decade-long outperformance until 2008-2009 (as shown in figure 2). During this time, Europe and Japan remained stable with prices fluctuating within a narrow range, while emerging markets grew due to increased financial inclusion, expanded trade access (such as China joining the World Trade Organization) and a rising middle class.3The 2000s also saw a “commodity super cycle”, driven by emerging markets – like China and India – creating high demand for commodities – food, oil and metals – benefitting exporters like Brazil and Russia. It was in this cycle that the term “BRICS” was coined.4Given these past cycles, some investors believe that international equities might once again outperform.

The chart shows the values of the S&P 500 Index's returns minus the MSCI World ex USA Index's returns.

Past performance does not predict future returns. Source: Comgest, Factset.

However, it’s difficult to predict these types of swings in market behaviour. At Comgest, we believe that investment decisions based solely on these types of predictions are presumptive in nature and based on limited data. In our view, market outperformance has little to do with historical cycles or macroeconomic factors, such as monetary and fiscal policies. We rather view it as being primarily driven by companies with strong sales growth and healthy profit margins, which has resulted in substantial EPS growth.

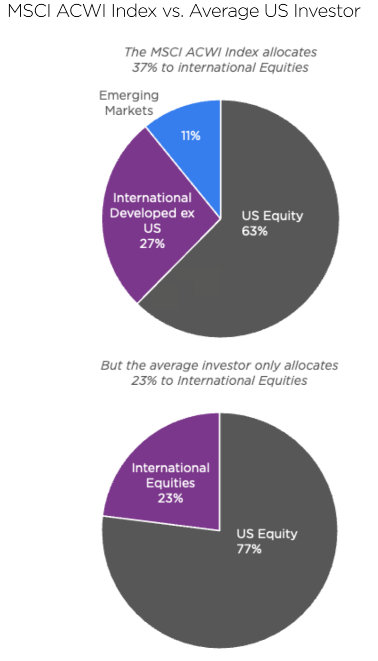

Source: Hartford Funds, Factset, Morningstar. Ending values may differ from totals provided due to rounding. As of 31-Dec-2023.

The same pillars driving quality growth companies in the U.S. exist abroad, too. Quality growth attributes, including significant longevity, visible growth, robust free cash flow, high barriers to entry and strong culture are global in nature. That’s why our investment style is unconstrained by benchmarks, geographies and sectors. Instead, we focus on company-specific fundamentals that we believe enable sustainable, double-digit earnings-per-share (EPS) growth. Based on our experience, there are many competitively advantaged franchises outside of the U.S. with strong fundamentals and comparatively cheaper valuations.

Investing in international equities encourages the pursuit of alpha by diversifying holdings, rather than concentrating all investments in a single geographic location, like the United States. While regulatory and currency variations exist across financial markets, the fundamental attributes that define quality companies are global in nature. As a case in point, the actual fundamental growth drivers and exposures of our investee companies are also global.

Source: Factset / Comgest, as of 11-Jul-2024. The data shown is data of the representative account of the Global ex US Equities Composite, managed in accordance with the Composite since the Composite’s inception. Please refer to the important information section for more details on the representative account, its selection methodology and where to receive the GIPS compliant presentation of the composite.

As of September 2024, our non-U.S. equities exposure includes5: 72% in the EU, 17% in Japan and 11% in EM; this is compared with actual underlying revenue exposures6of 32% for the U.S., 15% for the EU, 10% for Japan, and 43% for emerging markets.7From our perspective, investing internationally offers better portfolio diversification by seeking alpha through varied holdings (which also have globally diversified revenues and operations – including in the US), rather than relying solely upon a specific geographic allocation. Whether in Europe, Japan or emerging markets, like China, India and Latin America, we believe that there are quality companies positioned for long-term growth.

In the past, U.S. investors tended to associate European stock markets with outdated companies and low growth rates. This view was often rooted in stereotypes and misconceptions around Europe’s corporate culture, rather than a deeper understanding of a company’s growth drivers. The reality is that European markets boast global leaders across various industries, including healthcare, technology and consumer luxury products.

In contrast to the “Magnificent Seven” driving Wall Street, the “Granolas”8are a group of 11 European stocks with similar growth. Comgest has held several of the Granolas for years – well before the nicknames – as we don’t take such categorisations or hype into consideration when making investment decisions. Our focus lies in understanding what makes certain companies competitive and what enables them to drive consistent, visible, long-term growth. Based on Comgest’s nearly 40 years of experience, there are many longstanding companies experiencing exponential success due to their continuous innovation, brand recognition and healthy balance sheets – not membership of a particular group nor their location.

ASML, a Dutch semiconductor equipment supplier, demonstrates how decades of innovation can translate into consistent organic growth.

Founded in 1984 as a subsidiary of electronics giant Philips, ASML was established to respond to the growing market demand for semiconductor lithography.9After decades of research and innovation, ASML is the only company in the world that possesses the technology and machinery to create the patterns to make the world’s most sophisticated chips.10

These multi-million-dollar lithography machines, which rely upon extreme ultraviolet (EUV) light, have become a critical passageway in the global supply chain for chips. Leading manufacturers, including Taiwan Semiconductor Manufacturing Company (TSMC), Samsung and Intel, are unable to produce cutting-edge chips without ASML’s equipment and technology. Despite the challenges facing Europe – from the RussiaUkraine war to the continent’s slow post-pandemic economic recovery – ASML’s role as the global semiconductor industry’s linchpin remains unchanged. What’s more, recent advancements in artificial intelligence are likely to further extend the company’s research and development (R&D) lead over its competition.

Europe has long been considered a global leader for premium consumer brands, especially when it comes to the wine and spirits sector. Pernod Ricard, the French wine and spirits brand, offers an example of a European company that has leveraged its history, acquisitions and pricing power to establish itself as a market leader. Founded in Marseille and known for its aniseed-flavoured pastis liquor, the company has diversified its offerings in recent years by acquiring brands, such as Absolut vodka and Jameson whiskey.11These acquisitions have enabled Pernod Ricard to expand globally, particularly in emerging markets such as India, where year-to-date sales grew by 13% in 2023.12

As consumer preferences increasingly shift toward premium champagnes, whiskeys and spirits13, Pernod Ricard’s collection of premium brands is well-positioned to take advantage of this secular growth trend. The intricate fermentation process of these premium products requires time, expertise, and resources14—advantages that Pernod Ricard holds over potential new entrants. From our perspective, Pernod Ricard’s expertise and in-house knowledge enables the company to increase prices with minimal consumer pushback15, underscoring the uniqueness and quality of its products.

Despite limited GDP growth16, the European equity market continues to outpunch its weight in terms of equity returns. While puzzling, it is also reassuring, as it means that company fundamentals are being rewarded. In our view, it is hard to find companies like ASML and Pernod Ricard better positioned to continue its growth trajectory. They are profitable, innovative, and global leaders in their respective fields, consistently delivering strong earnings and free cash flow. These examples demonstrate that measurements, such as GDP or index performance, are uncorrelated and irrelevant to our long-term quality growth philosophy. Even in the face of macro-economic headwinds, we believe that we can identify exceptional quality growth in all markets which are represented in our high conviction fund.

One standout example is Hoya Corporation, the world’s second- largest lens maker. Founded in 1941 by brothers Shoichi and Shigeru Yamanaka, Hoya has been manufacturing optical glass for over 80 years.18The company strategically divested its legacy crystalware and camera businesses to focus on expanding its contact lens retail network throughout Japan. More recently, Hoya has leveraged its expertise to manufacture mask blanks and photomasks − critical components for semiconductor chip production.19The company demonstrates how innovation can drive growth in adjacent markets.

Hamamatsu Photonics, the leader in photomultiplier tubes and imaging devices, is another Japanese company leveraging innovation to provide cutting-edge companies with technologies for capturing, measuring and generating light.20The company’s portfolio includes light sensors and light sources essential in the production of LEDs and lasers as well as ultraviolent, infrared and x-ray light. Hamamatsu’s products are integral to medical devices, such as CT scans, automotive sensors and environmental monitors that detect pollution and radiation.20We believe that the company is poised to benefit from long-term growth trends related to sustainability, automation, artificial intelligence and healthcare.

Contrary to the misconception that Japan’s aging population renders it outdated, brands such as fashion retailer Uniqlo, have captured the attention of “cool” trendsetting consumers. The company, which opened its first store in June 1984 under the name “Unique Clothing Warehouse,” prioritises quality, affordability, and timeless wardrobe classics, including t-shirts, jeans, and sweaters.21These versatile apparel items resonate with consumers across Japan, Asia and beyond.

As quality growth investors, we recognize the importance of expanding into new geographic regions. Uniqlo has embraced international expansion, tapping into neighbouring Asian markets, particularly China, Thailand, and Vietnam. The brand is experiencing growing demand in China as consumers seek to cut down spending by purchasing more affordable clothing options. Looking beyond Asia, Uniqlo plans to open 200 new storefronts across the U.S. and Canada by 2027, further solidifying its global footprint.22International markets now account for more than half of Uniqlo’s total revenues − a milestone in the company’s history.23

Japan’s corporate landscape is evolving, with companies making better use of their balance sheets and enhancing profit margins. Despite these positive fundamentals, we believe that investors are missing out on opportunities in Japan by only focusing on index performance or macro- economic developments. Looking beyond the prevailing misconceptions, we see examples of undervalued companies with strong fundamentals and predictable long-term tailwinds.

The COVID-19 pandemic, a strong U.S. dollar and geopolitical tensions have created significant headwinds and challenges for emerging markets. As a result of U.S.-China trade tensions, some companies are adjusting their supply chains to reduce their reliance on China, leaving Brazil, India, and Vietnam to emerge as early beneficiaries. Notably, 2023 marked the first time in two decades that the U.S. purchased more goods from Mexico than China. Many investors view this as the start of a wider “de-globalisation” movement, where greater protectionism and onshoring supply chains will result in limited growth for emerging markets. These developments have caused investors to consider withdrawing from China altogether.

Despite these tensions, we believe that there are still undervalued companies with strong fundamentals operating in China, particularly those catering to domestic consumers. In recent years, the fitness and wellness industry in China has seen remarkable growth, benefitting domestic Chinese sportswear brands. Consumers are now more interested in high-quality products offering functionality and performance benefits than style.

Anta Sports is one Chinese sportswear company that has capitalised on this growing domestic demand for high-quality sportswear. Founded in the early 1990s as a small provincial shoemaker, the company has emerged as the country’s second-largest sportswear retailer behind Nike, with over 20% market share.24Over the past decade, Anta’s revenues have quintupled as the company expanded its market shares across China’s apparel, footwear and accessories sectors.23

During the same period, the company acquired several storied sports brands, including Salomon skis and Wilson tennis rackets, to establish new avenues for long-term growth in adjacent markets and outside of China. Overall, we believe that a much more selective approach to China is required, however we continue to see businesses with long-term competitive advantages and strong underlying fundamentals across sectors.

India has emerged as a prominent alternative for investors looking beyond China. The International Monetary Fund (IMF) predicts that India will become the world’s third-largest economy by 2027.25Key reforms, including India Stack, a unified digital infrastructure programme, have helped digitise the country, expand services to citizens and accelerate growth by formalising the Indian economy. HDFC Bank, India’s largest private bank and mortgage lender, has capitalised on this growth.

Added to Comgest’s investment universe in 2014, HDFC has built a brand name and reputation for quality in an industry where trust is a key competitive advantage. As the economy continues to expand, demand for affordable housing loans is expected to rise, and HDFC is likely to be well positioned to take advantage of this growth given its well-earned reputation among Indian consumers. According to the Reserve Bank of India, the value of outstanding housing loans grew from 19.1% year-on- year in June 2023 to 28.7% in May 2024 – a 17.8% increase.26We believe this accelerated demand for housing credit represents a growing end market for HDFC Bank.

Beyond India, we believe that there are other pockets of alpha to be found in Asia and Latin America. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest chipmaker exemplifies the power of consistent organic growth. Chips are manufactured in a highly specialised fabrication plant – known as a foundry – with the use of increasingly complex and expensive lithography equipment.

Since its creation in 1987, TSMC has focused its efforts on manufacturing chips designed by developers, including Apple and Nvidia. This targeted business model has enabled the company to serve a wide variety of customers, cut costs, optimise their production process and fuel organic growth. Due to its scale, TSMC is one of a handful of companies in the world with enough cash, technical skills and R&D capacity to build the most advanced chips. TSMC’s ability to spend and reinvest their profits is an enormous advantage over challengers.

Mercado Libre, Latin America’s largest e-commerce platform, is another emerging market company that has benefitted from technology, scale and innovation. Founded over twenty years ago in Buenos Aires, the company delivers goods throughout the region through its own logistical networks.

Although e-commerce has generally lagged in emerging markets compared to developed economies, there has been a surge in demand since the COVID-19 pandemic. The company’s organic growth has also allowed it to move into an adjacent market: financial services. Although 74% of Latin Americans have access to banking services (up from 55% in 2017), 26% of the population remains unbanked.27Mercardo Libre has been able to leverage its competitive moats, including strong relationships with merchants and consumers, to launch its own fintech platform, Mercado Pago. Unlike regional banks, Mercado Libre can tap into years of consumer data to offer loans, insurance and other financial instruments for their consumers and merchants.

At Comgest, we focus on quality growth, over the long term. We are unconstrained by geographies, sector allocations or macro-economic developments, choosing instead to focus on company-specific drivers of growth. The recent U.S. equities rally has been driven by companies with strong sales and profit margins driving outsized EPS growth – not macro dynamics.

In our view, the U.S. market does not have a monopoly over the competitive advantages and qualities that form the foundation of durable quality growth companies. If you know where and how to look, there are non-U.S. companies that possess the fundamentals we seek at Comgest: competitive advantages, high barriers to entry and pricing power which we believe makes them capable of sustainably growing their earnings – irrespective of the economic cycle or macro environment.

While international equities certainly present compelling valuation opportunities, it is equally important to see their growth potential improving as well. By trusting in the importance of EPS growth, we are confident that there are several undervalued companies outside of the U.S. with promising growth trajectories.

1 Includes Apple, Tesla, Microsoft, Nvidia, Alphabet, Meta and Amazon.↩︎

2 U.S. Federal Reserve: https://www.federalreserve.gov/boarddocs/hh/2000/february/ReportSection2.htm↩︎

3 Reyes-Heroles, Ricardo, Sharon Trailberman and Eva Van Leemput (2020). Emerging Markets and the New Geography of Trade: The Effects of Rising Trade Barriers. International Finance Discussion Papers 1278. https://www.federalreserve.gov/econres/ifdp/files/ifdp1278.pdf.↩︎

4 Goldman Sachs: https://www.goldmansachs.com/our-firm/history/moments/2001-brics.html↩︎

5 The complete history of our Global ex-US portfolio is available upon request.↩︎

6 Approximated based on internal estimations of underlying investments using available disclosures.↩︎

7 Excludes the United Kingdom.↩︎

8 The GRANOLASinclude GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L’Oréal, LVMH, AstraZeneca,↩︎

9 ASML, History: https://www.asml.com/en/company/about-asml/history↩︎

10 Clark, Don. The Tech Cold War’s ‘Most Complicated Machine’ That’s Out of China’s Reach. The New York Times, 24-May-2024 (subscription).↩︎

11 Source: Pernod Ricard, “Our History.” Accessed 31-Oct-2024.↩︎

12 Source: Pernod Ricard Integrated Annual Report FY23.↩︎

13 Rumney, Emma. “Spirits Set to Overtake Wine as Global Drinking Habits Change.” Reuters, 10-Jul-2024.↩︎

14 Source: “The Champagne production method.” Pernod Ricard, 12-Apr-2015.↩︎

15 Vidalon, Dominique. “Pernod Ricard eyes more price hikes in second half, confident on China” Reuters,16- Feb-2023.↩︎

16 Source: Eurostat, Quarterly national accounts – GDP and employment Amid recent political uncertainty and the ongoing debate between value and growth investing, Japan remains a market that has long been overlooked by investors. Despite its aging demographic profile, Japan has managed to battle deflation and transform its challenges into new opportunities through improved efficiency and automation. Over the past few years, Japanese corporations have been prioritising improved governance and shareholder needs against a weaker yen. With a wealth of companies exhibiting similar growth drivers to their U.S. counterparts, Japan presents an enticing investment opportunity for foreign investors.17↩︎

17 Read our investment letter on “Japan Equities: Dawn of a New Golden Era?”.↩︎

18 Source: Hoya, “History.” Accessed 31-Oct-2024.↩︎

19 Source: Hoya, “Business Domains.” Accessed 31-Oct-2024.↩︎

20 Source: Hamamatsu, “Why Hamamatsu?” Accessed 31-Oct-2024.↩︎

21 Pilling, David. “Lunch with the FT: Tadashi Yanai.” Financial Times, 20-Sep-2013.↩︎

22 McLymore, Arriana. “Fast Retailing’s Uniqlo to Add Stores in North America.” Reuters, 26-Apr-2023.↩︎

23 Source: Fast Retailing Inc. https://www.fastretailing.com/eng/ir/library/pdf/ar2022_en_03_sp.pdf↩︎

24 Source: Comgest’s analysis, company data, Statista *Data as of 31-Mar-2024.↩︎

25 Shukla, Prateek. “IMF’s Gita Gopinath Says India Could Become 3rd Largest Economy by 2027.” Business Standard, 16-Aug-2024↩︎

26 Reserve Bank of India. Sectoral Deployment of Bank Credit– May 2024, 28-Jun-2024..↩︎

27 Source: World Bank, World Bank Global Findex Database 2021.↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

Not an investment recommendation No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Trademark and index disclaimer Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

S&P Dow Jones Indices LLC (“SPDJI”). S&P is a registered trademark of S&P Global (“S&P”); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest’s fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

Information provided subject to change without notice All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest Italia is the Italian branch of Comgest Asset Management International Limited, enrolled in the Milan Companies Register with no. MI-2587566 and in the CONSOB register with no. 191. Its registered office is at Via Del Vecchio Politecnico 9, 20121, Milan, Italy.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.