You are visiting United States

If this is incorrect,

01-Apr-2025

L'Oréal's former headquarters building in Paris.

Image source: L'Oréal corporate website

Sustaining a business over the long term is no easy task. In the United States, more than half of all new businesses fail within five years, and only a quarter survive beyond 15 years, according to the U.S. Small Business Administration.1Few companies manage to endure for centuries.2Take L’Oréal, for example, the French beauty giant has been in operation for over 110 years. In a previous white paper, we explored the concept of Lindy’s Law3, which theorises that the longer a company survives, the more likely it is to continue to thrive. We observed that, as companies endure, their competitive moats typically strengthen, enabling them to sustain growth and navigate future challenges. We refer to these companies as "marathon runners," as they go the distance, forming the bedrock of the returns we generate for our clients.

In this paper, we expand upon our previous discussion by examining the characteristics that enable global companies to survive and thrive over decades and centuries. While the financial theory might suggest otherwise, our experience as professional investors tells a different story.4By conducting years of research, Comgest’s analysts seek to identify the factors that separate marathon runners from the rest of the pack. We have found that the success of these companies is not confined to a specific sector or region. Any company with the right traits—such as strong free cash generation, smart capital allocation, diversification, global reach, crisis resilience, and unique corporate culture—can achieve marathon runner status and perpetuate growth for generations to come.

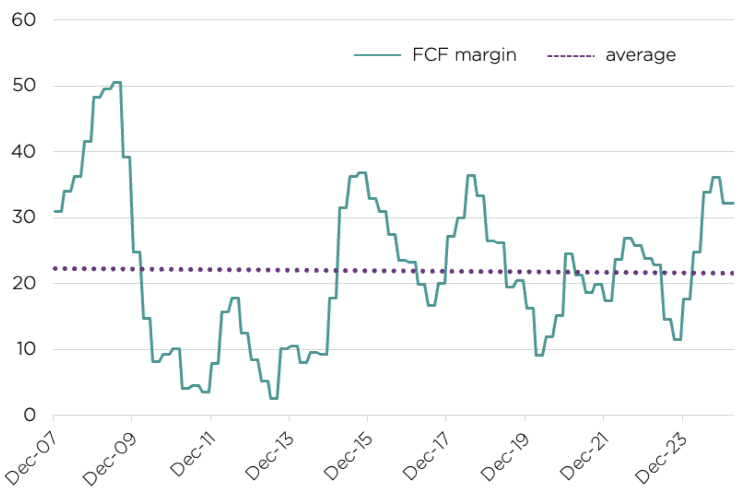

Marathon runners typically maintain substantial cash reserves and generate significant annual free cash flow. At first glance, this might sound inefficient—after all, excess cash can dilute the high capital returns of marathon runners. As investment professionals, however, we believe that cash can enhance business resilience by offering the flexibility to pursue new growth avenues, regardless of capital market conditions. Consequently, companies with weak cash credentials are unlikely to achieve marathon runner status.

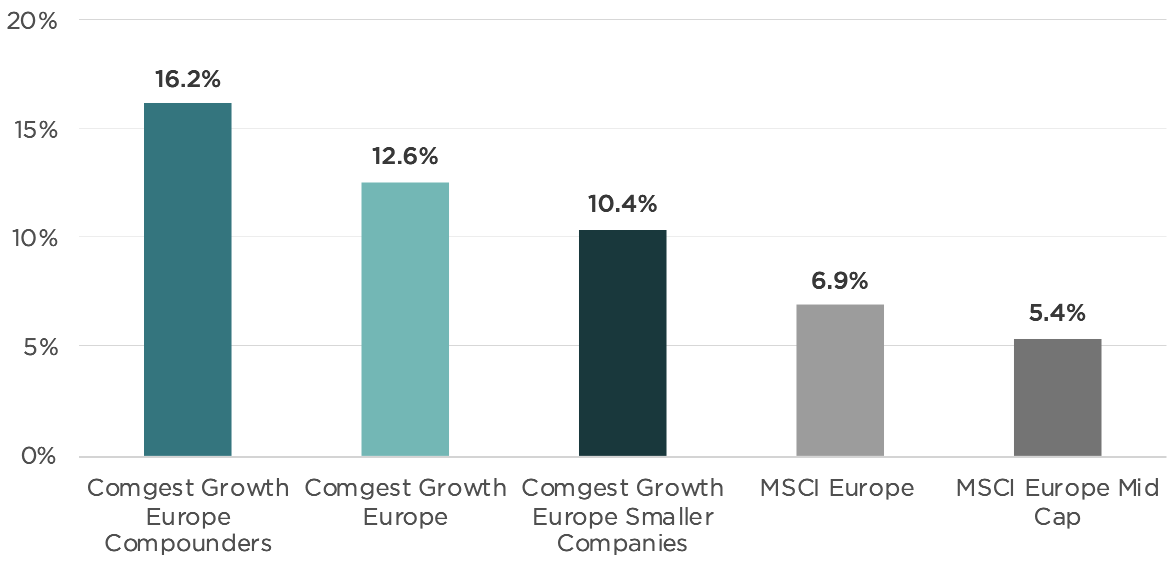

Within our product range, we believe that our Compounders equity strategies—Europe, Global and Japan—demonstrate an important link between marathon runners and cash generation. Launched in December 2019, our Europe Compounders Equity strategy (Europe Compounders)— fully dedicated to marathon runners—leads our product range with its robust free cash flow profile (as shown in figure 1).

Source: Comgest, FactSet per 31-Dec-2024. * Free cash flow margin is defined as free cash flow divided by sales.

Just like a top marathon runner strategically hydrates and refuels with carbohydrates to sustain endurance, a successful company knows where and when to invest its cash to drive long-term growth. At Comgest, we prioritise the visibility of organic growth, which we believe is foundational for the longevity of our marathon runners. In our view, M&A provides valuable insights into the capital allocation skills of companies. Since 70% to 75% of M&A deals end in failure,5the rarity of their success makes them an ideal litmus test for identifying marathon runners. M&A failures can stem from clashing corporate cultures, assets too big to integrate or management’s blind focus on earnings per share (EPS) accretion. However, we believe that marathon runners possess the required integration and execution skills to mitigate these risk.

The M&A market tends to be pro-cyclical, with acquisition opportunities increasing during periods of elevated equity market valuation, which tends to be the worst time to buy due to the risk of overpaying. Successful M&A requires patience, focusing not on capital markets or short-term EPS considerations, but on long-term value generation. Marathon runners, backed by strong cash reserves and a disciplined, long-term mindset, are better positioned to resist market-driven pressures and act when the right opportunity arises.

Source: L'Oréal website

Source: L'Oréal website

We consider “transformational M&A,” or attempting to transform a company through an extraordinarily large deal, as particularly risky.

In our view, a successful growth company—a marathon runner—is unlikely to take such a risk. In 2016, we sold our position in the German pharmaceutical and agrochemical company Bayer. Why? The company’s decision to buy the American agrochemical business, Monsanto. The deal should have transformed Bayer into a global leader in crop and life sciences. Eight years later, however, it mired the company in debt and ongoing legal battles. In hindsight, the Monsanto acquisition revealed that Bayer was not a marathon runner.

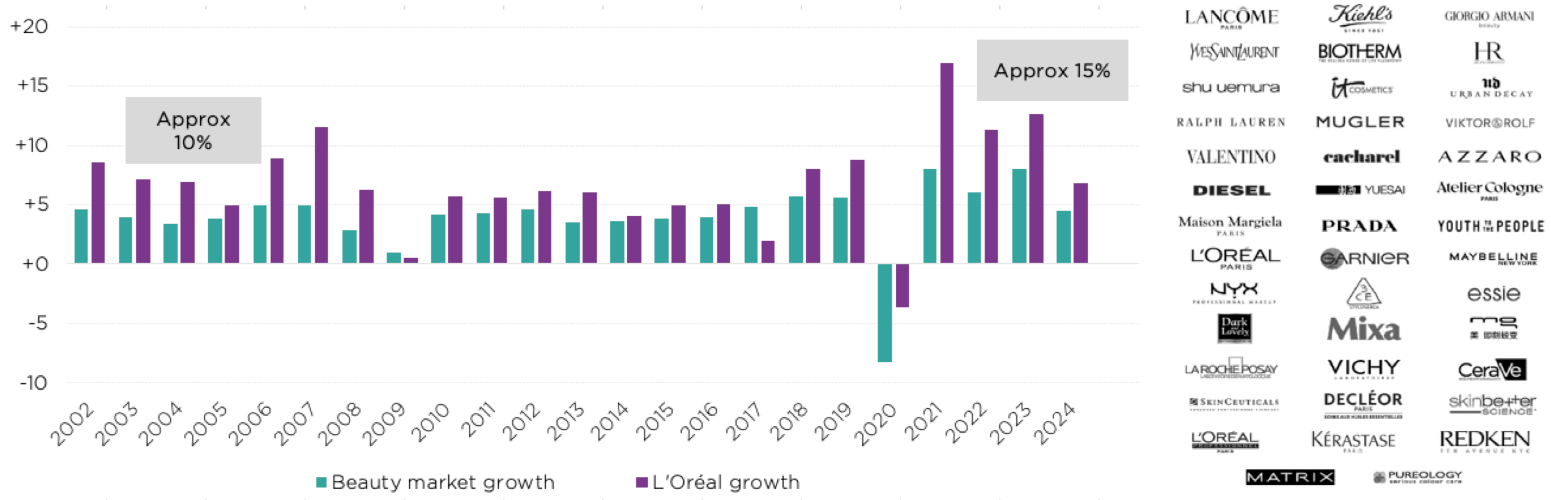

The failure of transformational M&A can sometimes provide a marathon runner with an opportunity to deploy its cash wisely. This is clearly demonstrated by the M&A strategies of Brazilian cosmetics company Natura and French beauty giant L’Oréal. Natura, grappling with years of declining sales in its home market, embarked on a series of transformational acquisitions, purchasing The Body Shop in 2016 and Avon Products in 2019. These deals more than doubled the company’s total sales and boosted international revenue.6However, this aggressive expansion also tripled the company’s net debt.7Integration issues and spiralling refinancing costs culminated in Natura’s decision in 2023 to sell its crown jewel, the luxury brand Aēsop, to stabilise its balance sheet.8

Under pressure to divest, Natura found a buyer in L’Oréal, which seized the opportunity with a strategic €2.5 billion all-cash offer—minimising its risk of overpaying.9This demonstrates that value creation in M&A starts with the right timing and pricing—principles that marathon runners cherish. The scale and global footprint of marathon runners, such as L’Oréal, offers significant opportunities to generate the springboard for future M&A synergies. The company’s acquisition of Aēsop was motivated by the opportunity to globalise a luxury brand through L’Oréal’s wellestablished operating and distribution model.10By expanding into new regional markets, L’Oréal has a long runway for organic growth (as shown in figure 2).

Source: L’Oréal, data as of 13-Mar-2025. The security discussed above is provided for information only, is subject to change and is not a recommendation to buy or sell the securities. The security discussed herein may not be held in the portfolio at the time you read this paper.

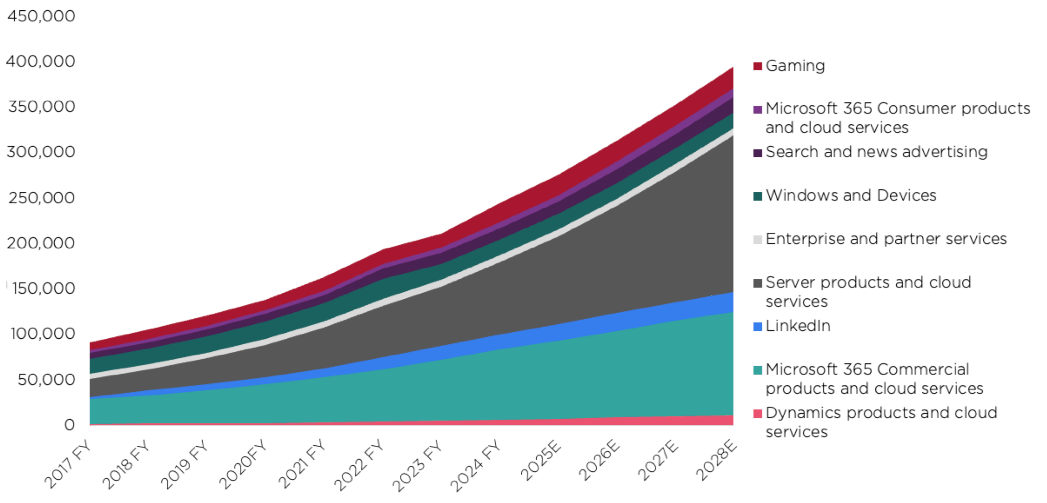

Similarly, Microsoft’s $26 billion acquisition of LinkedIn in 2016 underscores the critical role of synergies and substantial cash reserves in making M&A deals successful.11The tech giant’s $100 billion pot of cash dwarfed that of Salesforce, which had also been vying for the social media platform.12Post-acquisition, Microsoft has utilised LinkedIn’s network to broaden its customer base for its cloud services. By 2023, LinkedIn’s sales had tripled to $15.7 billion, making a valuable contribution to Microsoft’s organic growth trajectory.13

Source: Microsoft/Comgest, data as of March 2025. For illustrative purposes only. The security discussed herein may not be held in the portfolio at the time you receive this presentation. The security discussed is provided for informational purposes only, is subject to change and does not constitute a recommendation to buy or sell the securitiy.

For marathon runners, like L’Oréal and Microsoft, M&A deals serve as new sources for organic growth to further strengthen their market-leading position. These compounder companies leverage their size and reach to generate synergies—advantages that smaller players can only aspire to.

In this “winner takes all” scenario, success depends on the patience, scale, culture, cash and execution capacity of marathon runners. Rather than high-risk, “make-or-break” decisions, these companies focus on strategic initiatives that fuel organic growth and diversify revenue across new regions, sectors and brands. This approach is how marathon runners can perpetuate their growth over time.

While M&A can serve as the litmus test, the companies we select for our Comgest Compounder strategies must, above all, demonstrate a track record of sustained organic growth. Leveraging their cash, marathon runners can fuel organic growth by investing in a wide variety of areas, including research and development (R&D), technologies, brands and sales channels. We believe these investments can strengthen a company’s scale and size while also building “competitive moats”—high barriers to entry— that hinder competitors from challenging their market position.

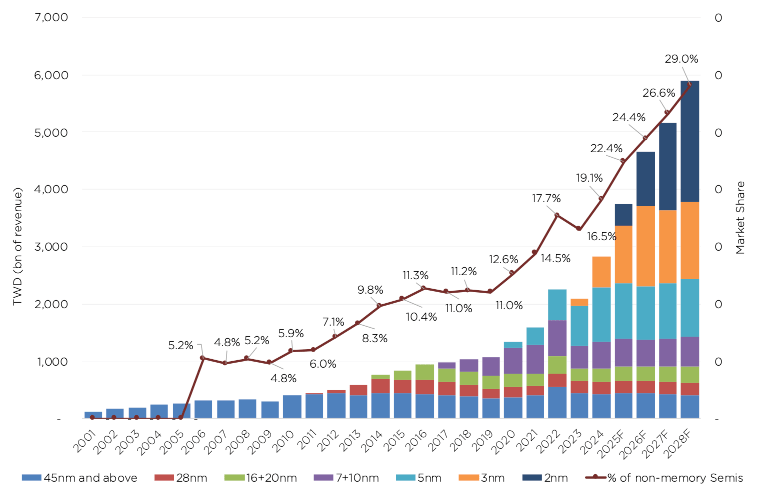

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest chipmaker manufacturer, exemplifies why sustained organic growth matters for marathon runners. The global semiconductor industry is in a race to create smaller, more sophisticated chips to power everything from phones to cars and datacentres.14Chips are manufactured in a highly specialised fabrication plant, known as a foundry, using increasingly complex and expensive lithography equipment. Since its creation in 1987, TSMC has focused its efforts on manufacturing chips designed by developers, including Apple and Nvidia. This targeted foundry business model has enabled TSMC to serve a wide variety of customers, cut costs, optimise its production process and gain market share.15

TSMC’s trajectory highlights the importance of enduring competitive advantages. The foundry’s reliance on intricate and expensive equipment, driven by the push to minimise chip size, has led to soaring levels of industry-wide capital expenditure (CapEx). These rising costs have created formidable barriers to entry for companies lacking the financial strength and technological expertise to compete. Despite escalating CapEx demands, foundries with scale tend to generate robust free cash flow, which they reinvest to sustain growth. In a capital-intensive industry, TSMC’s share of the overall industry CapEx is a sign of strength, having grown from 10% to 34% between 2007 and 2021, strengthening its moat built on scale and technology.16Over the past three financial years combined, TSMC spent close to $90 billion on CapEx, a lead difficult for challengers to match.17

Source: Factset/Comgest, data as of 27-Mar-2025.

Source: Factset/Comgest, data as of 28-Mar-2025

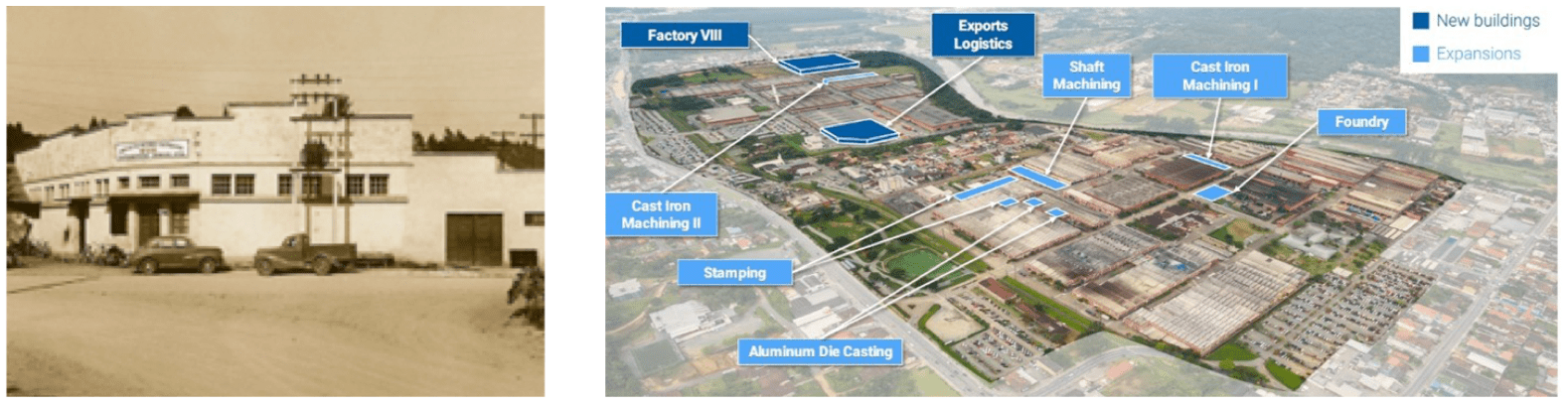

As long-term quality growth investors, we know that geographic expansion is vital to perpetuate growth. WEG, the Brazilian electric engine giant, has leveraged acquisitions to expand globally and achieve marathon runner status. Founded in 1961 as an electric motor manufacturer in the small town of Jaraguá do Sul, Brazil, the company manufactured 146 electric motors during its first year.18Today, 63 years later, the company’s original factory employs over 16,000 people and produces 19 million electric motors globally each year.19Figure 6 illustrates the remarkable growth of WEG’s original factory over six decades.20

Source: WEG corporate website - WEG’s first factory in 1964 (left) and its factory in 2023 (right).

Organic growth, however, is less about the numbers and more about setting the right pace, fine-tuning a production model and discovering the formula for success. For WEG, vertical integration—taking direct control of its production process, rather than relying upon external contractors— became key to their success. Brazil’s weak infrastructure in the 1960s led WEG to take full ownership of its supply chain.

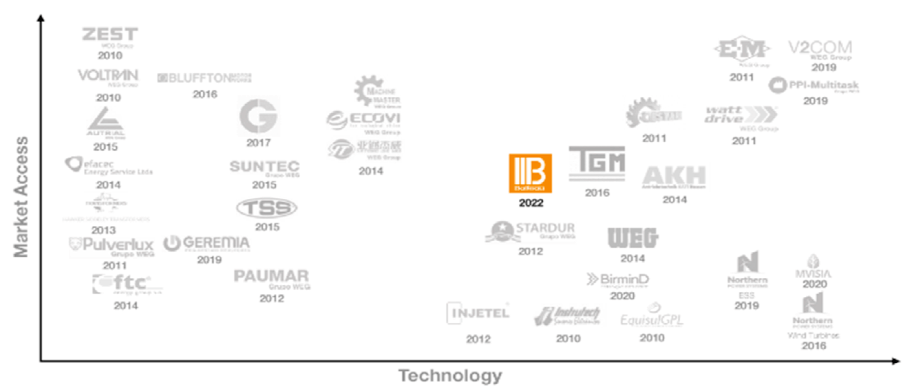

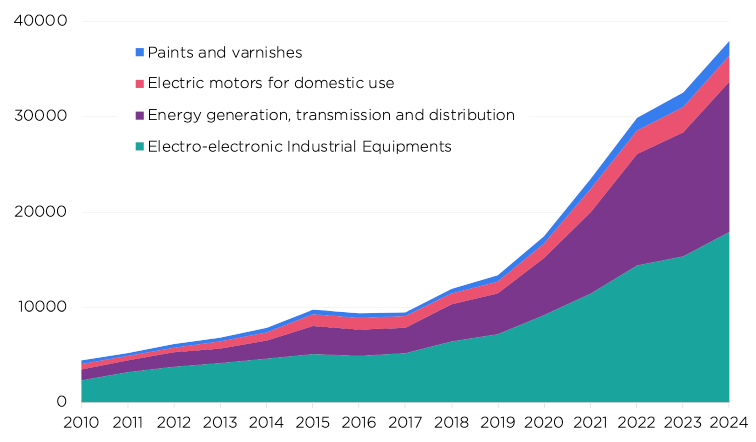

Faced with an unreliable supply chain in Brazil, WEG turned a vulnerability into a strength—a hallmark of resilient compounders. This approach has enabled the company to tailor products to local specifications and diversify into adjacent markets, including renewable and electric vehicle equipment. As shown in figure 7, the company’s strategic acquisitions fuelled its expansion, establishing it as a global one-stop shop in the electric engine value chain.

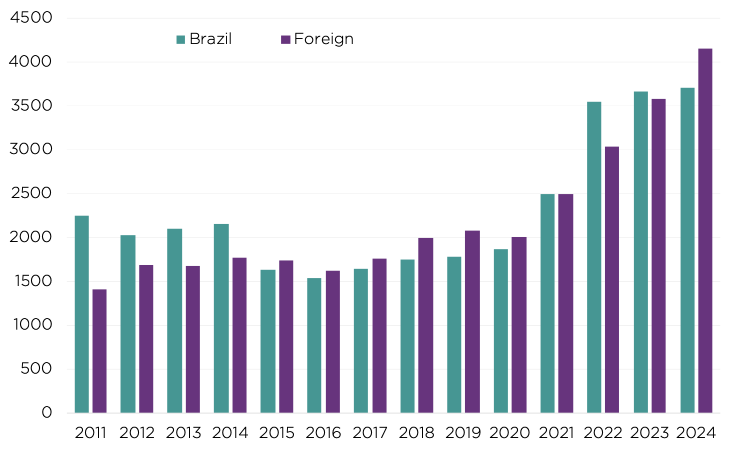

WEG achieved this through close to 30 bolt-on acquisitions in the 2010s, which gave it access to new regional and adjacent markets, including energy generation, transmission, distribution, storage and battery charging solutions. With its targeted bolt-on acquisitions, the company limited integration risks.21These acquisitions have fortified WEG’s global position in the growing electric vehicle and renewable energy sectors. Over the past decade, international markets have accounted for two-thirds of WEG’s total sales growth (see figure 9). WEG’s experience demonstrates how international expansion and expansion into adjacencies can fuel long-term growth.

Source: WEG Investor Presentation as of 31-Oct-2024.

Source: WEG Investor Presentation as of 31-Oct-2024.

Since Comgest’s inception in 1985, we have engaged with thousands of companies. From our conversations with management, competitors and customers, we believe that a company’s success is, above all, a human process. Understanding the human “fabric” that holds a company together—its corporate culture—is essential for assessing its ability to sustain long-term success and achieve marathon runner status.

Founded by French chemist Eugène Schueller in 1909, L’Oréal has thrived for over a century, starting with Schueller’ invention of hair dye for Parisian hairdressers. Schueller’s motto, “keep trying until you get it right”22, remains at the heart of the company’s culture—fuelling ongoing growth, research and innovation. Early ground-breaking beauty products like L’Oréal Blanc (hair bleach), Ambre Solaire (sunscreen oil) and Dopal (soap-free shampoo) were accompanied by pioneering marketing strategies, including building-side advertisements and radio commercials. In the 1970s, the iconic “Because I’m Worth It” (later, “Because You’re Worth It”) campaign symbolised women’s empowerment—a tagline still in use today, reflecting L’Oréal’s lasting brand strength and innovation.23

Consistency is key to a marathon runner’s success, and for companies like L’Oréal, core values such as corporate culture are typically preserved through steady management and leadership. Since Schueller’s passing in 1957, the company has only had five CEOs, ensuring stability and continuity of its founding principles. In addition, the majority of L’Oréal’s shareholders are still Schueller’s descendants and Nestlé24. We believe that this long-term, consistent ownership structure fosters independence and safeguards the qualities that keep L’Oréal on the cutting edge of the beauty industry.

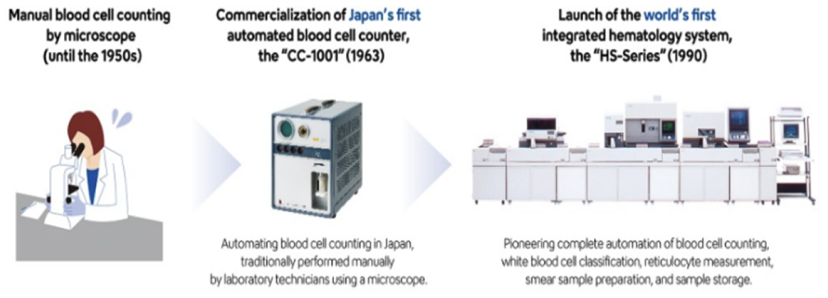

Another marathon runner that benefits from a distinctive corporate culture is Sysmex, a global leader in blood and urine testing systems. Headquartered in Kobe, Japan, Sysmex has gained acclaim for producing high-quality products in the in vitro diagnostic medical devices (IVD) market. The IVD industry has faced persistent pressure to enhance the precision and reliability of their products and to provide productivity gains for its clients.25

Source: Sysmex website.

Sysmex developed the HS-Series Integrated Hematology System in 1990, marking the world’s first fully automated system for blood cell counting, white blood cell classification, reticulocyte measurement to assess bone marrow hematopoietic capacity and preparation of blood samples for abnormal value investigation.

Sysmex’s success lies in consistently exceeding client expectations. Over the past three decades, the company has achieved annual sales growth of 10% and net profit growth of 13%, significantly increasing market share.26The company’s unique customer-first culture, rooted in the Japanese concept of Anshin—peace of mind, reassurance and trust—sets it apart from competitors. This commitment to clients fosters strong customer relationships and is reflected in Sysmex’s consistently high customer satisfaction ratings.27Sysmex’s responsiveness to client needs also drives innovation, as demonstrated by the development of over 20 haematology systems over the past four decades.28Today, the company’s IVD equipment performs tens of thousands of daily lab tests with minimal human involvement, ensuring top-tier precision and quality.

WEG is another company that has leveraged strong corporate culture to achieve long-term success. Since its founding, WEG has prioritised employee education and training. The company opened its own training centre, CentroWEG, in 1965. Based on the German vocational model29, this three-year programme offers over 5,000 hours of training, equipping employees with skills that have enhanced the company’s performance. When WEG went public in 1993, the company became one of the first in emerging markets to offer profit-sharing, aligning employee interests with company growth.

The company also benefits from stable leadership, notably CEO Harry Schmelzer, who joined WEG in 1981 and became CEO in 2008.30Chairman Décio da Silva, who started as an apprentice at age 12 and succeeded his father, WEG’s founder, as chairman in 1989, brings continuity and vision.31From our experience, companies with consistent governance, like WEG, tend to thrive. Stable leadership, long-term dedication, a culture of internal promotion, and the founding family’s influence contribute to the qualities that make marathon runners poised for lasting success.32

At Comgest, we believe that a company's success is rooted in its corporate culture, where long-term growth is driven by a deep commitment to its people, values and customer relationships. Companies like Sysmex, L’Oréal and WEG exemplify this approach, with their focus on stability, innovation and employee development securing their leadership in the market.

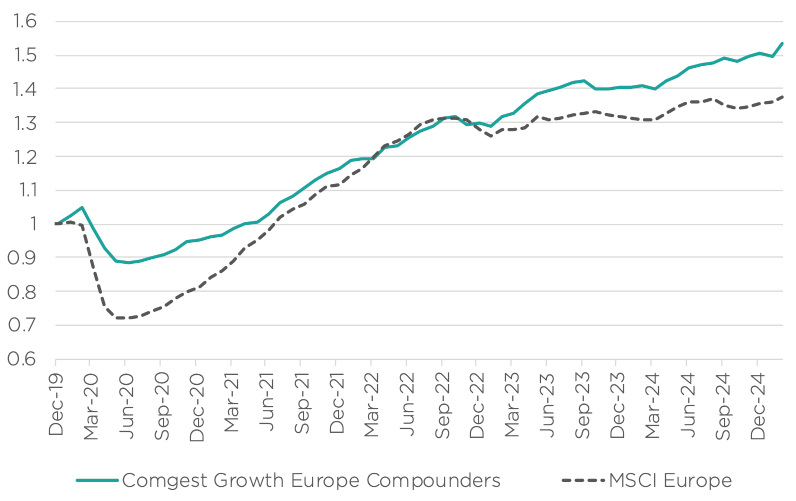

Marathon runners tend to not only survive crises—they often emerge stronger and more competitive. We view these companies as defensive investments, particularly within our Comgest Growth Europe Compounders strategy. In our view, the unique combination of scale, diversification, cash reserves, a strategic long-term vision and strong corporate culture have enabled these companies to endure economic downturns.

Source: Factset/Comgest, data as of 08-Jan-2025

As shown in figure 11, the EPS of the Comgest Growth Europe Compounders strategy outperformed the comparative MSCI Europe index during and after the COVID-19 pandemic. For these companies, the pandemic was merely one of many challenges that they have successfully navigated throughout their history.

For instance, WEG’s vertically integrated production model shielded the company from global supply chain disruptions during the pandemic. By operating its own copper smelting and wiring units, WEG produced its own copper wire —a key component for its electric engines — without relying on external suppliers. A high level of vertical integration can create redundancies designed for addressing exceptional and unforeseen situations. In other words, there is a plan B for when things go wrong. While these designs might not optimise short-term output, they can strengthen resilience during times of crises.

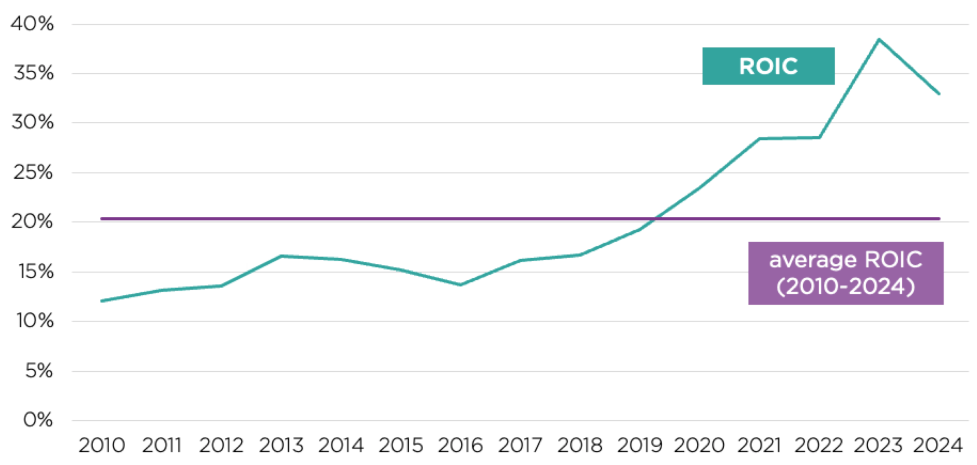

As other competitors struggled with global supply chain issues, WEG maintained its pre-COVID delivery rate of under three months for most products. Additionally, WEG’s return on invested capital (ROIC), a key measure of how effectively a company uses its capital, has averaged an impressive 20% over the past three decades, never falling below 11%.33

Resilience is a core element of the compounder growth formula. Marathon runners, like those highlighted here, refine their production models, set a sustainable growth pace, understand their clients’ needs and consistently go the extra mile. They invest in people, innovation and brand, embracing continuous improvement even in the face of crisis.

Marathon runners are not confined to categories, as demonstrated by TSMC, Microsoft, L’Oréal, WEG and Sysmex —leaders from five different regions and sectors. These companies consistently exhibit visible and predictable growth, embodying our interpretation of Lindy’s Law: the longer a marathon runner exists, the longer it will last. However, it’s not just age that sets these companies apart. They thrive due to a successful blend of cash generation, capital allocation, resilience, scale, diversification and a strong corporate culture.

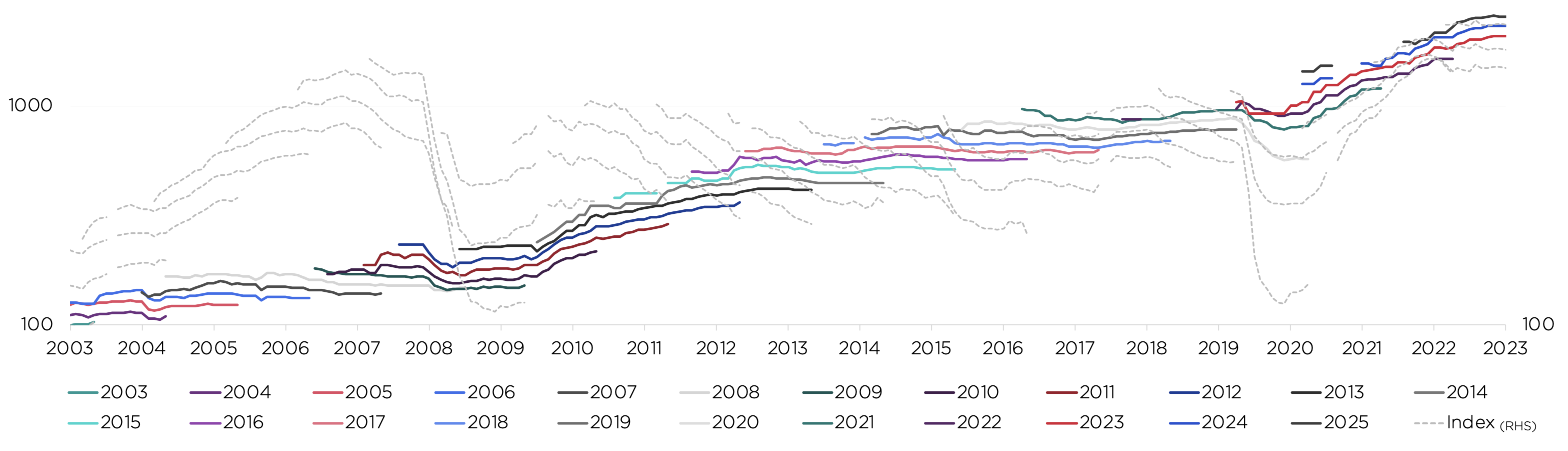

At Comgest, we embrace a long-term, quality growth approach, unconstrained by benchmarks. We let marathon runners compound in our portfolios over the long-term. In our view, many investors underestimate the staying power of these companies. From our perspective, these investors are often distracted by short-term gains, macroeconomic shifts or valuations. As shown in figure 13, earnings estimates for the luxury brand Hermès have risen at a consistent, annual double-digit pace over the past two decades, in stark contrast to the fluctuating and barely-growing MSCI Europe index.

Source: Comgest/Factset, data expressed in EUR as of 31-Oct-2023.

Index: MSCI Europe - Net Return. The index is used for comparative purposes only and the Fund does not seek to replicate the index. The security discussed above is provided for information only, is subject to change and is not a recommendation to buy or sell the securities. The security discussed herein may not be held in the portfolio at the time you receive this presentation

In our view, a short-term focus limits investors from fully appreciating the long-term growth drivers of marathon runners. Our long-term investment horizon enables us to engage with these companies over decades, building relationships that help us to compound double-digit returns over one, two and sometimes three decades. Whether it’s a European beauty brand, a Brazilian industrial leader, a US software innovator, a Japanese medical device manufacturer, or a Taiwanese foundry, we believe that Comgest’s quality growth approach and Compounders framework can identify companies positioned for sustained success—and stay with them for the long-term haul.

All figures shown in US dollars, unless otherwise noted.

1 Based on statistics for the period from 1994-2019. U.S. Small Business Administration, “Frequently Asked Questions About Small Businesses ”, revised December 2021.↩︎

2 Houlder, Vanessa. “Why the Mysteries of Corporate Longevity Matter to Investors.” Financial Times, 24Dec-2024.↩︎

3 For more information, read “Seeking the Fountain of Youth: Lindy’s Law & Quality Growth Investing” by Wolfgang Fickus (Comgest; 2023). Please visit the “Our Thinking” page of your local Comgest website for access to this paper.↩︎

4 We refer here to the Competitive Advantage Period (CAP). It is the period of excess returns when a company generates capital returns exceeding their cost of capital. For more details, please read our White Paper number 8, Deconstructing the Comgest Quality Growth Approach, December 2018.↩︎

5 Lev, Baruch, and Feng Gu. “We Analyzed 40,000 M&A Deals over 40 Years. Here’s Why 70-75% Fail. ” Fortune, 13-Nov-2024.↩︎

6 Pooler, Michael. “Cosmetics Group Natura Embarks on Makeover.” Financial Times, 22-Jan-2023.↩︎

7 Butler Sarah. “The Body Shop Owed More than £276m to Creditors at Time of Collapse.” The Guardian, 5-Apr-2024.↩︎

8 Louch, Will, Laura Onita, and Michael Pooler. “Natura to Sell the Body Shop to Private Equity Firm for£207mn.” Financial Times, 14-Nov-2023.↩︎

9 Natura was also obliged to sell The Body Shop for 341m € in 2023, a brand it had acquired from L’Oréal in 2016 for 931m €.↩︎

10 Roman, Edwin. “Why L’Oréal Bought Australian Skin Care Brand Aēsop at a $2.5 Billion Valuation. ” Yahoo! Finance, 14-April-2023.↩︎

11 McBride, Sarah. “Microsoft to Buy LinkedIn for $26.2 Billion in Its Largest Deal .” Reuters, 14-July-2016.↩︎

12 Taylor, Harriet. “Why Microsoft Beat Salesforce to Acquire LinkedIn. ” CNBC, 16-Nov-2016.↩︎

13 Iqbal, Mansoor. “LinkedIn Usage and Revenue Statistics (2025) .” Business of Apps, 3-Feb-2025.↩︎

14 Davies, Christian, Kathrin Hille, Song Jung-a, and Qianer Liu. “Semiconductor Giants Race to Make next Generation of Cutting-Edge Chips.” Financial Times, 11-Dec-2023.↩︎

15 Hille, Kathrin. “TSMC: How a Taiwanese Chipmaker Became a Linchpin of the Global Economy.” Financial Times, 24-Mar-2021.↩︎

16 Comgest Analyst Research, November 2023↩︎

17 Comgest/TSMC Quarterly and Annual Reports↩︎

18 “One Hundred Million Motors - Wow.” WEG, 16-Jan-2006.↩︎

19 WEG Integrated Annual Report 2023↩︎

21 “Weg’s Expansion Continues: Reivax Acquisition Follows Major Chinese Investment. ” The Rio Times, 26Nov-2024↩︎

22 Houzelle, Chantelle. L'Oréal, le génie de la coloration , Les Echos , 23-Aug-2012.↩︎

23 “Because You’re Worth It. ” L’Oréal. Accessed 20-Feb-2025.↩︎

24 Read more on the shareholder pact between Nestlé and L’Oréal↩︎

25 Behnam, Mohammad, Andrei Dan, Chris Eakins, Ian Lyons, and Gerti Pellumbi. “Digital Diagnostics: A Path Forward for IVD.” McKinsey & Company, 7-Dec-2023.↩︎

26 Sysmex Annual Report 2024↩︎

27 Sysmex America has received the IMV ServiceTrak™ Best Customer Satisfaction award for 16 consecutive years.↩︎

28 “Sysmex’s History.” Sysmex. Accessed 21-Nov-2024.↩︎

29 “The German Vocational Training System: An Overview.” German Federal Foreign Office. Accessed 25Feb2025.↩︎

30 “Harry Schmelzer Jr. - Chief Executive Officer.” WEG. 24-Feb-2025.↩︎

31 “Décio Da Silva, Chairman of WEG’s Board, Receives the Title of Eminent Engineer of the Year 2024. ” WEG, 11-Oct-2024.↩︎

32 64% of the capital is held by the 3 founders and their families.↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance does not predict future returns. Forward looking statements, data or forecasts may not be realised. The index used is for comparative purposes only and the portfolio discussed does not seek to replicate the index.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).