You are visiting United States

If this is incorrect,

06-Feb-2025

What distinguishes the US as the world's strongest stock market? While many point to its leading technology, research facilities and abundant natural resources, Comgest believes that the true driver of US growth is its labour productivity. Our US Equities strategy aims to harness this efficiency by focusing on the companies that achieve more with fewer resources.

Over the past decade, the US stock market has consistently outperformed its international counterparts. Since 2014, the S&P 500 index of largecap US companies has generated 12.5% annualised returns, outpacing the 4.4% achieved by the MSCI World ex USA index. 1In the past year alone, the S&P 500 surged by 24.5% - marking the fourth time since 2019 that the index has achieved gains exceeding 20%. 2From our perspective, recent US outperformance is due to a wide variety of factors, including the country’s entrepreneurial spirit, sophisticated research infrastructure, top-tier education system, respect for the rule of law, and abundant natural resources.

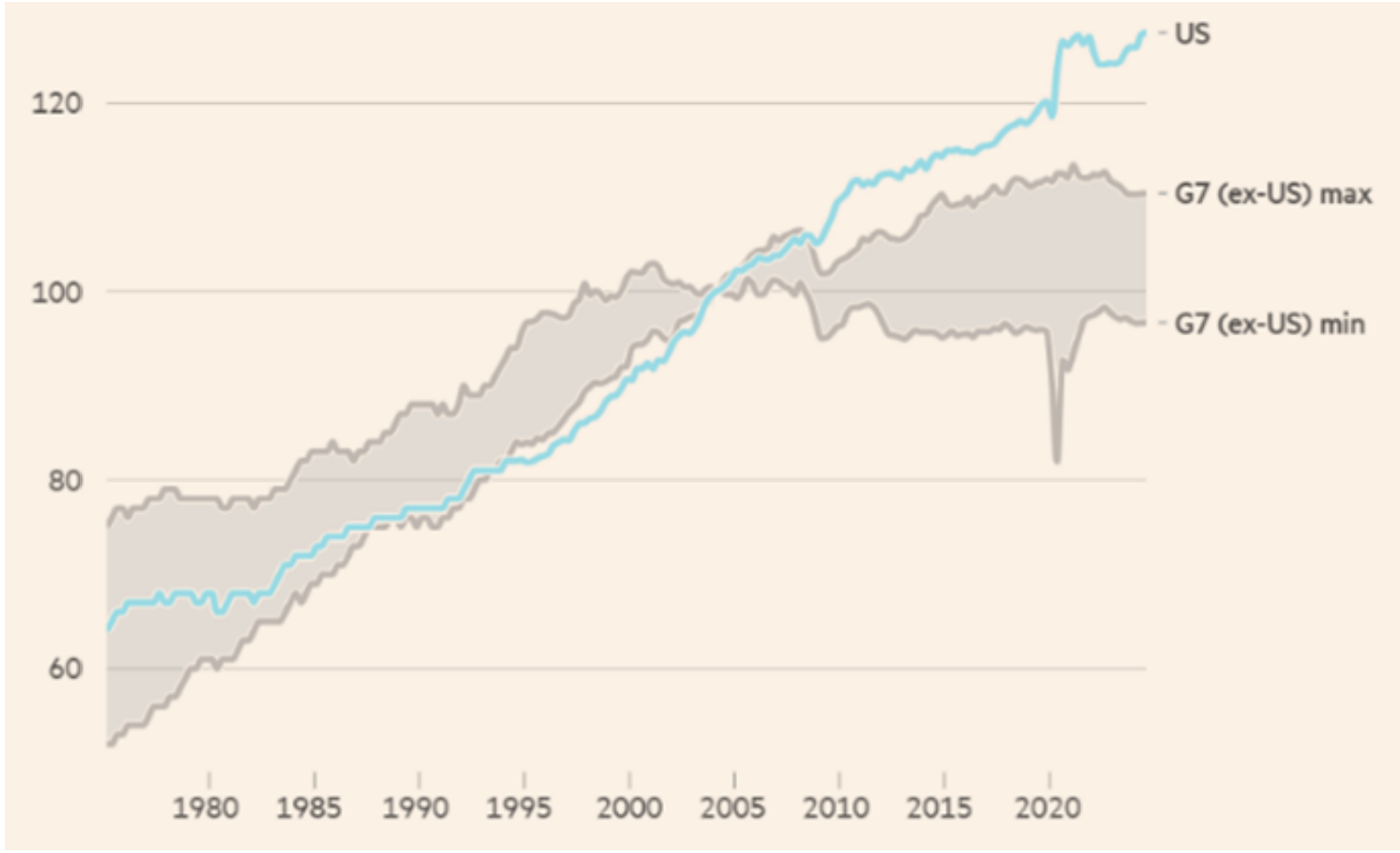

Output per hour worked, rebased (100 = Feb 2004)

Source: Financial Times, OECD, LSEG, National Statistics as of December 2024.

In our view, a critical yet often overlooked driver of US outperformance is the country’s labour productivity rate. Between 1995 and 2019, US labour productivity per hour worked increased by 50%, or the equivalent of 2.1% annually. 3For comparison, the eurozone’s labour rate increased by 28%, or 1% annually, over the same period. 3Following the COVID-19 pandemic, the US has widened its labour productivity advantage over the rest of the “Group of Seven” (G7) countries (see figure 1). 4Between the fourth quarter of 2019 and the second quarter of 2024, labour productivity in the US increased by 6.7% compared to just 0.9% in the European Union. 5Amid declining global birth rates and population growth, we regard US labour productivity as a fundamental sign of economic resilience, which underscores our belief that the US economy is still capable of thriving.

Consistent with this outlook, our Comgest US Equities strategy seeks “productivity enhancers,” or companies that offer better products at lower costs, use fewer resources and are “all-weather performers” that provide critical services to consumers, such as healthcare and software.

At Comgest, our focus remains steadfast on identifying those companies with strong fundamentals and enduring competitive advantages that we believe can achieve our goal of delivering long-term, consistent returns to our clients.

President Trump’s return to the White House – with pledges of tax cuts and deregulation – alongside the rise of artificial intelligence (AI) has fuelled investor optimism for a sustained US stock rally in 2025. 6However, we contend that investment decisions should not be swayed by political rhetoric or the performance of specific sectors, such as AI.

Whether it’s the construction industry or robotic medical procedures and animal healthcare, the vast US market offers a multitude of growth opportunities, including those beyond the Magnificent Seven. 7

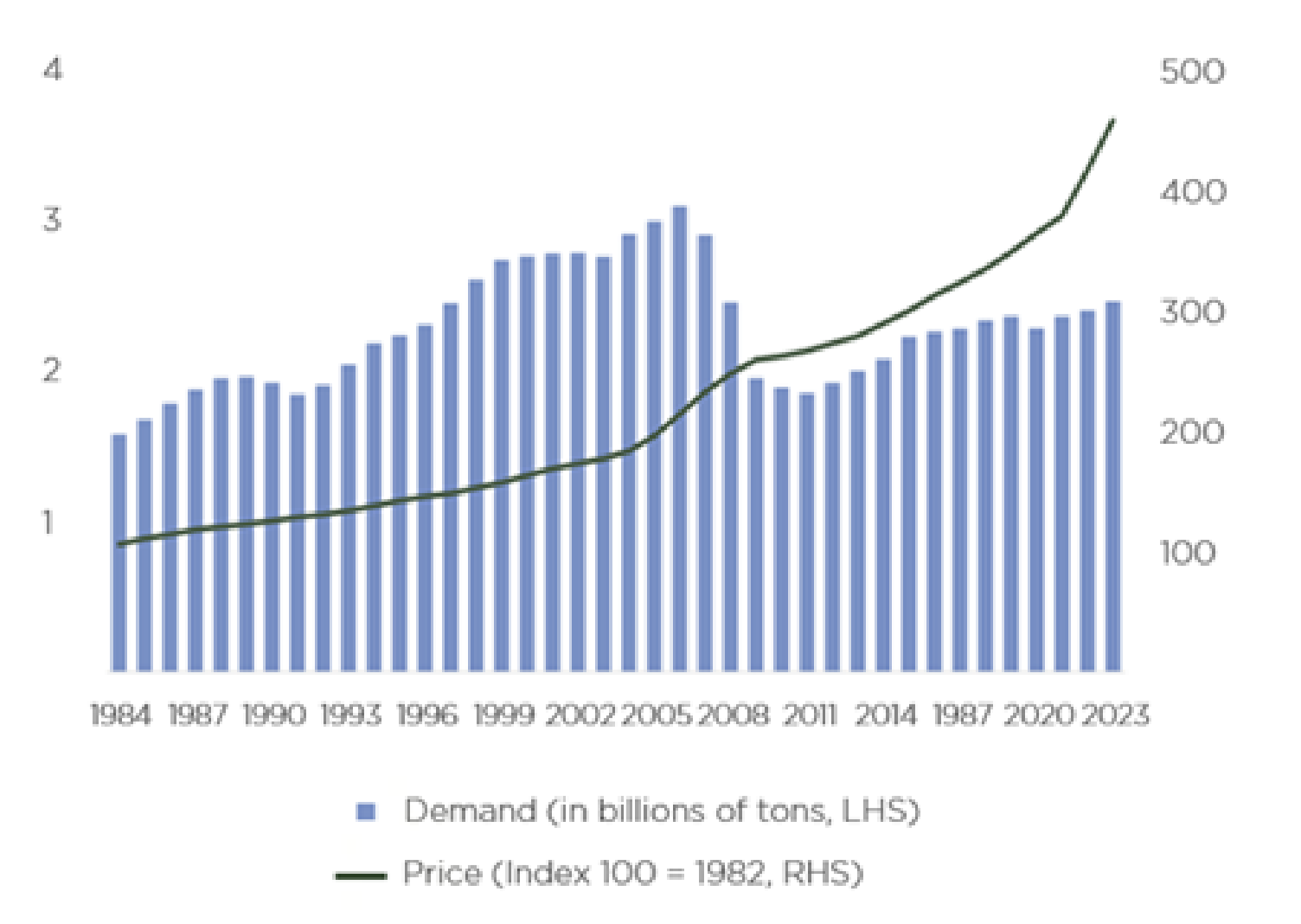

Source: Vulcan Materials Company Q3 2024 Earnings Call report, Comgest, as of 30-Oct-2024.

Source: Vulcan Materials Company Q3 2024 Earnings Call report, Comgest, as of 30-Oct-2024.

After generations of neglect and disrepair, the US infrastructure network – roads, railways, airports and bridges – has come under enormous pressure and lags other industrialised countries. In 2021, the American Society of Civil Engineers gave the US a “C minus” for infrastructure, citing poor roads, deficient aviation infrastructure and an ageing electrical grid. 8One in three bridges need to be replaced or repaired, and 20% of all airport arrivals and departures are delayed due to overwhelmed airports. 9In the face of these challenges, there has been growing investment and bipartisan support for revitalising the country’s infrastructure.

At the same time, international and domestic migration patterns are likely to put even more pressure on America’s outdated infrastructure network. Between 2023 and 2024, the US population grew by nearly 1.0%, marking the fastest population growth since 2001, driven by a surge in net international migration. 10

States in the American South and West, such as Florida, Texas, Nevada, and Utah, are among the nation’s fastest growing. 10

We believe that these challenges present opportunities for long-term investors, especially companies in the construction industry. In our view, Vulcan Materials Company, the largest producer of construction aggregates (materials like sand, gravel, and crushed stone used in construction projects), is well positioned to take advantage of these growing infrastructure needs. Founded in 1909 in Birmingham, Alabama, the company controls several indispensable transportation routes by barge, train and bus. 11Vulcan Materials has a notable presence in the American South and West, including 35 of the most rapidly expanding cities in the country. 12With the rise of AI, Vulcan Materials has also been involved in the construction of data centres and factories. The company has also capitalised on reshoring (the return of manufacturing to domestic shores), alongside the growth of renewable energy solutions. 13

Output per hour worked, rebased (100 = Feb 2004)

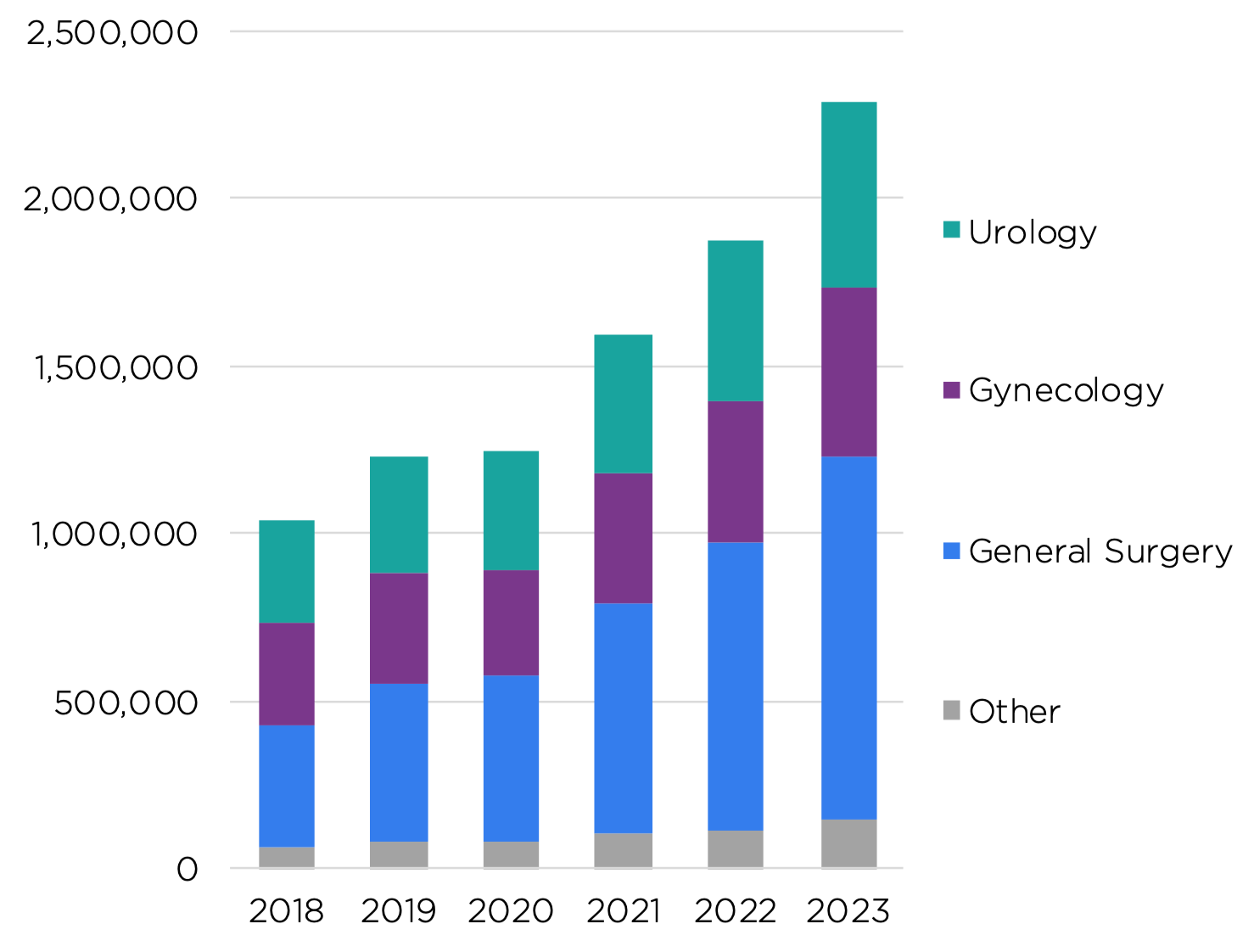

Source: Intuitive Investor Presentation, October 2024.

With more people around the world living longer, there has been an uptick in medical operations. Between 2018 and 2023, medical operations and surgeries increased year-over-year by 22% (as shown in figure 3). 14Intuitive Surgical manufactures tools capable of assisting doctors with surgeries and offers patients the ability to conduct operations from the comfort of their homes. The company’s robots, including the Da Vinci surgical machine, offer patients minimally intrusive surgeries, leading to fewer surgical complications and faster recovery times. 15

Based on our investment process, we believe that Intuitive Surgical has the characteristics that align with our Quality Growth approach as well as the type of “productivity enhancers” that we seek when constructing our Comgest US Equities portfolio. From our perspective, the company’s tools present a win-win-win solution for hospitals, patients and the wider healthcare system. Aside from providing better patient comfort and recovery, we believe that Intuitive Surgical’s tools can free up hospital beds and secure cost savings for healthcare systems by enabling at-home surgeries.

The world’s ageing population suggests a future decline in the number of doctors, nurses, and qualified medical professionals. The Association of American Medical Colleges (AAMC) projects a shortage of up to 86,000 physicians in the US by 2036. 16Currently, 20% of the US clinical physician workforce is older than 65, the typical retirement age, and 22% are nearing retirement, aged between 55 and 64. From our perspective, Intuitive Surgical’s products can help healthcare systems maximise the productivity of fewer doctors and address the shrinking supply of qualified medical professionals.

Since 2020, the company’s robot install base has increased by 14% annually, indicating that doctors are increasingly embracing roboticassisted surgery (as shown in figure 4). 17In addition, the company has demonstrated consistent revenue growth from operational leases, services and accessory sales, with 83% of revenue being recurring in 2023. 17As long-term quality growth investors, we value the visibility and consistency of this revenue growth over time.

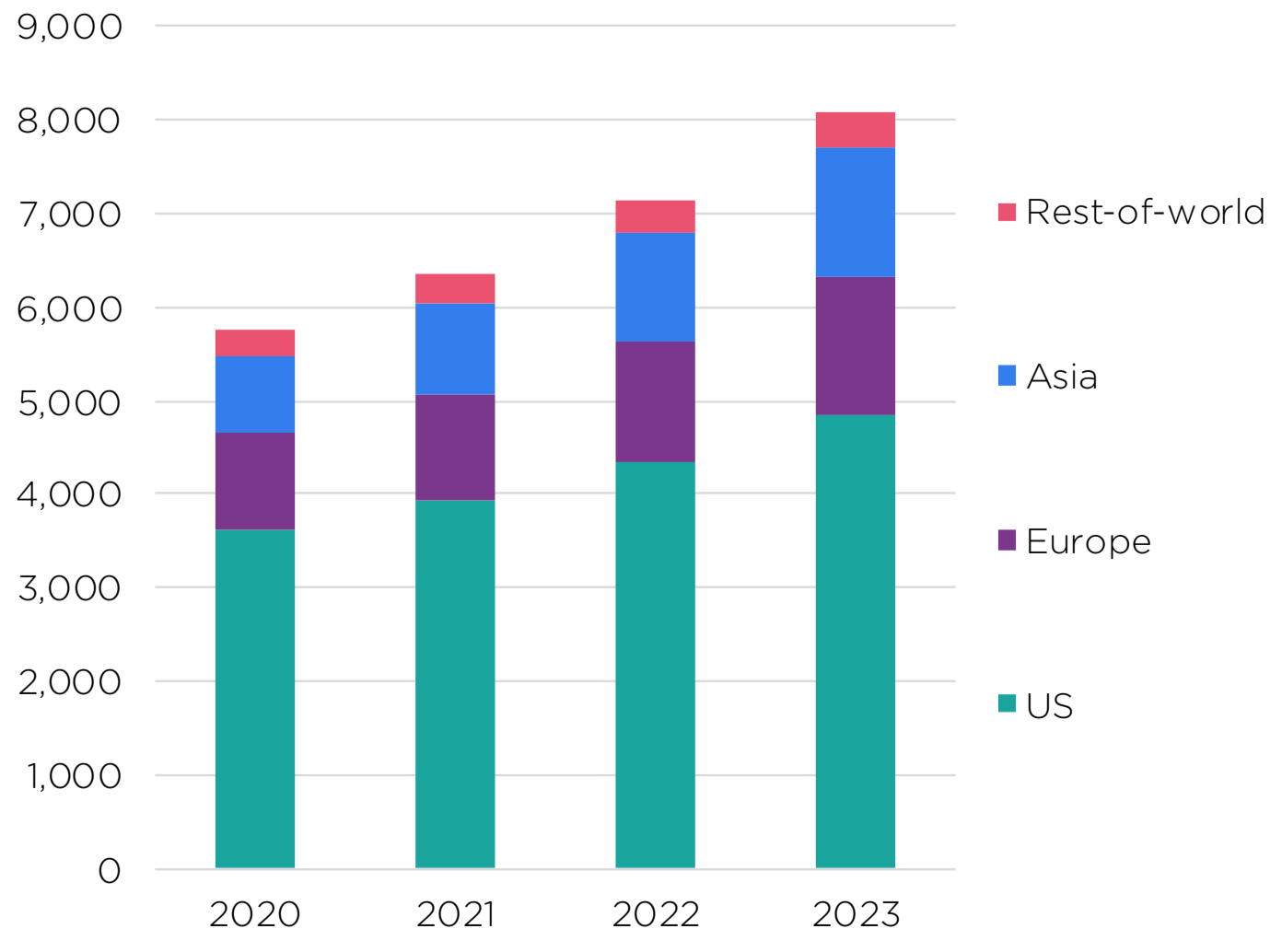

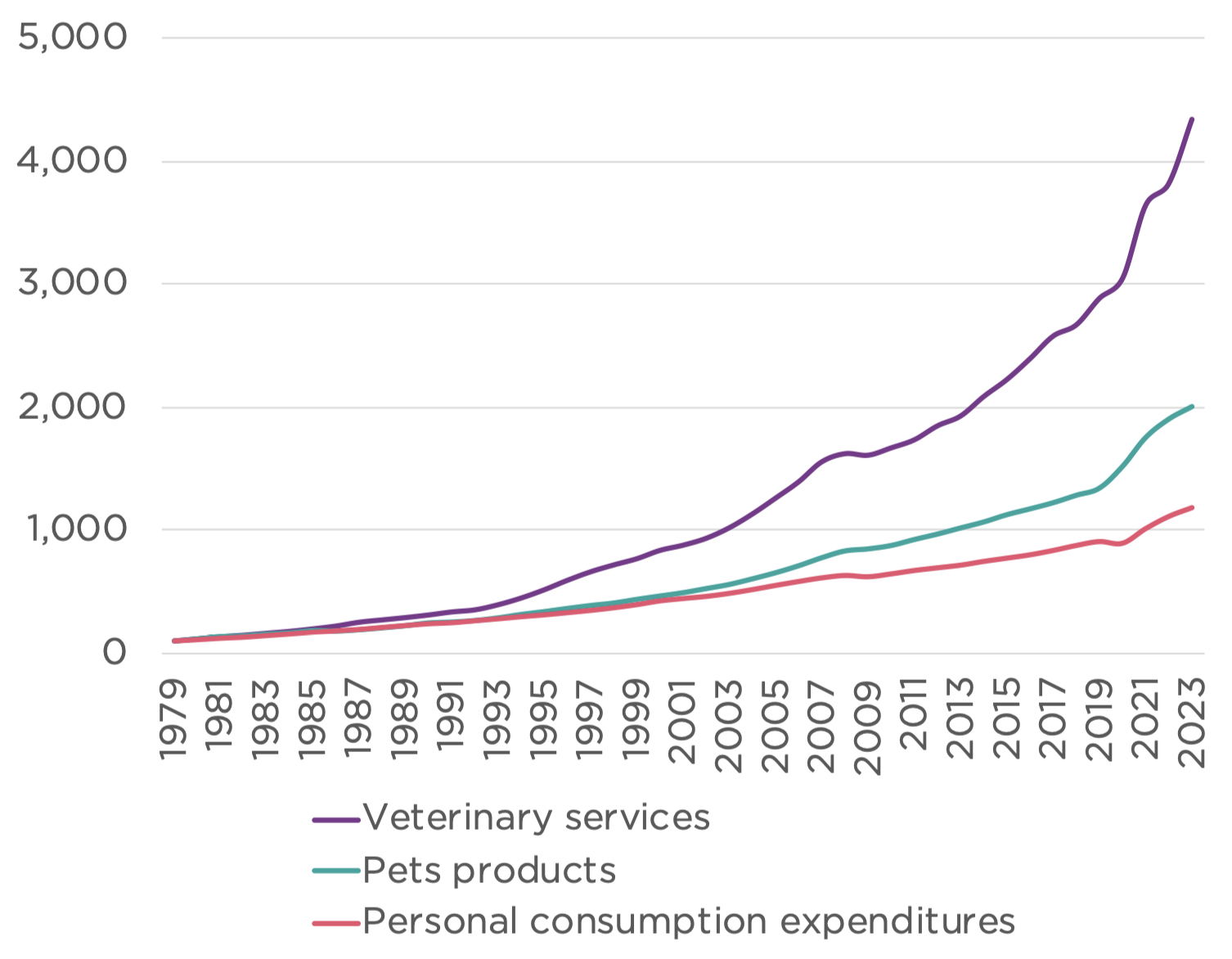

While marriage and birth rates are declining globally 19, there has been an increase in pet ownership. In the US, 66% of Americans owned at least one pet in 2023, up from 56% in 1988. 20Over 90 million households (46%) in the European Union own a pet. 21Meanwhile, in China, the number of pets is expected to double the number of toddlers by 2030. 22Many “pet parents” consider their pets to be the equivalent of children and are willing to spend significantly on food, accessories and veterinary services for their “fur babies” (as shown in figure 5). 23

Zoetis, the world’s largest producer of medicine for pets and livestock, is improving animal health outcomes. As with other pharmaceutical companies, Zoetis has leveraged research and development to produce medicines aimed at addressing animal diseases and medical conditions. 24The company’s approach to innovation has led to a wide variety of medical advancements in treating pain, cancer, heart disease and other life-threatening conditions. 25In addition to R&D, we believe that the company possesses deep commercial and manufacturing advantages over competitors in this industry.

Source: Zoetis, Comgest as of 30-Nov-2024.

Over the years, Zoetis has built enduring relationships with veterinarians, farmers and other key suppliers of animal health medication around the world. The company receives invaluable feedback from these suppliers, which is useful in developing the next generation of animal medical treatments. On the manufacturing front, Zoetis controls its entire supply chain with facilities across the United States, Europe and Asia, which we believe serves as a shield against macroeconomic uncertainty.

As long-term investors, we adhere to the principle that patience is the key to unlocking value creation. Although these sectors – infrastructure, healthcare and pet health – may lack the allure of AI, we believe that they offer long-term growth opportunities. Our investment strategy, grounded in bottom-up research, seeks companies with enduring competitive advantages and sustainable earnings growth. Rather than constraining ourselves to certain sectors and trends, we instead choose to focus on a company’s resilience, efficiency and growth potential over long run.

Economic cycles will come and go, but we maintain confidence that certain characteristics of the US market, including labour productivity, are likely to remain. Comgest’s investment approach is predicated on a long-term horizon: we aim to hold our investments indefinitely and expect them to demonstrate consistent growth. From this perspective, we believe that companies like Vulcan Materials, Intuitive Surgical, and Zoetis possess the strong fundamentals, competitive advantages and resilience that will see them go the distance, regardless of market conditions.

1 Comgest / FactSet as of 10-Jan-2025 ↩︎

2 Steer, George. “ US Stocks Soar More than 20% for Second Year in a Row.” Financial Times, 31-Dec-2024. ↩︎

3 Da Silva et al. “ Labour Productivity Growth in the Euro Area and the United States: Short and Long-Term Developments.” European Central Bank, 23-Sept-2024. ↩︎

4 The G7 is an informal group of the world’s most advanced economies, including Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. ↩︎

5 Da Silva et al. “ Labour Productivity Growth in the Euro Area and the United States: Short and Long-Term Developments.” European Central Bank, 23-Sept-2024. ↩︎

6 FT Editorial Board. “ Will US markets keep rising under Trump?” Financial Times, 7-Jan-2025. ↩︎

7 Includes Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. ↩︎

8 “ ASCE’s Infrastructure Report Card Gives U.S. ‘C-’ Grade, Says Investment Gap Trillion, Bold ActionNeeded.” ASCE American Society of Civil Engineers, 3-March-2021. ↩︎

9 “ ARTBA Bridge Report.” ARTBA, 20-Aug-2024. ↩︎

10 “ NET International Migration Drives Highest U.S. Population Growth in Decades.” US Census Bureau, 20-Dec-2024. ↩︎

11 “ About Vulcan” Vulcan Materials. Accessed 13-Jan-2025. ↩︎

12 “ Enhance Our Core, Expand Our Reach - 2023 Annual Report.” Vulcan Materials Company. Accessed 13-Jan-2025. ↩︎

13 “ Vulcan and Stellantis in Joint Project to Develop Geothermal Renewable Energy to Supply Mulhouse Plant in France.” Stellantis, 31-May-2023. ↩︎

14 Intuitive Investor Presentation Q3 2024↩︎

16 “ New AAMC Report Shows Continuing Projected Physician Shortage.” Association of American Medical Colleges, 21-Mar-2024. ↩︎

17 Intuitive Investor Presentation Q3 2024↩︎

19 " The Lancet: Dramatic Declines in Global Fertility Rates Set to Transform Global Population Patterns by2100.” Institute for Health Metrics and Evaluation, 20-Mar-2024. ↩︎

20 “ Pet Population Continues to Increase While Pet Spending Declines.” American Veterinary Medical Association, 10-Oct-2024. ↩︎

21 “ New FEDIAF Facts & Figures Highlights the Growth of European Pet Ownership.” FEDIAF, 22-Jun-2022. ↩︎

22 Ying Shan, Lee. “ China Will Have Nearly Twice as Many Pets as Young Children by 2030, Goldman SachsSays.” CNBC, 9-Aug-2024. ↩︎

23 Baker, Linda. “ Are We Loving Our Pets to Death?” The New York Times, 22-Jun-2024. ↩︎

24 “ 2023 Zoetis Annual Report.” Zoetis, 31-Dec-2024. ↩︎

25 “ Zoetis Animal Health Research & Development.” Zoetis. Accessed 29-Jan-2025. ↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised. This letter contains certain forward-looking statements, opinions and projections that are based on the assumptions and judgments of Comgest and the Strategy with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Comgest or the Strategy. Other events which were not taken into account in formulating such projections, targets or estimates may occur and may significantly affect the returns or performance of any Strategy managed by Comgest. Because of the significant uncertainties inherent in these assumptions and judgments, you should not place undue reliance on these forward-looking statements, nor should you regard the inclusion of these statements as a representation by Comgest that the Strategy will achieve any strategy, objectives or other plans. For the avoidance of doubt, any such forward looking statements, opinions and/or assumptions.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by JPX Market Innovation & Research, Inc. or affiliates of JPX Market Innovation & Research, Inc. (hereinafter collectively referred to as "JPX") and JPX owns all rights and know-how relating to TOPIX such as calculation, publication and use of the TOPIX Index Value and relating to the TOPIX Marks. S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index. MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages ( www.mscibarra.com).

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).